Why Apple TV+’s 40% Subscription Price Hike Is Entirely Justified | Charts

Apple recently announced that it’s increasing the monthly price of a subscription to Apple TV+ from $4.99 to $6.99. This 40% price hike is the first time the streamer has raised its price since launching in 2019. The platform’s $4.99 sticker price made it one of the most affordable streamers in the United States, even considering its smaller catalog size relative to competitors. The $5 price point was half the price of Netflix Basic, Paramount+ Premium, and Peacock Premium Plus — all ad-free tiers of competitors.

In a statement about the price increase, Apple said: “We introduced Apple TV+ at a very low price because we started with just a few shows and movies. Three years later, Apple TV+ is home to an extensive selection of award-winning and broadly acclaimed series, feature films, documentaries and kids and family entertainment from the world’s most creative storytellers.”

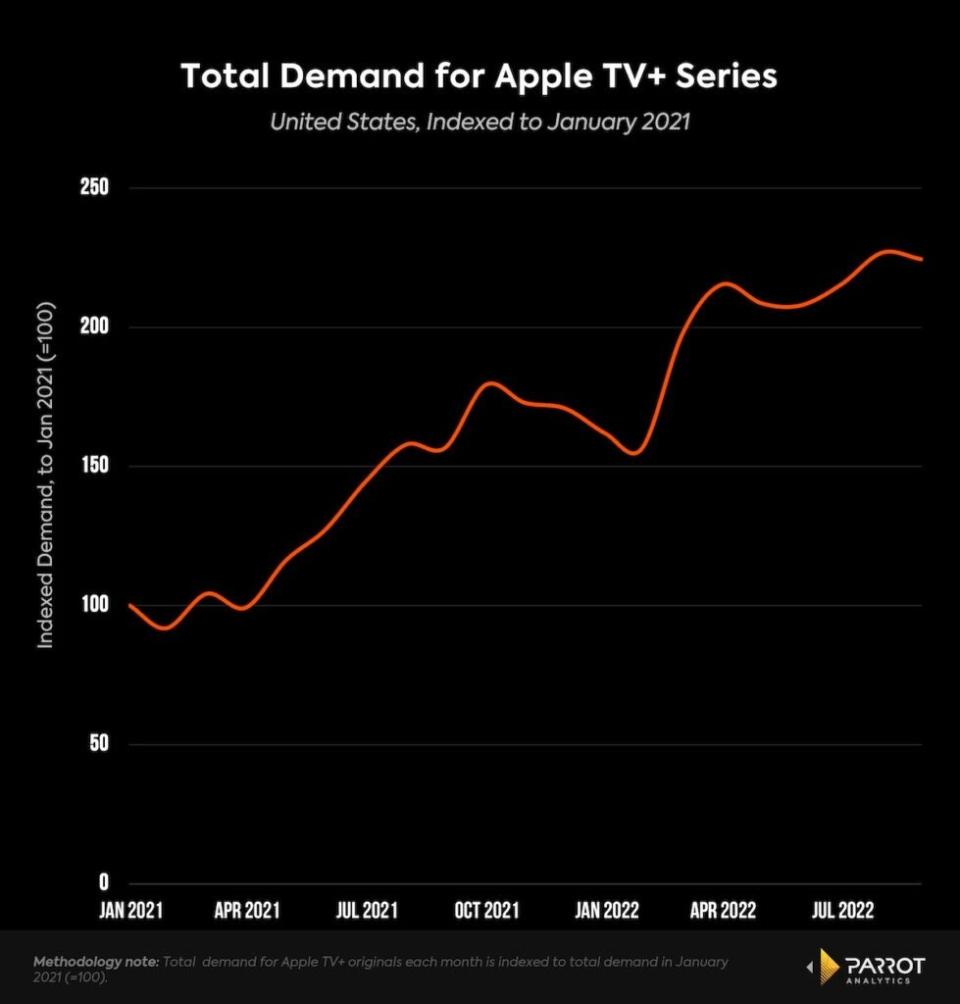

When we look at how demand for all shows available on the platform has changed since 2021 this is measurably true. Demand for shows on Apple TV+ more than doubled from January 2021 to September 2022, according to Parrot Analytics‘ data, which takes into account consumer research, streaming, downloads and social media, among other engagement.

From this perspective, Apple TV+ is making good on its value proposition to subscribers. The rapid growth in both the amount of content on Apple TV+ and the total demand for its catalog appears to justify the price hike. Even at the new price, the platform is still among the cheapest ad-free plans available — now tied with Discovery+, whose ad-free tier also costs $6.99.

A benefit of Apple TV+’s focus on building out a platform of must-watch original content is that all this content is exclusive to the platform. Therefore, while Apple TV+’s total catalog might be smaller than other streamers’, its ability to draw in subscribers punches above its weight because all of this content is only available on Apple TV+.

Apple TV+ has managed this growth not by recklessly pouring money into ballooning the amount of content but by making smart content investments that have resulted in a library of high-quality programming that has won critical acclaim. At this year’s Emmy awards, both “Ted Lasso” and “Severance” were among the most honored shows of the night. “CODA” became the first Best Picture winner distributed by a streaming platform at this year’s Academy Awards.

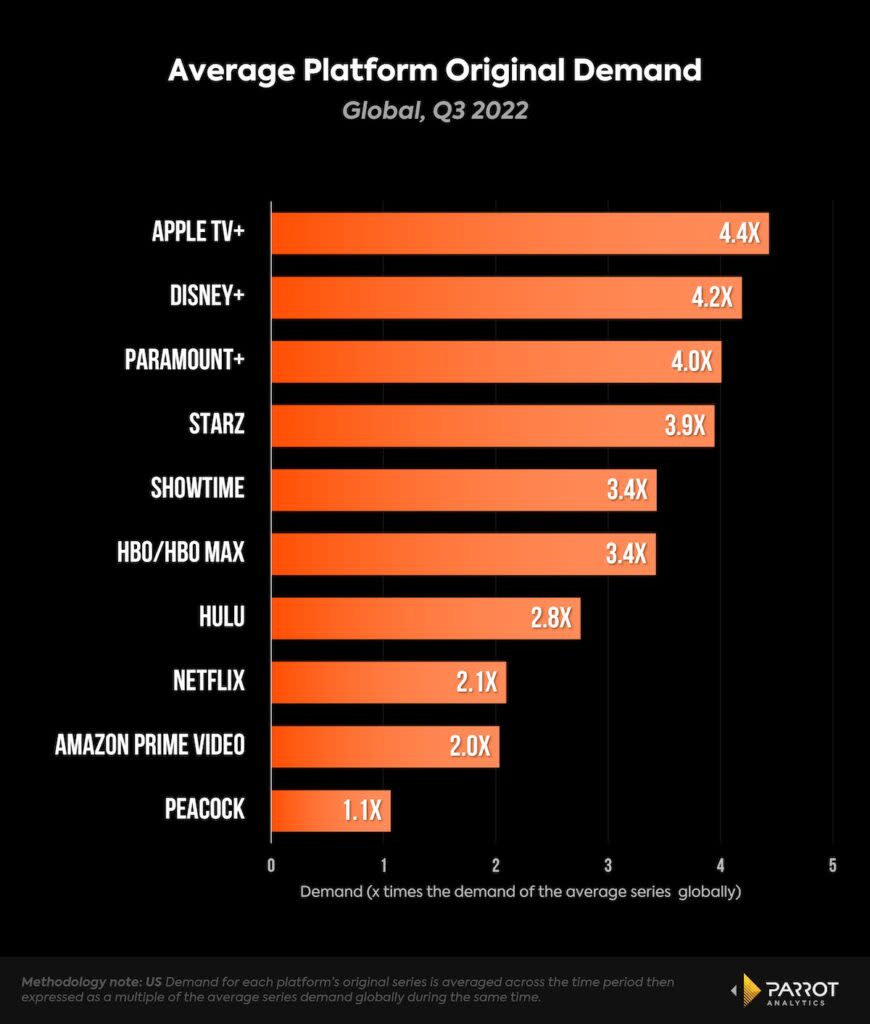

But it isn’t just critics and Academy voters falling in love with Apple TV+ — its shows are also winning the hearts of audiences around the world. In Q3, the average Apple TV+ series had 4.4 times the demand of the average series, according to Parrot data (which takes into account consumer research, streaming, downloads and social media, among other forms of engagement). This puts Apple ahead of other major streamers in terms of the amount of attention its series attract on average. It even leads Disney+ slightly in this measure. While Disney+ continues to crank out mega-hits from its Marvel and “Star Wars” franchises, a number of less in-demand series from the platform have brought its average original demand below Apple TV+.

Another way to think about the quality of content from these platforms is their hit rate — the percentage of shows that reach a critical level of demand. In this respect, Apple TV+ is also a leader. Let’s assume that 8.0 times is the level of demand that quantifies a show as a hit (less than 3% of shows reach this level of demand). According to Parrot’s data, 19% of Apple TV+ series had above this level of demand globally for the quarter. Compare this to Netflix, where only 6% of its original series reached this level of demand, or Disney+, where that number was 12%. The odds that the next Apple TV+ series stands out amid the competition are greater.

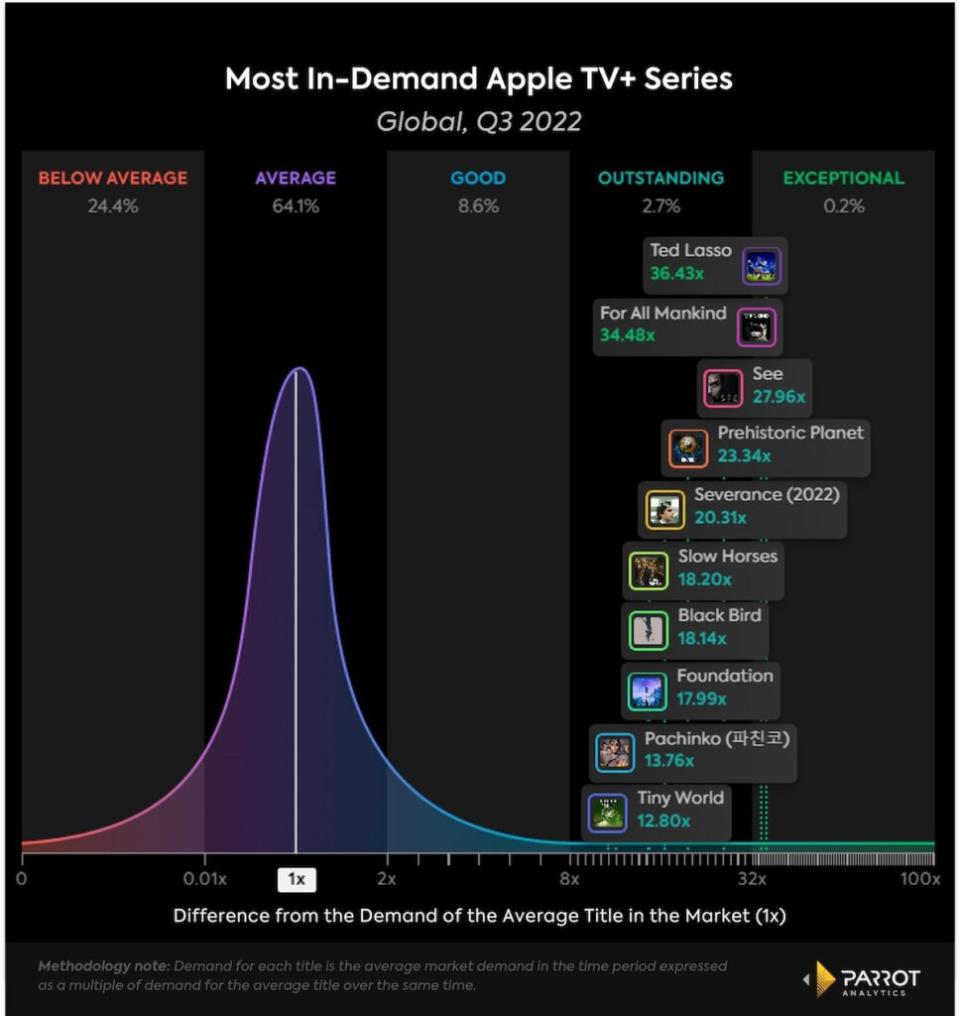

All of the 10 most in-demand Apple TV+ original series for the quarter comfortably surpass this 8.0 times threshold. The streamer’s two most in-demand series for the quarter, “Ted Lasso” and “For All Mankind,” are among the top 0.2% of shows with greater than 32 times the demand of the average series. “Ted Lasso” has been the platform’s biggest hit to date, consistently ranking as the most in-demand Apple TV+ series, so it’s a positive sign that “For All Mankind” is able to nearly match its level of demand.

Two documentary series featured in the 10 most in-demand Apple TV+ originals for the quarter — “Prehistoric Planet” and “Tiny World.” The documentary genre has been one of the fastest growing genres and Apple TV+ is positioning itself to capitalize on growing doc demand.

“Pachinko” stands out as a non-English series from Apple TV+ that has found global success recently. The show had nearly 14 times the average series demand for the quarter. Apple TV+ was a global platform from the day it launched, unlike many of its domestic competitors who have had fragmented international rollouts. Continuing to invest in international content like “Pachinko” will be key to winning audiences around the world.

If Apple TV+ continues with its focus on quality and is able sustain its hit rate in the coming years, it will make good progress towards organically building a premium streaming service, essential to subscribers, that can compete with other platforms at a higher price point.

Christofer Hamilton is a senior insights analyst at Parrot Analytics, a WrapPRO partner. For more from Parrot Analytics, visit the Data and Analysis Hub.

Also Read:

Disney+’s ‘Andor’ Rises as Other Franchise Shows Slip in Demand | Chart