Why Disney Shouldn’t Celebrate Beating Netflix’s Global Subscribers Just Yet | Charts

After the Walt Disney Company reported its third-quarter results, it became clear that the company had achieved something big: Its 221.1 million total number of subscribers across all its services globally (Disney+, Disney+ Hotstar, Hulu and ESPN+) pulled ahead of Netflix’s total global subscriber count of 220.7 million for the first time. But it may be too premature to celebrate.

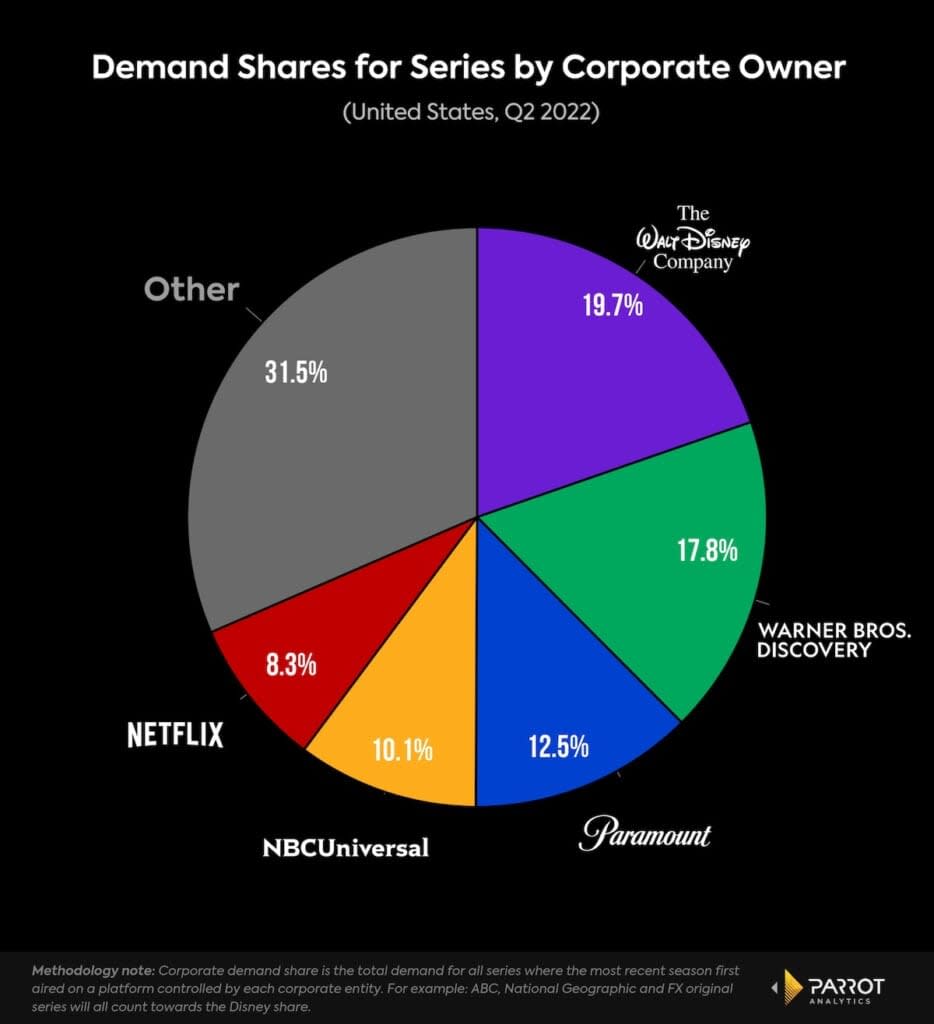

While the realization that Disney has beat out Netflix in terms of global subscribers may sound surprising, it really shouldn’t be. Disney has been the leader for a long time in terms of the total demand for shows that fall under its corporate ownership, according to Parrot Analytics‘ data, which takes into account consumer research, streaming, downloads and social media, among other engagement.

Last quarter’s result is a good indicator that Disney is finally translating their lead in total demand at the corporate level to an advantage in the battle for streaming subscribers.

Expect the future to look more like this as companies claw back the rights to their own content on their streaming platforms. This bodes well for the future of Warner Bros. Discovery as it begins utilizing the full weight of its corporate catalog of content on its soon-to-be merged streaming platform. It also highlights the urgency facing Netflix as it competes against media conglomerates as they are finally focusing all their resources on winning the streaming race. Netflix’s first-mover advantage in the streaming wars continues to evaporate.

But while Disney looks to be in a stronger position than ever in the new streaming landscape, several observations should give any of the company’s executives pause before taking a victory lap:

A year ago, Disney+ had four of the five most in-demand streaming originals by U.S. audience demand in the April-June quarter. This past quarter it had two.

In a show of overconfidence, Disney+ scheduled “Obi-Wan Kenobi” to debut directly against the fourth season of Netflix’s “Stranger Things” on May 27. “Stranger Things” drew several times more demand than “Obi-Wan Kenobi” with both global and U.S. audiences.

Disney+ pushed back the next “Star Wars” live action series, “Andor,” from Aug. 31 to Sept. 21 in order to avoid competing with the debuts of HBO’s “Game of Thrones” spin-off “House of the Dragon” and Amazon Prime Video’s “Lord of the Rings: The Rings of Power.”

Losing the Indian Premier League cricket streaming rights will cause Disney’s global subscriber numbers to take a hit.

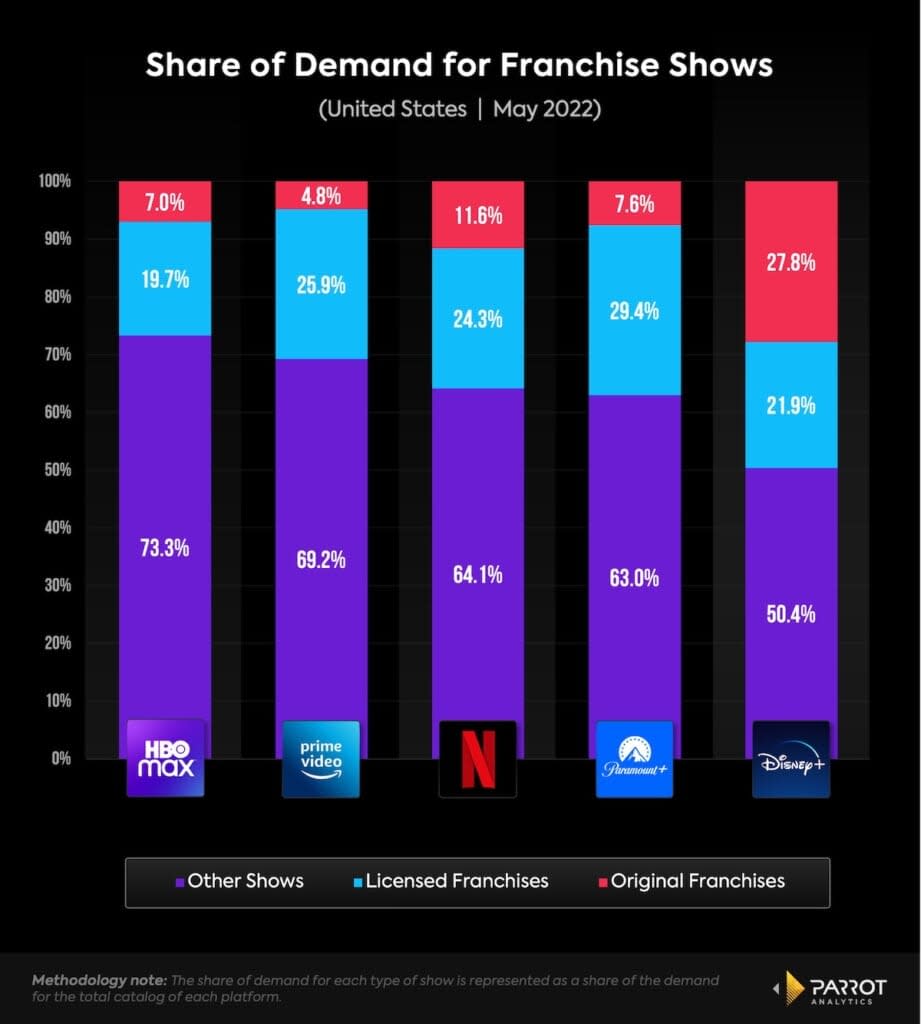

Disney+’s reliance on franchises — especially Marvel and “Star Wars” — to drive subscriptions is as strong as ever. Among streamers in the U.S., Disney is notably dependent on its franchises, with about 50% of demand for its catalog coming from a show belonging to one of its franchises.

These properties will help Disney+ retain much of its sizable subscriber base for the foreseeable future, but it remains to be seen how much more Disney+ can grow without branching out beyond these two franchises.

If Disney+ is to look outside of Marvel and “Star Wars” for subscriber growth, there’s a potential option in-house… which brings us to the biggest question for Disney’s streaming ambitions: What is the plan for Hulu?

The service, including FX content on Hulu, has accounted for a steady stream of critical hits with outstanding demand (what we define as being in the top 2.9% of all shows) in the past year such as “Only Murders in the Building,” “The Dropout,” “Dopesick,” “Reservation Dogs,” “The Bear” and more.

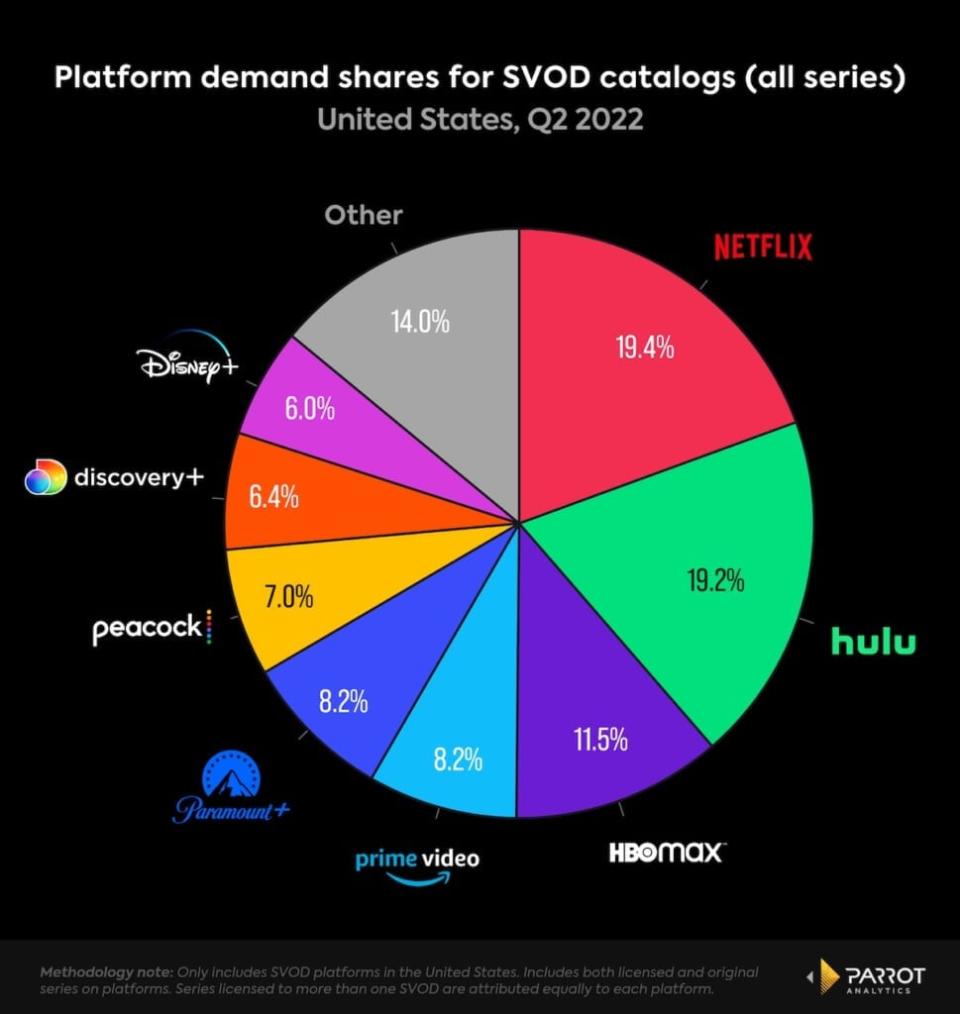

The Disney bundle is one of the best values available to U.S. streaming consumers, but would it make more sense for Hulu and Disney+ to be folded into the same platform like Discovery+ and HBO Max? Comcast’s minority stake in Hulu complicates plans for that in the immediate future, which means Disney needs to make a decision on whether it will buy out its Hulu partner. In terms of demand for all shows on-platform, Hulu (19.2%) is just behind Netflix (19.4%) and a theoretical combination of Hulu and Disney+ (25.2%) would healthily beat out the coming combination of HBO Max and Discovery+ (17.9%) in U.S. on-platform demand share.

One reason Hulu was an important part of Disney was that it could house programming for more mature audiences. But now that Disney+ is already streaming the TVMA-rated Netflix Marvel series and opening itself up to other R-rated fare, should there be less concern about “adult” programming from Hulu appearing alongside more traditionally family-friendly Disney fare?

It’s definitely time for Disney to make some decisions.

For more from WrapPRO content partner Parrot Analytics, visit the Data and Analysis Hub.

Also Read:

Why Paramount+ Needs to Look for New Frontiers to Compete in the Streaming Wars | Charts