Why David Zaslav Is Going to Pass on Warner’s Shot to Renew NBA Rights — The Next Text

- Oops!Something went wrong.Please try again later.

Each week, Next TV writers Daniel Frankel and David Bloom exchange SMS messages about the strange objects each insists they saw, separately, in the night sky … before they blacked out … only to awaken cold, naked and alone, in the middle of an Oxnard, Calif. strawberry patch, 50 miles north of Los Angeles. These are the objects they say they saw:

DAVID BLOOM: So, O Great and Wise Editor, turns out you’re not the only journalist with a keening sense of loss for the late and dearly lamented HBO/Max L.A. Lakers show, Winning Time. Ross Douthat of The New York Times used Winning Time’s unexpected demise last month to make a bigger point: As we trudge toward the post-Peak TV era, we’re facing one certain emerging trend in streaming video, but maybe we’ll get a second, too. As he wrote, “If the Peak TV era is ending, a show like Winning Time is a good example of what I’ll miss about it.” Basically, the movie business already doesn’t have many highbrow or “high middlebrow” features anymore. Now streaming, where those shows thrived for the past decade, is about to follow suit into cheap, unremarkable but lineup-filling shows. We’re getting set up for a rerun (of course) of the mass-market appeal and awards-worthlessness of 1990s CBS, an era of programming indistinguishable from cottage cheese in its blandness. Douthat also quotes a “semi-optimistic” prediction by former Amazon video chief Roy Price that a sea of milquetoast may spawn a high-end competitor trying to differentiate itself. Someone will try to go high-end. That Price thinks this is no surprise. Remember, he pushed Amazon Prime Video toward prestige awards-bait shows such as Transparent and The Man in the High Castle. I agree someone will focus on the premium end of programming and indeed, already is. That service is called Apple TV Plus. And Apple executives don’t face the same pricing pressures that, say, Casey Bloys at Warner Bros. Discovery has these days. But maybe someone else also will chase that dragon instead of yet another Les Moonves Cottage Cheese Fest. What say you?

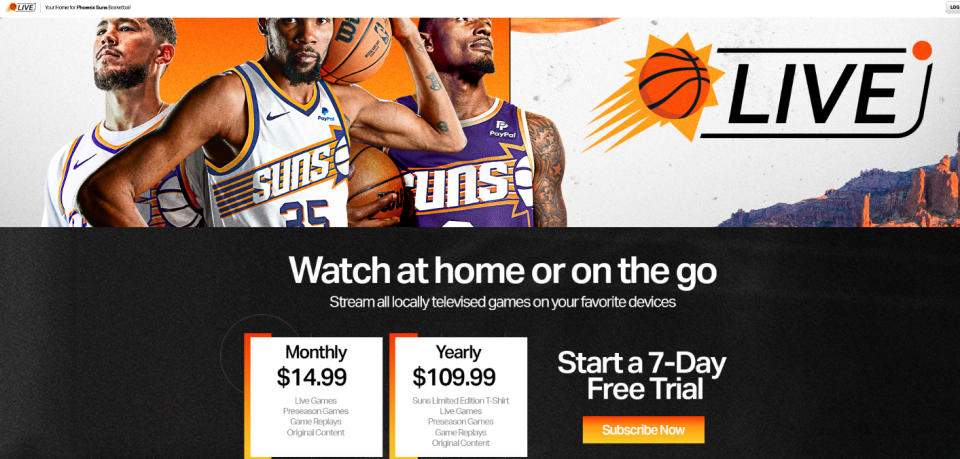

DANIEL FRANKEL: That's all really interesting … and sorta bleak. In that kind of future, if I want that old-time HBO Sunday-night experience moving forward, there’s enough market demand to supply it for me. Which is good. But it'll come at the expense of further hegemony for Apple, which already controls so much of my screen time. The whole thing is starting to unfold like Rollerball, the 1975 Norman Jewison-directed dystopian-future sci-fi film starring James Caan as the star of a fictional ultra-violent sports league, the flagship consumer product of a corporation that controls … pretty much everything. And that’s what it's going to look like when Amazon and Apple take hold of the NFL and NBA. Speaking of which, locally, it looks like the future of local “ball” just rolled out last week with the Phoenix Suns and Utah Jazz unveiling their respective DTC services. Fifteen bucks a month to stream all your team's games seems like a winner to me. Sports fans get what they want for a reasonable price and everyone else isn't forced to pay for it.

DAVID: OK, wait, wait, wait! Rollerball wasn’t a documentary? It was fictional? This is most dispiriting. But your point about it maybe becoming a documentary only validates my abiding affection for science fiction as a way to think about what possible futures, and how we might shape them into something less horrific. Which brings us back to one crucial component of subscription TV’s incipient cottage cheese era, a reshaped sports TV universe. The Utah Jazz deal was, perhaps, a special case. Given the team’s name, it really wanted to do a deal with Sinclair’s Salt Lake City station KJZZ, often called KJazz. The result is a happy confluence of brand reinforcement and local reach for an ardent local fan base. Most teams aren’t so fortunate, or flexible. But regional sports networks are an endangered species, struggling against invasive newcomers like AVOD and tech giants, while their native cable TV range shrinks. Local sports subscriptions, enabled by Next Gen TV digital broadcast capabilities, could be a nice little business for teams, their distribution partners, and their most ardent fans. That price point is pretty digestible, if highly seasonal, and doesn’t function as a tax on non-fans. I guess the question is whether it’s a sustainable price. I’m dubious. Against that local backdrop, it’ll be even more interesting to see what happens with renewals of NBA national/international TV rights. Does Apple drop a large number for some variant on its Major League Soccer arrangement? Does debt-laden Warner Bros. Discovery have the bank account to keep up, and will it absolutely have to, given Max’s just-launched live sports addendum? What does a national streaming presence mean for those local deals, especially as fans stack up lots of expensive subscriptions?

DANIEL: I’m going to jack up a wild three-pointer here and say no way WBD and Zaslav reach deep and re-up the NBA. Like the NFL, the NBA’s “product” has never been better. Forget the level of skill and competition the pro game has ascended, as it integrates freakishly amazing athletes from all over the world. (My son describes any freakishly impressive display of anything now as being “Doncicish,” as in Slovenian Dallas Mavericks star Luka Dončić.) The production values just get better and better. TNT delivered an average audience of 4.7 million viewers through two rounds of NBA playoffs coverage in April-May. What else out there will deliver that audience beyond Taylor Swift in an NFL press box? If Amazon was willing to pay $1 billion a year for a crappy selection of NFL Thursday night games, what do you think it'll make of WBD's current and soon-to-expire $1.2 billion-a-season pact with the NBA? Adam Silver and the league are going to have to fight ’em off. I get that Zaz and WBD just launched the Bleacher Report-branded sports add-on for Max (which conspicuously has no presence of Sir Charles Barkley and TNT’s Inside the NBA crew). I'm not sure that means anything — WBD still has a season left in this contract. But for the money the NBA is going to want for its next deal, I suspect Zaslav’s gonna let us all eat Shark Week.

DAVID: Don’t you mean Shark Month? That’s the obvious next unscripted franchise showing its dorsal fin as cable and broadcast TV outlets dive ever more deeply into reality competitions and game shows. Hoary old competition show Survivor will deliver 90-minute episodes “all season,” the promos threaten. (Talk about living up to your name, though; Survivor started 23 years ago, outliving the Y2K bug and the teen years of millennials). CBS (the midstrike version) is riding the reality competition/game-show horse hard: its Friday-night lineup, for instance, features three, including the Latinx-inflected Loteria Loca. We won’t see new scripted shows on air until at least January, and probably much later, given the intractable disputes still looming over the actors strike. That, in turn, could further entrench this fall’s programming approach long after the actors come back. And you’re right about that miserable Thursday night NFL lineup. Even Hall of Fame broadcaster Al Michaels couldn't hide his disdain for last week’s matchup between the mediocre Washington Commanders and a Chicago Bears team that finally ended an atrocious 14-game losing streak. Amazon is still getting plenty of tune-in, especially by younger, more affluent viewers who like to buy things on Amazon. So break out the Bezos moneybags for the NBA. Young stars such as Dončić and latest No.1 overall pick Victor Wembanyama of France have an international appeal far beyond what Lamar Jackson or Patrick Mahomes can muster outside the United States. Even Taylor Swift paramour Travis Kelce doesn’t travel like the NBA. If you’re running a global streaming service, the NBA is just a lot more valuable, with a lot more programming to boot.

DANIEL: Yeah, my eyes are Mamba-focused on this NBA topic as it relates to Zaz. What do you think the odds are he comes up with, say, $2 billion a year to keep the league in the Warner kingdom? With Sir Charles saying that he might not stick around, even with a $100 million contract? And ESPN cratering what’s left of the airlock TNT lives in? One on one? Buckets. Your ball. Take the shot, Bloom.

DAVID: WBD in its first 18 months of existence has been all about getting smaller and cheaper, a natural response when you start out with $55 billion in debt on a not-that-big company. Now they have a media company that the market values at $25 billion, with around $45 billion in remaining debt after relentless “synergies,” cost-cutting, reorganizations, tax writeoffs, cancellations, mothballing, etc. After all those financial machinations, free cash flow is up (thanks, strikers), but shares are way down, around 57% since the current regime took over, to about $10 apiece. That’s not the usual context for taking a $2 billion/year shot at part of the NBA rights, even if that shoots a hole in the sports initiative they’re doing with Max.

WBD in its first 18 months of existence has been all about getting smaller and cheaper, a natural response when you start out with $55 billion in debt on a not-that-big company.”

That doesn’t seem to pencil out in the streaming world we’re now in, especially for a company with a lot of financial challenges. Want a shot from downtown, though? Here’s a Steph Curry-worthy one: If WBD does bid, it effectively does so jointly with NBCUniversal, on the presumption that they’ll be a merged entity, perhaps already spun off by broadband and mobile operator Comcast, by the time the new rights actually kick in. I was chatting with an industry analyst this morning who was dubious that Zazworld will have the resources to play in this otherwise. The analyst’s bigger take was that the sports leagues, especially the U.S-focused ones such as the NFL and MLB, need to begin buying directly into some linear networks. If they don’t, the analyst argued, within a few years the leagues won’t have any way to reach the broad, regionally focused audiences that watch their games on linear. Absent that kind of investment, the linear networks will be dead and gone by 2032, Netflix and Apple won’t care about U.S.-centric sports that don’t travel well in their many international territories, and the NFL will only get bids from Amazon. And we know how Amazon can be when it has an advantage in a business deal.