Why Disney Can’t Rely on Marvel and ‘Star Wars’ to Reach Streaming Subscriber Goal | Charts

- Oops!Something went wrong.Please try again later.

Marvel and “Star Wars” series have helped to grow Disney+’s subscribers quickly, but the streamer may have maximized those fan bases as demand for the series has been inconsistent and may not be enough for the streamer to reach its own growth goals — according to Parrot Analytics‘ data, which takes into account consumer research, streaming, downloads and social media, among other consumer engagement.

In 2020, Disney CEO Bob Chapek told a group of investors and analysts gathered for a special Disney+ event that the company’s 2-year-old streaming service would reach between 230 million and 260 million subscribers worldwide by fiscal 2024. As of Disney’s second quarter in 2022, Disney+ has 137.9 million subscribers — an impressive feat. Within that projection, however, Disney+ would have to maintain an average add of 10 million subscribers globally over the next 10 quarters to reach its goal.

The questions now: How feasible is that for the Mouse House? And where is that growth going to come from?

Also Read:

How Reality TV Can Help Streamers Ride Out the Coming Economic Roller Coaster | Chart

Disney added 7.9 million subscribers in its fiscal second quarter — about 2.1 million off from the pace it needs. The vast majority of those subscribers came from its Indian brand streaming service, Disney+ HotStar, with the rest split between Disney+ domestic and Disney+ international. While International Premier League soccer games helped Disney+ HotStar add a significant number of subscribers, questions about what drove the remaining growth remain.

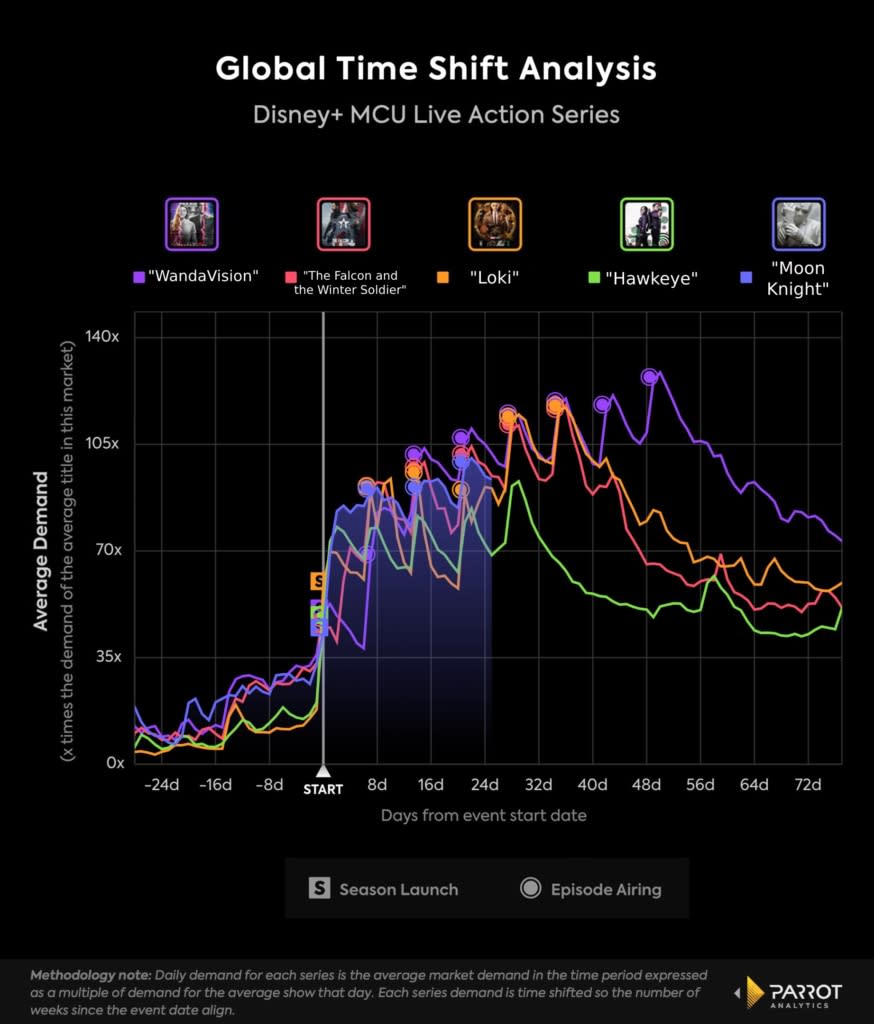

A recent study from Parrot Analytics found that while Marvel’s “Moon Knight” is an incredibly in-demand show — the most in-demand premiere of the first quarter — there’s a slowdown in demand for Marvel content. The chart below demonstrates that while each Marvel series boasts exceptional audience demand, landing within the top 0.2% of all TV series globally, “Moon Knight” sits in the middle of the pack of Marvel TV series when looking at global demand. “WandaVision,” “Loki” and “The Falcon and the Winter Soldier” – the first three Marvel streaming series to premiere — have the strongest demand. After last fall’s “Hawkeye,” though, demand begins to falls off.

The data suggest that Disney’s continued Marvel efforts, which are a core highlight of the Disney+ package, may work better to retain customers than to attract new ones. While this is predictable (at some point, every person who’s into Marvel will have Disney+ and keep paying for it month after month), Disney will have to find other programming to keep adding 10 million new subscribers per quarter over the next 10 quarters to hit its growth goals.

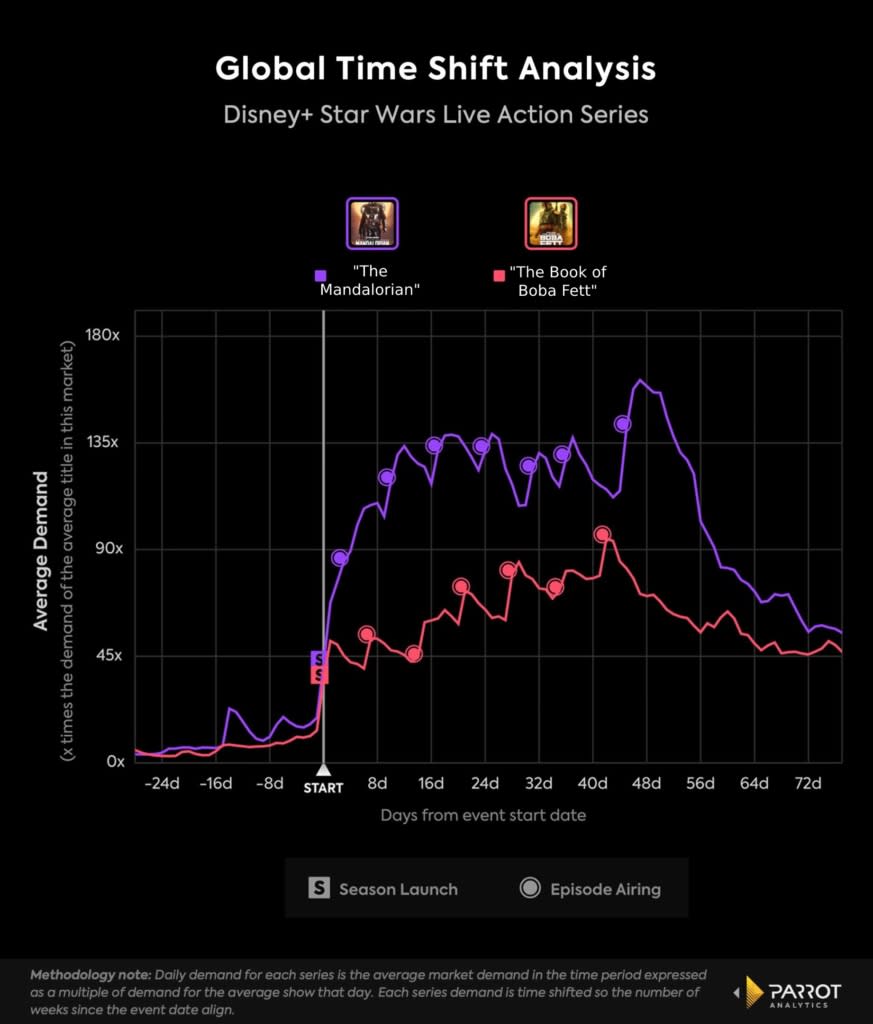

Disney’s “Star Wars” franchise has shown a steep drop in demand for its most recent live-action entry. “The Book of Boba Fett” debuted to less demand than “The Mandalorian.” Even when demand picked up for “Boba Fett” around mid-season, the spinoff never came close to “The Mandalorian’s” first season.

While “The Mandalorian” had the benefit of being the first major “Star Wars” live-action show — and had a breakout star in Baby Yoda — there were more than 100 million new Disney+ subscribers on the platform by the time “The Book of Boba Fett” debuted.

That said, if the upcoming “Obi-Wan Kenobi” is able to approach “The Mandalorian’s” global demand levels, “Star Wars” remains a growth driver for Disney+ moving forward. What’s abundantly clear is that it will become more of a case-by-case basis. Not every “Star Wars” or Marvel show is going to convince a lapsed subscriber or a new subscriber to sign up, but both can become a powerful retention play for Disney+.

Which leaves questions about where Disney+ will find its next big subscriber growth tool. The platform will need to seek out other “Hamilton” moments, a reference to the spike in subscribers that Disney+ saw when a filmed version of Lin-Manuel Miranda’s hit Broadway musical debuted on the platform in July 2020. (As an added bonus, that show attracted a group of viewers who were distinct from the ones already lured by all that “Star Wars” and Marvel fan content.)

Disney CEO Bob Chapek has already expressed a desire to boost the platform with more general entertainment and four-quadrant programming (meaning content that appeals to men and women, both over and under 25).

The real test for Disney+, which is set to expand into several additional territories this summer and add a cheaper advertising-supported tier in the near future (which can help it reach that 2024 subscriber goal), is determining what type of new content outside of the core franchises will help power growth — and help determine Disney+’s next brand iteration in the process.

Also Read:

Disney+’s ‘Moon Knight’ Edges Out HBO Max’s ‘Peacemaker’ for Most In-Demand Premiere | Charts