Why Paramount Global Hasn’t Been Snatched Up in Media Consolidation Feeding Frenzy | Analysis

- Oops!Something went wrong.Please try again later.

Ever since Paramount Global chair Shari Redstone won a hard-fought battle to re-merge CBS and Viacom in 2019, the combined company has been a chop-licking catalyst for entertainment media analysts and C-suite executives speculating on whether the company will be the the next meal for a consolidation-hungry industry. Yet despite the fervent conjecture, a realistic and viable suitor has yet to emerge.

Paramount Global has long been seen as an acquisition target due its relative size: Even merged, the company’s market cap is $12.6 billion (down from the $26 billion it was valued at at the time of the merger) and the enterprise value is $25.6 billion, far below its rivals such as Comcast, Disney and Netflix. The chatter reached a fever pitch when Warren Buffett’s Berkshire Hathaway acquired $2.6 billion worth of Paramount Global stock in May, which some interpreted as a sign that a juicy resale might come in the relatively near future.

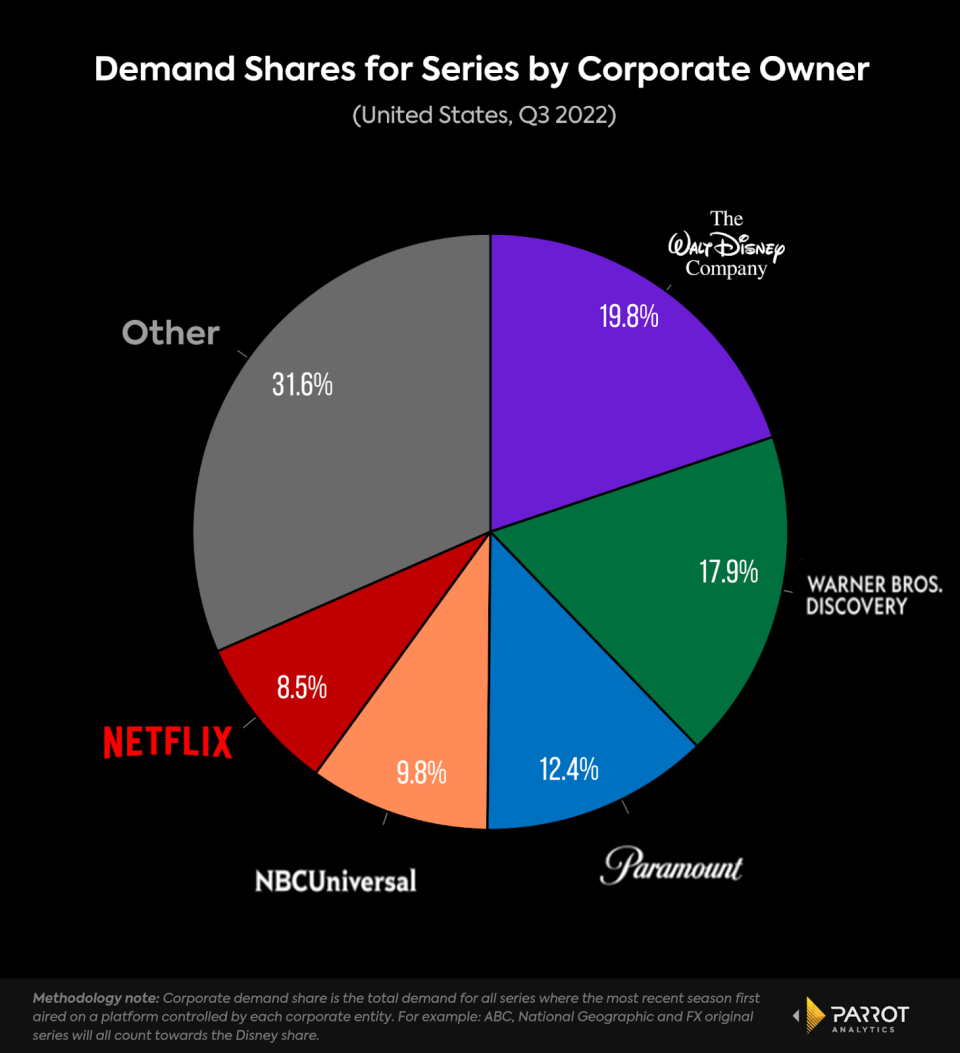

So why, despite an impressive corporate content catalog that ranked third behind only Disney and Warner Bros. Discovery in Q3, according to Parrot Analytics, hasn’t a Paramount Global sale come close to materializing? Let’s break it down.

Linear Attachments and Licensing Issues

Netflix held acquisition talks with Paramount Pictures once upon a time, but the first-mover streamer was only interested in the company’s library of content and not its linear broadcast (CBS) and cable networks (Paramount Network, Comedy Central, Nickelodeon, BET, MTV, VH1, Showtime, Smithsonian Channel). Understandably, a streaming company that champions over-the-top (OTT) viewing via the internet has no desire for legacy entertainment entanglements. As former Viacom digital media executive turned media analyst Andrew Rosen recently wrote in his PARQOR newsletter, “What happens when an AMC Networks or a Paramount Network disappears due to lack of demand?”

On top of that, any interested parties would have to sort through a web of complex licensing agreements already in place. For instance, certain Paramount Pictures films still debut on cable network Epix after their theatrical runs due to a pay-one deal that expires in 2024. Comedy Central’s “South Park” is housed on HBO Max through 2025. Paramount Network’s “Yellowstone” streams on Peacock and a number of other titles are still licensed externally or non-exclusively. A potential suitor would need to pony up top dollar for a company that isn’t in full control of many of its biggest hits for several years.

As of now, Redstone doesn’t appear interested in selling off the company either altogether or piece by piece. But in an interview Wednesday at Columbia Journalism School’s Knight-Bagehot gala dinner, CEO Bob Bakish called Paramount “tremendously undervalued” and did not rule out that the company might get swept up in the industry-wide M&A fervor. “Will there be more consolidation going forward? Absolutely yes,” he said. “Who will be on top? Who will get acquired? Who the hell knows? Will a tech company do it? They got the balance sheets.” (A rep for the company had no comment for this story.)

Also Read:

Netflix Throws Down the Gauntlet With a Big Q3 Comeback: Your Move, Disney

Linear Regulatory Issues

Comcast reportedly approached Paramount Global prior to Paramount+’s launch with the idea of housing the company’s titles on Peacock, which Redstone and Bakish obviously rejected. The two companies discussed other ways in which their fledgling streaming efforts could bolster one another, rather than compete directly, which resulted in the joint overseas venture SkyShowtime. (A combined NBCUniversal and Paramount Global corporate content library would account for an industry-leading 22.2% of all US audience demand in Q3).

The frequent back-and-forth between the companies led many to believe that a merger between Paramount Global and NBCUniversal parent Comcast made the most sense. However, in any such scenario, the new company would have to sell off one of its broadcast networks — CBS (Paramount Global) or NBC (NBCU) — to win approval of U.S. government regulators. The same goes for Disney, which owns ABC.

Of course, spinning off a broadcast network is a tricky proposition in the current climate. Could it remain an independent news and sports operation à la Fox? Would a company such as Nexstar, which recently acquired a majority stake in The CW from Paramount Global and Warner Bros. Discovery, be interested? How would such a deal even be structured? This path is marked by a number of unknown variables.

“One of the main obstacles for a buyer of Paramount Global is CBS, and not necessarily all of CBS mind you, but rather the CBS news operations and its 15 owned-and-operated local television stations,” former M&A banker turned financial journalist William D. Cohan wrote in March.

Also Read:

Nexstar’s ‘Ambitious’ Overhaul of The CW: Fewer Genre Series, More Low-Cost Reality

How much value does Paramount Global have without CBS?

CBS is a powerful Paramount+ content driver – the network boasts having 17 of the top 30 titles on the streamer while nearly 25% of the streamer’s library is comprised of CBS titles. The linear network remains the most-watched broadcast network in terms of overall viewers and a consistent revenue driver despite audience declines.

Indeed, Paramount Global is largely funding its direct-to-consumer losses through its linear TV profits. While the company’s direct-to-consumer segment lost $900 million over the first half of 2022, the linear model still generates billions in quarterly revenue ($10.9 billion over the year’s first two quarters).

This raises a complicated Catch 22: How valuable is Paramount Global without CBS, which carries highly important news, sports and scripted assets? On the flip side, similar to the Netflix conversations that went nowhere, how realistic is a sale when Paramount Global is still so deeply entrenched in linear attachments?

Big Tech Pushback

Netflix, Amazon and Apple aren’t likely to be interested in broadcast networks and cable channels. But even if Redstone relented and shed the company’s legacy connections, any acquisition overtures from a Big Tech player would face significant scrutiny from the Department of Justice and Federal Trade Commission.

The Justice Department spent 15 months attempting to block AT&T’s acquisition of Time Warner on antitrust grounds, and current FTC chair Lina Khan is a known critic of Big Tech. Any interest from the FAANG (Facebook, Apple, Amazon, Netflix, Google) companies would set off alarm bells as the regulatory bodies look to preserve market competition and beat back any rising monopolies.

“My argument is part of a larger recent debate about whether the current paradigm in antitrust has failed,” Khan wrote in her now-famous 2017 Yale Law Journal article. “Though relegated to technocrats for decades, antitrust and competition policy have once again become topics of public concern.”

Even if such a deal could sneak by regulatory oversight, Apple has never shown a big appetite for big external acquisitions (its largest was Beats by Dre for $3 billion back in 2014), particularly one that could cost as much as $30 billion.

Also Read:

Kevin Mayer Says Disney Could Do Without ESPN and ABC (Video)

Waiting on Warner Bros. Discovery

Despite the recent merger of Discovery Inc. and WarnerMedia (and subsequent comments from CEO David Zaslav), it is widely believed that Warner Bros. Discovery is priming itself for a potential spinoff or sale in the not-too-distant future. If that’s the case, potential M&A partners for Paramount Global, such as Comcast, may very well be waiting for that shoe to drop. Warner Bros. – with its collection of blockbuster intellectual property such as “Harry Potter” and DC Comics, cable crown jewel HBO, and a lack of broadcast network commitments – may be seen as the more attractive asset.

This has more or less put Paramount Global in a holding pattern, assuming company leadership even wants to sell at this point (Redstone said in June that her company has the “scale to succeed and win.”)

Paramount Global boasts a growing direct-to-consumer business that rose to 64 million worldwide subscribers as of Q2. It has the most-watched broadcast network in CBS. (The company will announce Q3 results on Nov. 3.) The film studio has released a string of box office victories over the last 18 months, led by the year’s box office champ “Top Gun: Maverick.” Despite all that, the company’s stock price is down more than 40% year-to-date, closing Thursday at $19.11.

On its surface, the media empire appears to be a collection of attractive assets potentially available at a discounted price. That should theoretically be a great deal. But in Hollywood, appearances are always deceiving and the obstacle course of potential snags has seemingly warned off the expected admirers for now.

Brandon Katz is an industry strategist at Parrot Analytics, a WrapPRO partner. For more from Parrot Analytics, visit the Data and Analysis Hub.

Also Read:

6 Takeaways From TheGrill 2022: Hybrid Models Work, Content Still Rules and Abortion Worries Loom