Why Hollywood Can’t Seem to Solve the Streaming Bundle Puzzle

Streaming companies have promised consumers more flexibility and a better overall experience than cable. But as Wall Street has pivoted from subscriber growth to profitability, it’s become messy. Today, consumers are confronted with ads, password sharing crackdowns, multiple bills and logins to juggle and more difficulty finding content — in some cases making their overall household streaming outlay just as expensive as before, resulting in canceled subscriptions that send churn rates trending in the wrong direction.

It’s a vicious cycle.

One short-term solution, streaming companies are finding, is a more flexible recreation of the cable bundle that streaming was supposed to leave behind.

Recent examples include Disney+, ESPN+ and Hulu, Verizon’s ad-supported Netflix and Max offering, Amazon Prime, which offers streaming alongside perks like free shipping, and Apple One, which offers Apple TV+ along with music, news, fitness subscriptions and iCloud storage.

So far, bundle offerings are having an impact. Disney+ and Hulu saw churn rates in November of 6.6% and 9.06%, respectively, on their own, according to Antenna. But when included in a bundle, the churn rates for the same month dropped to 4.74% and 5.49%. Likewise, Apple TV+ experienced a churn rate of 10.53% for November on its own, compared to 4.5% for the month when included in a bundle.

But simply bundling all streaming services together — in a so-called “super bundle” as Warner Bros. Discovery CEO David Zaslav has referred to it — doesn’t solve a key issue: The lack of one single interface where consumers can manage all their subscriptions, even those outside of streaming video.

Hollywood is obsessed with “getting back to the economics of the last era,” Evan Shapiro, a media professor at New York University and Fordham University, told TheWrap. “But in reality, we’re entering a completely new era where you can get all that money back, but it’s going to be from a completely different shape of offerings. The puzzle pieces are very, very different, but the margins exist.”

A desire for a simplified experience and fewer transactions

The bundling push stems from consumers’ desire for a simplified experience and fewer transactions.

Consumers use a total of about 12 entertainment sources across categories including streaming, gaming, music — but only half of those sources are considered “must haves,” according to Hub Entertainment’s latest Battle Royale survey of nearly 3,000 consumers. Broken out by age, individuals between 18 and 37 use 16 entertainment sources with eight being must haves, while those above 35 years old use 10 total sources with about half of those being must haves.

Pricing is only part of the churn problem

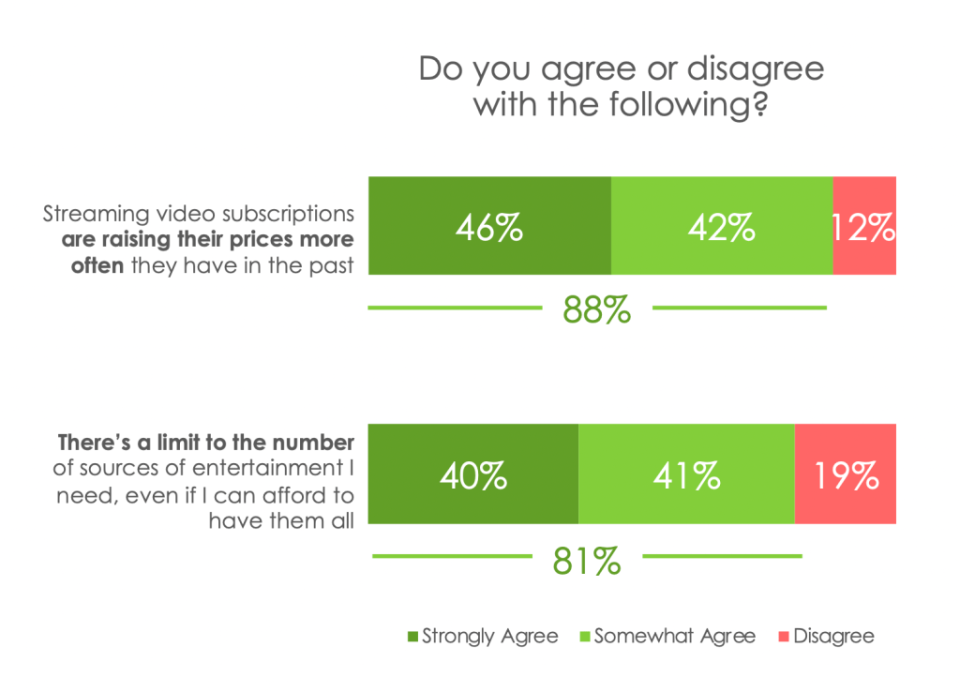

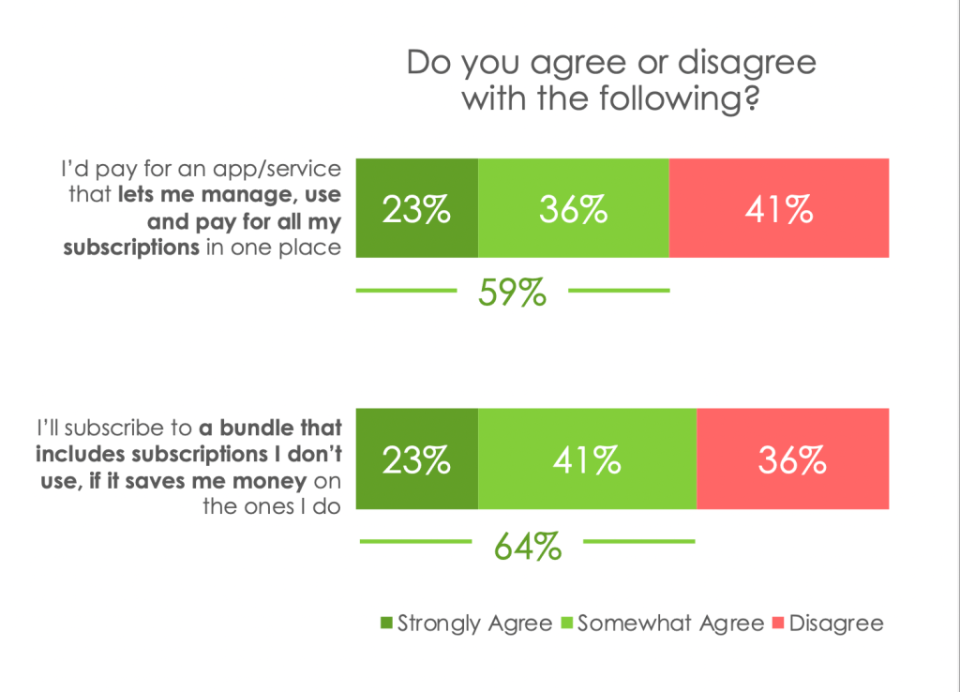

The average U.S. subscriber pays $924 annually for subscriptions, or $77 per month, according to a survey of 5,000 subscribers conducted by online payment technology company Bango between December and January. One quarter pay $100 per month and one in 20 pay over $200 per month, Bango noted.

With the abundance of subscriptions, 35% said they have lost track of how much they’re spending, while 32% said they’re consistently frustrated with how they currently manage and pay their subscription bills. Over half of subscribers (57%) surveyed said they have discontinued their subscriptions because of unanticipated price hikes.

But pricing is only part of the problem. The current bundle offerings don’t do anything to improve a user’s experience on an individual streaming platform, analysts with MoffettNathanson said in a recent research note.

A partial solution is integrated search through platforms like Roku or Comcast and Charter Communications’ joint streaming venture Xumo, which has deployed 1 million of its streaming boxes nationwide since launching in October. That still requires multiple clicks to switch between services and “meaningful cooperation among the media companies,” who would need to grant access to programming choice data and confirm whether individual customers are subscribed and if they’re on ad-supported or ad-free tiers.

The problem with cable is not so much the cost, but how much of what people are paying goes to pay for stuff they never use.

Hub Entertainment Research founder Jonathan Giegengack

Another option is interface integration through platforms like Amazon and Apple’s channel stores. Channel add-ons, such as Paramount+ on Apple TV+ or Max on Prime Video, accounted for 23% of all streaming services as of the fourth quarter of 2023, up from 20% in the third quarter of 2023, according to a Kantar Research study conducted between October and December.

The share of video streaming services accessed as a channel on Apple TV+ increased 45% over the last six months of 2023. The firm also found that Prime Video benefitted Amazon Prime shipping during its fourth quarter events including Prime Day in October and Cyber Monday in November, as well as holiday shopping in December, while Apple TV+ benefitted from iPhone sales during the same period.

“Typically, the more engaged you are with an ecosystem, the more engaged you are with streaming,” Kantar’s Consumer Insights Director Hannah Avery told TheWrap.

Among Prime subscribers who are monthly users of two Prime services, 68% of them use Prime Video, Avery said. Compared to Prime subscribers who use five or more Prime services, 96% of them use Prime Video monthly. When bundled, Apple TV+’s weekly non-usage declined 20% compared to subscribers who do not bundle the service, Avery added.

MoffettNathanson warned that interface integration requires individual streamers to agree to be housed under one aggregator’s brand — a price that may be “too high to pay” for some.

Thinking outside the streaming video box

The streaming industry has “been slow to think beyond the bounds of Hollywood,” Magid global media, entertainment and games executive vice president Michael Bloxham told TheWrap.

“It’s always been very clear that there’s a lot more that can be brought to the table for subscribers that goes beyond simply watching video,” Bloxham said. “If I’m buying stuff through a service that is also a streaming service, I’m much less likely to just hop because I’m not watching any shows right now.”

Shapiro said that the key to any bundle is adding a “high touch utility” — a service that consumers are more likely to interact with on a daily basis. He touted Paramount+’s partnership with Walmart+ as one notable example and said Netflix bundling with Peloton or The New York Times could be a potential “home run.”

Another offering that could help Disney and Comcast’s streaming services stand out is a bundle that would include theme park tickets or merchandise. In January, Disney announced that Disney+ subscribers could get a free dining plan with travel packages that include a Disney Resort hotel room and a theme park ticket with a park hopper option.

“This is the time for companies to be innovative and think and swing big rather than incrementally create bundles that still look the same as the other bundles that are out there,” Hub Entertainment Research founder Jonathan Giegengack told TheWrap.

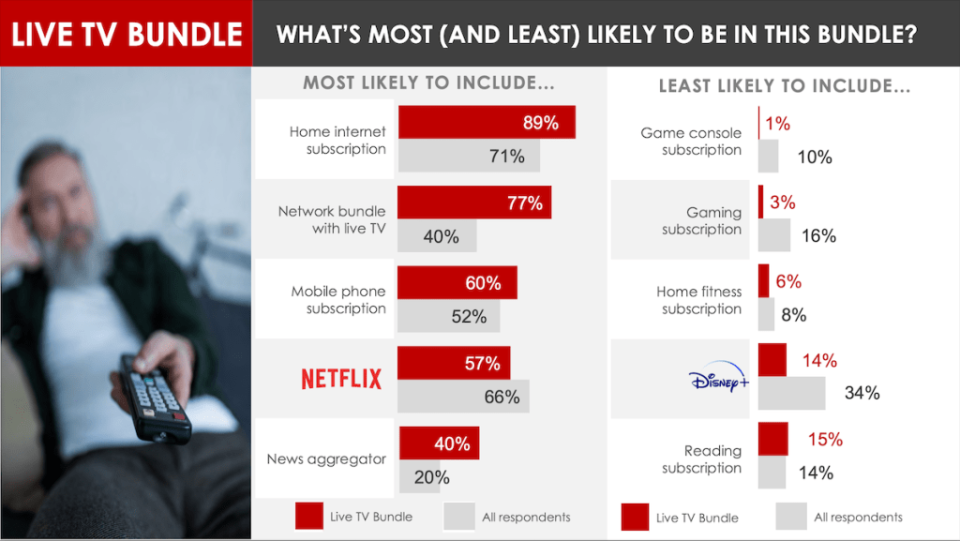

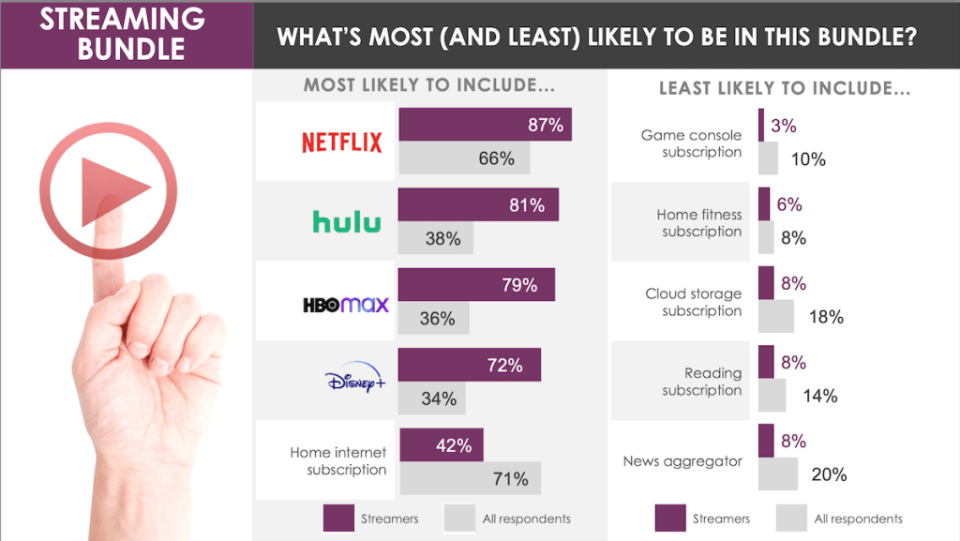

Last April, Hub Entertainment Research asked 3,000 consumers what they would want in an ideal bundle. The results were broken into four types: streaming bundles, utility bundles, gaming bundles and live TV bundles.

About 40% of respondents chose the live TV bundle, which was most likely to include a home internet and mobile phone plan, a network bundle with live TV, Netflix and a news aggregator.

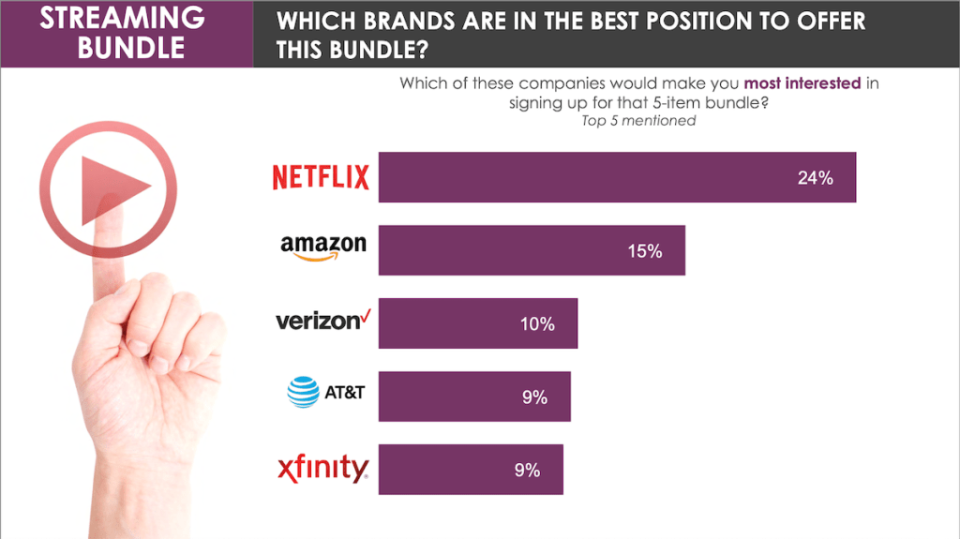

One quarter of respondents chose the streaming bundle, which was most likely to include Netflix, Hulu, Max, Disney+ and a home internet subscription.

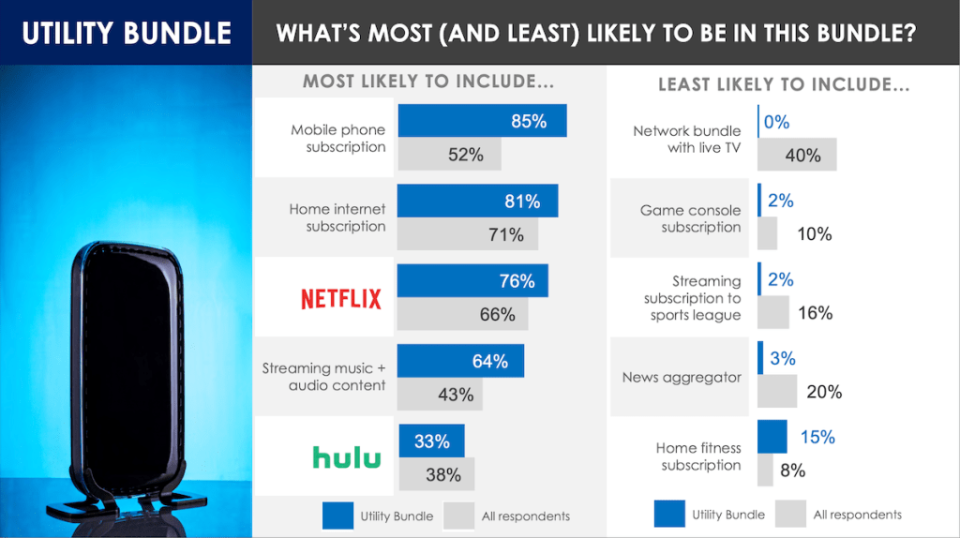

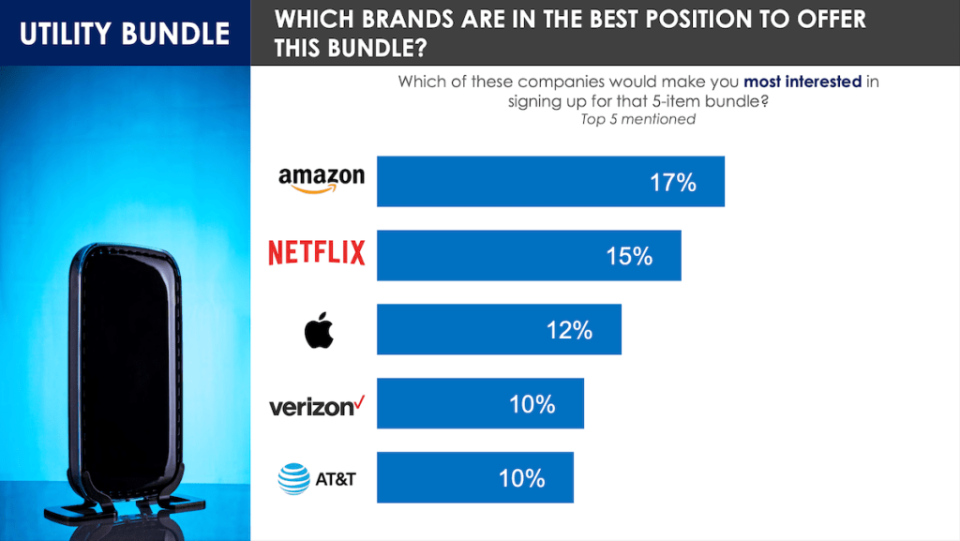

Slightly fewer — 22% — chose a utility bundle, which was most likely to include a home internet and mobile phone plan, Netflix and Hulu and some form of streaming music or audio.

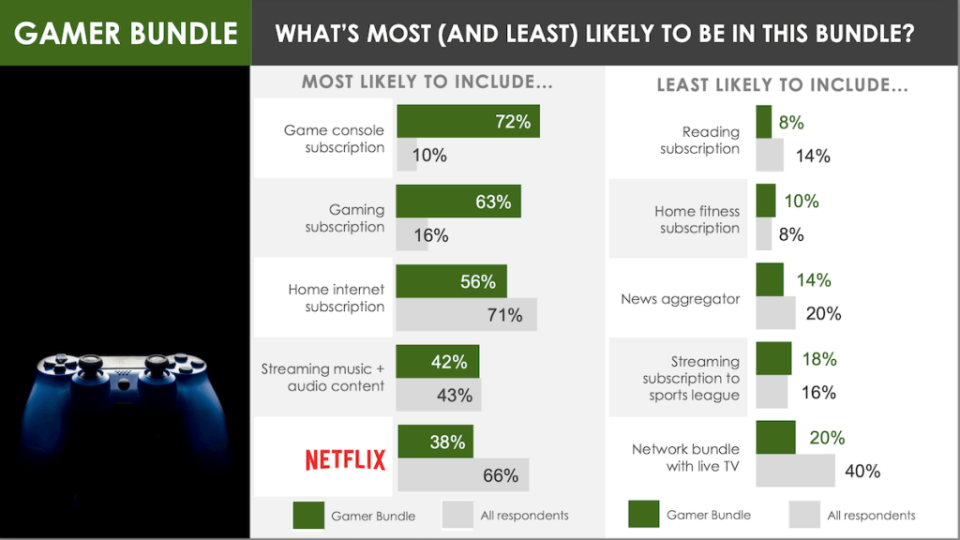

Slightly less than half as many — 13% — chose a gaming bundle, which were most likely to include a game console or gaming subscription, a home internet plan, some form of streaming music or audio and Netflix.

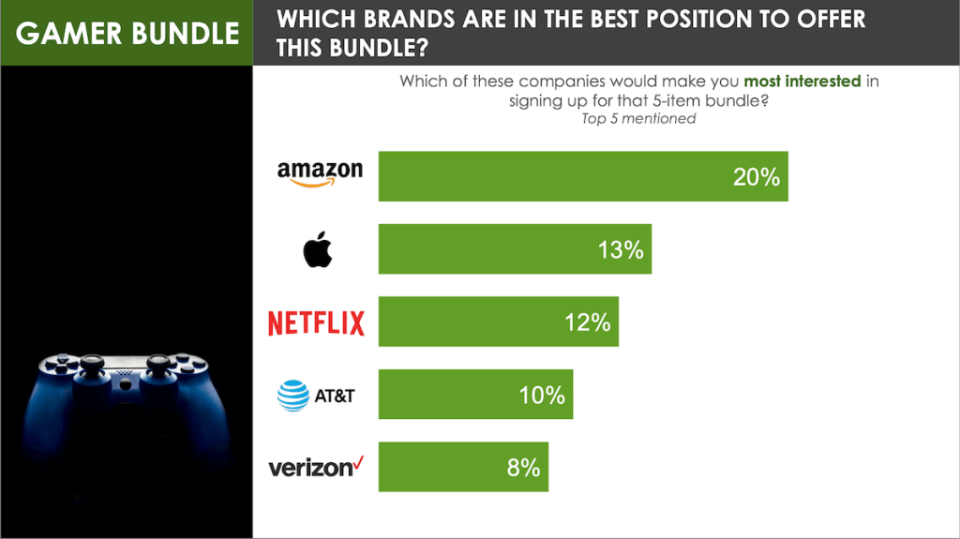

When asked which brands were best positioned to create these bundle offerings, consumers’ top choices included Netflix, Amazon, Apple, AT&T, Verizon and Xfinity.

The aggregator wars

While Shapiro argued that any bundle that includes Netflix will be in a “pole position,” Giegengack is skeptical that the company would lead the charge on aggregation.

In the short term, he said, “it’s a lot less of a lift for the Verizons and Amazons of the world than it is for Netflix because they have to create their own content and they’re more likely to be part of somebody else’s bundle.”

For the tech giants, a notable barrier is Hollywood’s fear that a possible team up would allow them to monopolize the entertainment industry. “That’s a very real fear because they’ve shown how they can pretty much take over industries,” Bloxham told TheWrap.

Last year, Verizon launched its +play platform, a one-stop shop where consumers can access their subscriptions all in one place. The telecommunications giant, which manages nearly 12 million content subscriptions, has over 30 partners affiliated with the offering, including Peloton and DuoLingo. The initial concept for the idea came after a 2019 promotion with Disney+ prompted interest from other streamers like Apple TV+ and Discovery+.

“We realized that we were in a unique position because you had more programmers who wanted a deal like Disney and an efficient channel to go to market,” Verizon Chief Revenue Officer Frank Boulben told TheWrap. “And on the other side, for many consumers managing their digital subscription services was becoming a pain point.”

Through its myPlan perk program for $10 per month, Verizon offers access to the Disney Bundle and an ad-supported Netflix and Max bundle. The company earns an average of about 15% on the price consumers pay for its bundles, though that percentage varies depending on the services included. Users who don’t want the streaming bundles can also receive a $15 per month credit to spend on individual streaming services or other offerings such as Xbox GamePass Ultimate or MasterClass.

“The benefit is two-fold,” Boulben said. “On our side, customers who take content subscriptions with us and use them churn less on the mobile side. So it helps our connectivity business. On the other side, content subscribers that get their subscription via Verizon churn less from a content provider standpoint.”

Aggregation also may be a “less heavy lift” for cable providers like Comcast and Charter, Giegengack said. In addition to Xumo, Charter started bundling Disney+ with its Select TV packages in January as part of its latest carriage agreement.

“The problem with cable is not so much the cost, but how much of what people are paying goes to pay for stuff they never use,” Giegengack said. “If you can give consumers a mechanism to create a bundle that they actually want to use and the cable company can be the facilitator of that, that would help transform the business of what a pay TV provider offers into something that’s more relevant to what consumers today are looking for.”

When asked by Bango, half of respondents said they want their mobile operators to offer a single platform to manage and bill all their subscriptions in one place. About 19% said they’d even be willing to pay 50% more on their monthly bill if their favorite subscriptions were included in the price — equivalent to an extra $364 per year based on the average monthly U.S. phone bill. In comparison, 29% of respondents said they would want their cable or TV providers to do so.

The future of bundling

Shapiro anticipates a significant uptick in the number of bundled streaming offerings over the next five years, with bundles similar to Amazon Prime, Paramount+ and Walmart+, and Verizon+ play being the most successful.

“People who try to only bundle TV with TV will sell subscriptions, but they’re not going to make any money because it’s only based on discounts,” he added.

While Boulben believes bundles across different companies will “have their place,” he does not see them dominating the industry anytime soon. Instead, he expects a “coexistence” between bundled and a la carte offerings.

Verizon +play plans to add category marketing on the platform as it continues to gain scale, with areas including streaming, lifestyle and wellness and education services. But Boulben stressed that aggregating everything in one place under one login is still years away.

“It requires technical development and changes with our partners,” he added. “The model has to mature more before we can convince all the partners that it’s an investment worth making.”

The post Why Hollywood Can’t Seem to Solve the Streaming Bundle Puzzle appeared first on TheWrap.