Why The CW Has to Reinvent Its Streaming Strategy | Charts

Since its debut in 2006 as a joint venture between Warner Bros. and CBS, The CW primarily served as an outlet for its parents’ studios. That’s all changing now that Nexstar has purchased a majority stake in the broadcaster, putting its streaming strategies up in the air.

Since a lucrative output deal with Netflix ended in 2019, CW shows have tended to go on its parents’ streaming services Max and Paramount+. The CW has its own streaming app and website which Nexstar has increasingly emphasized in investor presentations as its way into the ad-supported streaming market. And with Warner Bros. Discovery and Paramount Global now owning smaller stakes which Nexstar could buy out altogether next year, The CW is set to chart its own streaming path.

The CW has several problems to solve with a schedule revamp that is taking it away from its YA roots, including the fact that many of its popular shows (as well as some duds) are expensive to license and it doesn’t see ancillary profit streams from them. The question now is whether The CW can take advantage of its shows’ successful presence on third-party streamers while it tries to establish its own digital audience.

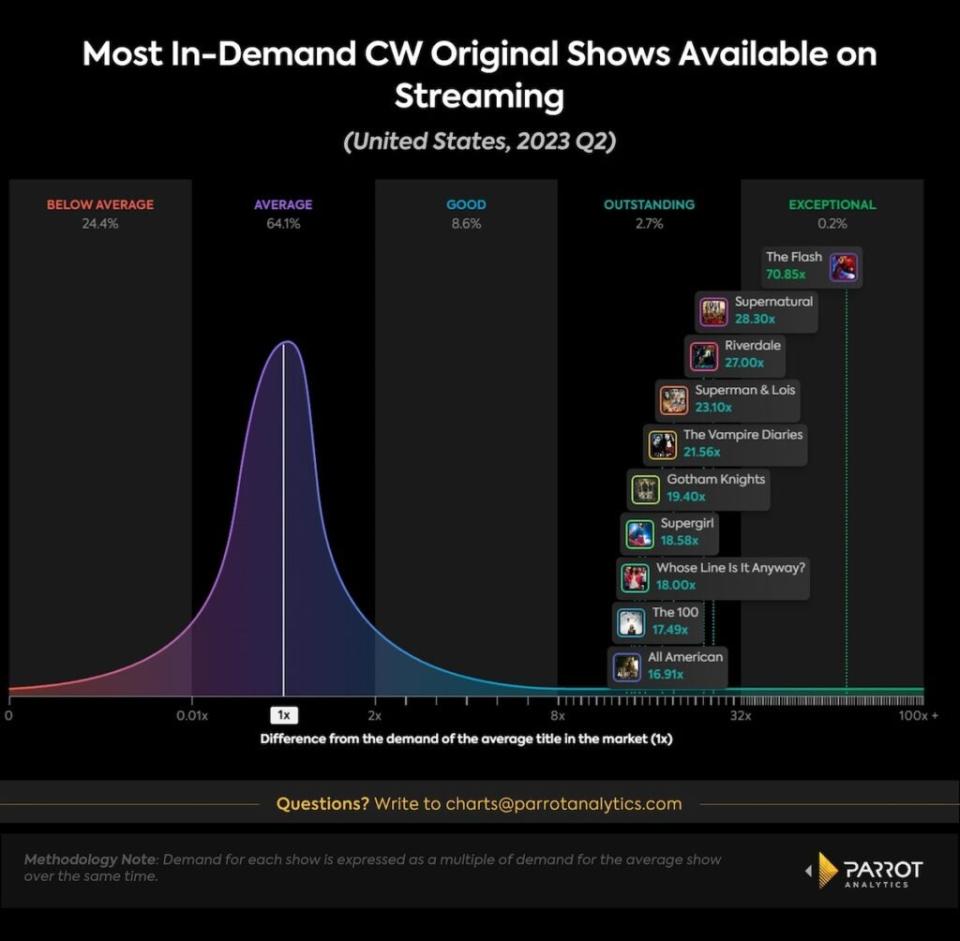

An illustration of this conundrum is the widespread popularity of several CW TV series on Netflix’s catalog. Among these are “The Flash,” the network’s flagship show, which generated demand 70.8 times greater than the average U.S. show following the launch of a new season in the first quarter of 2023. The enduring appeal of “Supernatural,” a show from 2005, and the teen drama “Riverdale,” whose final season was recently broadcast, also stand out.

Several other top 10 high-demand CW shows, like “Supergirl,” “The 100,” and “All American,” are also licensed to Netflix. But The CW’s upside from those shows’ streaming success is limited.

Looking backwards at the Netflix deal still offers some insights for The CW’s future strategy. Even four years after the expiration of the deal, CW shows accounted for 6% of the total demand for Netflix’s TV catalog in the second quarter of 2023, the largest presence for the network’s lineup on any streaming service. CW content accounted for 4.1% of the total demand for Max’s TV catalog, driven by popular CW shows like “Superman & Lois,” “The Vampire Diaries,” and “Whose Line Is It Anyway?”

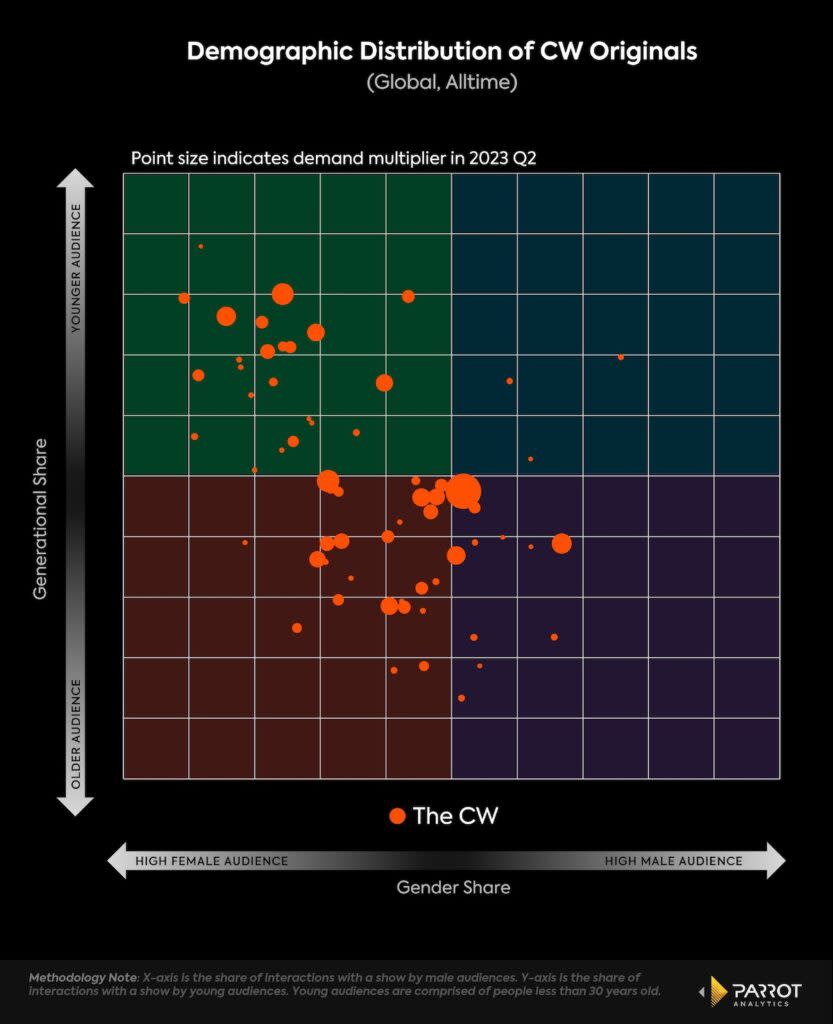

With The CW able to shop around for shows to broadcast and stream, it’s important to consider the network’s existing audience demographics. The network’s catalog is skewed toward female audiences, especially younger women. These shows could benefit from being licensed to a service that has a similar audience, where views on a third-party streamer could potentially also benefit The CW’s viewership over the air and online.

Netflix, Apple TV+, and Hulu stand out with a substantial amount of female-leaning original content. Netflix, in particular, has a more youthful and female-skewed audience, while Hulu, which had a streaming deal with The CW from 2011 to 2016, has a higher proportion of older female viewers. The CW could keep pushing its own streaming apps in a competitive marketplace — or it could strike a deal with a bigger streamer that could help grow the audience for its changing lineup.

Daniel Quinaud is a senior data analyst at Parrot Analytics, a WrapPRO partner. For more from Parrot Analytics, visit the Data and Analysis Hub.

The post Why The CW Has to Reinvent Its Streaming Strategy | Charts appeared first on TheWrap.