Why Amazon Is Doubling Down on Indian Series and Movies | Charts

Amazon Prime Video recently announced a massive expansion of its streaming footprint in India, including 26 new and nine returning original series. The new original series are set to release over the next two years and Amazon plans to double its investment in Prime Video in India over the next five years.

While the scale of this investment is impressive, it’s not surprising. India has been a key market of focus for Amazon as the company seeks to grow its global subscriber base and we have already seen exceptionally high demand for its original series there.

As of Q1 2022, 15.9% of demand for streaming original series in India was for an Amazon Prime Video original, putting the streamer behind Netflix but comfortably ahead of a combined Disney+ Hotstar (Disney’s Indian brand subscription service) — according to Parrot Analytics‘ data, which takes into account consumer research, streaming, downloads and social media, among other consumer engagement.

Prime Video’s 15.9% share of demand for original series makes India one of the markets with the largest share of demand for the platform’s originals. However, its share this quarter is actually well below its high-water mark for the past two years (20.4% in October 2020). Mounting competition from platforms like Disney+ Hotstar and a number of local streamers like Zee5 has chipped away at Amazon Prime Video’s demand share. It makes perfect sense now for Amazon to redouble its efforts in India to fend off competition while it’s still in a relatively strong position.

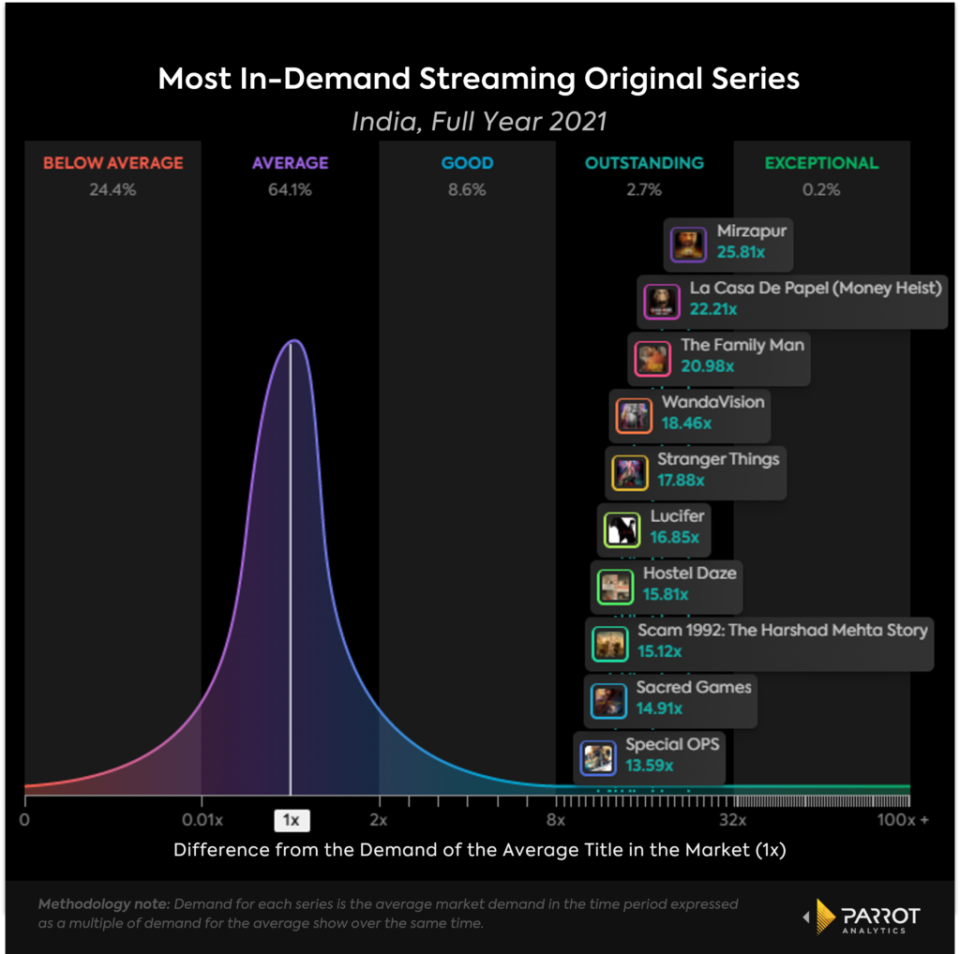

Investments in local content have been key to Amazon Prime Video’s success in India. In 2021, the most in-demand streaming original series in India was Prime Video’s “Mirzapur,” which had 25.81 times the average series demand for the year. Three of the 10 most in-demand streaming originals for the year were local productions from Amazon (including “Hostel Daze” and “The Family Man”).

While Netflix had more originals in the top 10 than Amazon, its only local show was “Sacred Games,” which ranked ninth most in-demand for the year, which seems to indicate that Netflix hasn’t quite figured out the key to the local market like Prime Video.

It would be narrow-minded to look at Prime Video’s investments in Indian content as only benefiting Amazon’s operations in the Indian market. In today’s borderless world of content, it’s likely that some of these new series will find fans around the world. Prime Video in particular, as a global streamer, knows that it’s in a position to make this a reality. The company’s head of local originals announced that one in five subscribers outside India watch content from the country.

In 2021, half of the 10 most globally in-demand non-English streaming originals were from India. This underscores the potential of India as an content exporter to the world and Amazon’s position to take advantage of this (three of the five Indian series above are Amazon originals).

We’ve previously measured Hindi as one of the languages whose content is seeing growing demand in the U.S. Amazon’s new planned slate of originals includes series in Hindi, Tamil and Telugu, so these languages may be the next to see a burst of growing demand in international markets if Amazon is successful with its new push in India.