Why Bob Iger Won’t Sell Disney’s Linear Assets | Exclusive

- Oops!Something went wrong.Please try again later.

In July, Disney CEO Bob Iger brought back former longtime Disney executives Kevin Mayer and Tom Staggs to advise him on what to do with Disney’s linear assets, which include ABC, ESPN, National Geographic, FX and Freeform.

Their unvarnished advice was to unload them — not urgently, but soon, two people knowledgeable with the company’s operations told TheWrap.

Since returning to Disney in 2022, the legendary corporate leader has faced anemic stock prices, creative doldrums and the worsening pressure from streaming, all problems advisers are telling him can be alleviated by selling off most of the entertainment giant’s linear TV assets.

The advisors echoed the analysis of Wall Street — these assets are steadily declining over time, even if they still currently throw off profit. Given consumers’ move to streaming, cable and broadcast television is headed for history.

Some six months later, Iger has yet to take any action.

“He just doesn’t want to sell them off,” one of the individuals said. “The non-linear sports networks should be gone, they provide nothing — nothing but earnings decline.”

Iger’s stance on the viability of linear TV has sloshed around since he took the reins of the company again in November of 2022. Two months earlier, when he was in between stints, the former ABC/Capital Cities president and COO agreed that traditional TV, including broadcast, cable and satellite, was “marching to a distinct precipice, and it’s going to be pushed off.”

Then in July, he said the TV networks “may not be core” to the business, while being clear that when it came to ESPN, “we want to stay in the sports business.” And this past November, he said “it is not the case” that Disney would sell the linear assets, with Disney Entertainment co-chair Dana Walden adding that the linear channels are “very deeply embedded” in its streaming strategy.

The Disney CEO’s recent reticence contrasts sharply with the message communicated by Disney’s main rival Netflix on Tuesday: Broadcast television cannot be saved through more consolidation. “We’re not interested in acquiring linear assets,” Netflix said in its letter to investors announcing its fourth-quarter 2023 earnings. “Nor do we believe that further M&A among traditional entertainment companies will materially change the competitive environment given all the consolidation that has already happened over the last decade.”

Like other major entertainment companies with legacy assets, the company is trying to work out the transition from linear to digital. But the need to set a strategy is more urgent for Iger, as Disney’s value has plunged in the past few years without seeing clear recovery.

Iger himself has pointed to a need to recharge Disney’s core creative franchises — Marvel, Star Wars and Pixar — which drive the global conglomerates’ flywheel of parks, merchandise, travel and content.

So why not shed linear? For one thing, these assets that are still profitable, even though declining. And Iger believes that the creative engine that drives linear television is critical to feeding a “rich flow of content” to the company’s streaming platforms, as the CEO told analysts in November.

In recent months, Iger has pointed to ESPN as having more potential, calling it a “core building opportunity” in November. Operating income for ESPN in 2023 fell by 2% to $2.8 billion from 2022, while revenues grew 2% to $16.4 billion.

But there may be more strategy to Iger’s thinking: The Disney CEO is worried that unloading the non-sports TV assets, which brought in $11.7 billion in revenues in 2023, or 13% of Disney’s total of $88.9 billion, could make the company too vulnerable to being acquired, another person familiar with Disney’s operations said. (Linear TV revenues fell 9% from 2022, while operating income plummeted by 21%.)

Facing the music

With Disney set to report its latest earnings on Feb. 7, Iger is facing a raft of challenges.

The company’s stock price, which closed at $94.86 on Thursday, is sluggish and trading at levels not seen for a decade. Its big-budget franchises, especially Marvel, are tired and creatively struggling. Disney is spending heavily to catch up on streaming. Activist investors are clamoring for board seats and for faster action to boost the stock price — and for a clear succession plan for Iger. Disney’s sprawling Experiences business, which brings in about 35% of overall revenues, had a disappointing summer, with lower-than-expected parks attendance. “And Pixar,” the knowledgeable person said, “is falling apart.”

Wall Street analysts and private equity executives have told TheWrap that Disney would be better off being acquired by a Big Tech company, most likely Apple. Or for a private equity firm – it could take multiple firms acting in unison — to attempt a history-making leveraged buyout of at least $200 billion.

Apple buying Disney “is the opportunity of a lifetime,” said Peter Csathy of Creative Media, a media, entertainment and tech advisory firm, who also writes for TheWrap. “If Disney is available, it could be one of those opportunities that breaks all the rules because it is such a unique asset.”

But tech companies, especially Apple, are unlikely to risk stoking the ire of regulators in Washington, D.C., who under President Biden have focused their sights on stemming potential monopolistic behavior, analysts told TheWrap.

To sell or not to sell

Iger is not seeking to sell all of Disney, the two people familiar with the company told TheWrap. And selling the company is not likely to solve all of Disney’s problems. “There is no silver bullet,” one knowledgeable person said. “It is going to be a slog to get back to $150 [per share].”

Analysts say that Disney, which currently has a market cap of $173.6 billion, could fetch upwards of $200 billion with a premium. That’s a price that only a company like Apple or Microsoft — the two largest companies in the world right now, each having passed $3 trillion in valuation — could afford. Up to now, Apple has been famously acquisition-shy: The largest deal it has ever done was the 2014 purchase of Beats Music and Beats Electronics for $3 billion.

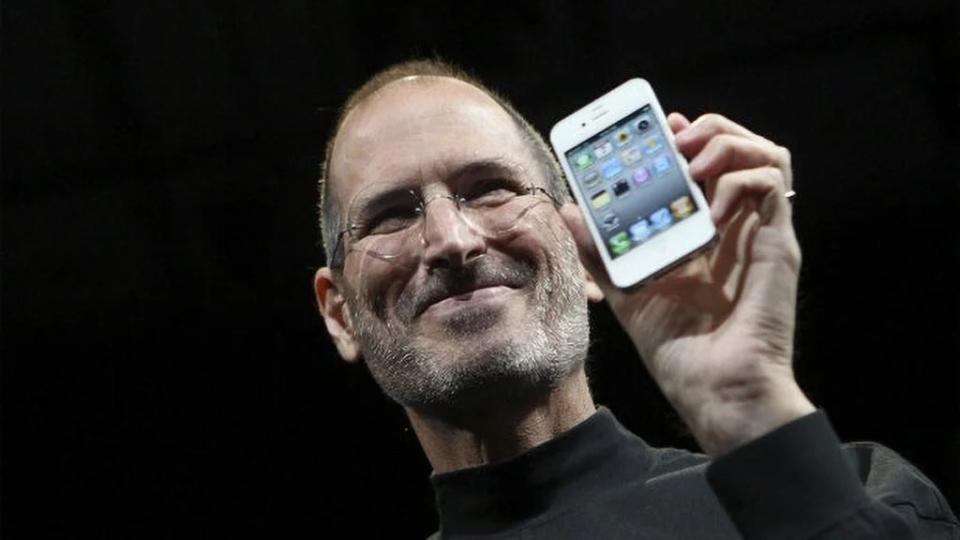

Still, Disney and Apple have strong ties dating to when Iger, shortly after taking over as CEO in 2005, agreed to license a handful of TV programs to Apple for its iPod video player. Then Iger persuaded Apple CEO Steve Jobs to sell Pixar to Disney in 2006 for $7.4 billion. On the day the companies planned to announce the deal, Jobs confided to Iger that his pancreatic cancer had returned and offered to let Disney out of the deal, which Iger refused. The Apple co-founder served on Disney’s board until his death in 2011. Iger famously wrote in his own memoir, “The Ride of a Lifetime,” that had Jobs lived they would have combined their companies.

Even under CEO Tim Cook, the ties continue, albeit the companies have never been as close as during the Jobs-Iger years. Apple’s latest product, the Vision Pro, a $3,500 mixed-reality headset set to launch next month, will include 150 3D movies, including Disney titles like “Avengers: Endgame,” “Star Wars: The Force Awakens” and “Encanto.”

When asked directly by an analyst in November about whether Disney was open to being acquired by a technology company, Iger said he would not speculate, but noted that people making such predictions should “consider the global regulatory environment.” He added: “It’s not something that we obsess about.”

Most analysts TheWrap spoke to don’t see Apple or any other tech company being interested in acquiring Disney’s sprawling Experiences business, which includes theme parks, cruise ships and resorts. A more likely scenario would see Disney selling off its premium content, including its content library, film studios and maybe Hulu and ESPN — and then selling its TV networks and broadcast stations to a private equity firm or strategic consolidator like Nexstar.

“Disney would be worth more today in a breakup,” said Barton Crockett, an analyst at Rosenblatt Securities.

There is no silver bullet. It is going to be a slog to get back to $150 [per share].

One person knowledgeable about Disney’s operations

The parks, which include properties in the United States, Europe and Asia, could be spun off to trade as a separate company, and be granted licensing rights in perpetuity for Disney’s IP, Crockett said.

Csathy, for one, sees another option. He outlined a scenario to TheWrap where Candle Media, the private equity firm founded by Mayer and Staggs, which is backed by Blackstone, would buy Disney in its entirety and then take the company private, build its value and then put it back on the public market a few years later. “It’s the perfect storm because you have the right management team, they know the assets inside and out,” Csathy said.

But a private equity deal for Disney would be several times larger than the biggest P.E. deal ever closed in U.S. history — the $32 billion leveraged buyout of TXU energy in 2007 — and likely take multiple firms to pull off, analysts and the people knowledgeable about Disney’s operations told TheWrap.

“Is there theoretically enough firepower out there” one of the people knowledgeable about Disney’s operations said. “Sure. But I just don’t see it. That is a pretty large equity check and there are a whole bunch of people you would need to bring together.”

The post Why Bob Iger Won’t Sell Disney’s Linear Assets | Exclusive appeared first on TheWrap.