Warner Bros. Discovery Wants to Compete for Kids and Families – and HBO Was in the Way | Analysis

Warner Bros. Discovery made headlines Wednesday by kicking off its Max streaming service — the renamed HBO Max — with buzzy series announcements based on familiar series. There’s a new “Harry Potter” streaming series, a “Big Bang Theory” spin-off and, yes, more dragons.

But CEO David Zaslav and his team will have to do more to impress a skeptical Wall Street and win over streaming consumers who already have an abundance of entertainment choices. And he will have to do that without the powerful HBO brand as a primary lure.

HBO is well-known — perhaps too well-known, in its specific associations with edgy content. Warner Bros. Discovery executives admitted as much Wednesday, saying they wanted Max to be seen as an all-ages, kid-friendly streaming venue. But is it a mistake to downplay an esteemed media brand in an effort to compete in a marketplace dominated by Disney and Netflix?

Also Read:

Warner Bros. Discovery Shares Tumble 5% Amid Max Relaunch

“It’s something they have to do in order to compete with the other big players in streaming,” Ateliere Creative Technologies CEO Dan Goman told TheWrap. “I honestly don’t think they have much of a choice. HBO had a very specific and limited audience.”

The new strategy, he added, was poised to “maximize viewer access.”

Warner Bros. Discovery faces a lot of pressure to do just that. The stock is down 46% from a year ago, when the company newly created from the merger of WarnerMedia and Discovery Communications began trading its shares. It fell another 6% Wednesday. At this moment, the debt load Discovery took on in buying WarnerMedia weighs more heavily on investors than the opportunities of the company’s impressive library.

Also Read:

Warner Bros. Discovery’s Max Streamer Ripped as a Terrible Brand Strategy: ‘Insanely Bad Decision’

Casey Bloys, who oversees HBO and content for Max, took great pains to assure interested parties that the HBO brand would remain at the top of the Max content mountain. But the name change and the push toward more family-friendly content echoed earlier reports that HBO was considered too much of an upscale brand and too adult-skewing for the all-audiences, four-quadrant streaming service Zaslav and shareholders prefer.

And part of the challenge of the HBO branding of HBO Max was its obscuring of the many other types of content available in the Warner Bros. library.

“You can’t have so many high-value kid-friendly brands [like Looney Tunes, Hanna-Barbera and DC Studios among others] and not make a play for the kids-and-family scene,” Cyma Zarghami, CEO of Nickelodeon from 2006 to 2018 and currently the founder and CEO of MIMO Studios, told TheWrap.

“They have to give it a shot,” she added.

The addition of Discovery’s lifestyle-oriented content, heavy on unscripted programming, further stretched the brand.

Also Read:

David Zaslav: Even With a Writers Strike, Max Streaming Launch Is ‘Ready to Go Guns Blazing’

“Max should help put Discovery+ content in front of a younger audience that has previously been underexposed, while also creating a much larger content catalog for current HBO Max viewers,” said Dallas Lawrence, senior vice president at Samba TV. “Leaning into content that speaks to younger audiences is a big area of possible growth for Warner Bros. Discovery… At this stage in the streaming wars, scaled and diverse content is king to keeping and attracting subscribers.”

The challenge is less about providing a library of kid-friendly shows and more about persuading subscribers to try Max’s particular offering. Hub Research founder Jon Giegengack points out that there’s no shortage of kids’ content and that the amount available in any genre exceeds the time the average kid has available to watch.

“Warner Bros. Discovery will need to convince people that their kids content is better than other platforms, or sufficiently different from others that it’s worth having both,” he said.

A marketing challenge

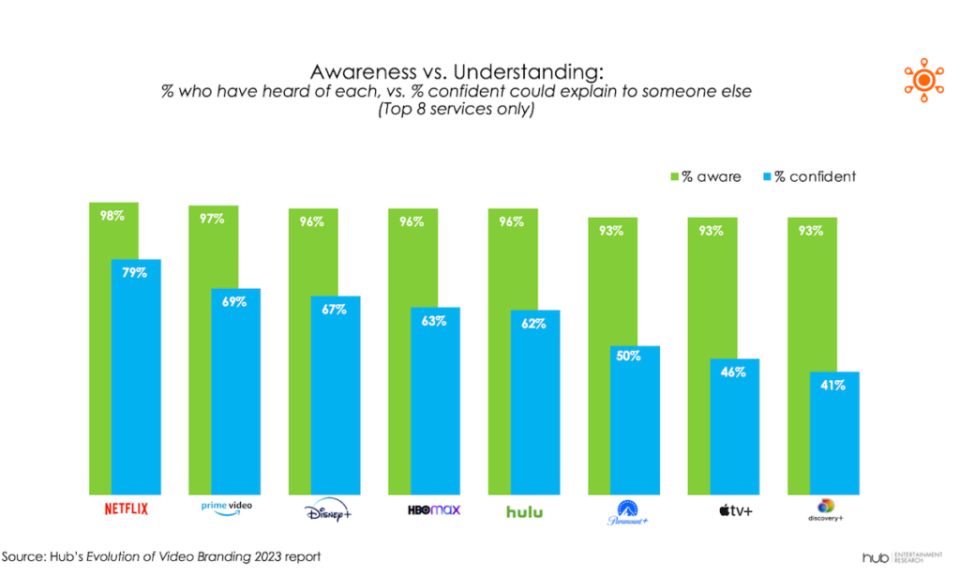

According to Hub Research’s latest “Evolution of Video Branding” survey, almost all respondents were aware of HBO Max, but just 63% felt confident they could explain how the service was different from its streaming alternatives, compared to 67% who felt the same about Disney+, 69% who felt the same about Amazon’s Prime Video and 79% who felt the same about Netflix.

Can Max fix that by courting families? Experts thought that sounded like a big challenge.

While Disney+ is obviously uniquely positioned as the dominant kid-friendly streamer, Netflix has made major inroads just by being first and having an interface so simple that a child can use it sans parental supervision.

“Everyone knows what Disney is whereas with Max they’re going to have to start a whole new marketing campaign,” streaming media analyst Dan Rayburn told TheWrap. “It’s just more messaging to the market in a crowded market.”

Fitz-Gerald Group founder Keith Fitz-Gerald called the rebranding “right up there with New Coke” and questioned dropping the HBO brand.

“History is shown that it’s hard to go toe to toe with Disney,” said Rebecca Hains, the author of “The Princess Problem” and professor of media and communications at Salem State University. She noted that Warner Bros. Discovery made headlines in August for jettisoning a deluge of quality kids content, including 200 episodes of “Sesame Street”, from its streaming service.

“It seems inconsistent that a network which caused so much concern for deleting children’s content is now being presented as the place for family fare,” she added.

Adding new shows while cutting costs

The relaunch comes as the entertainment giant has been undergoing a major restructuring, which it expects to complete by the end of 2024. Warner Bros. Discovery estimates the moves, including layoffs and other cost cuts, will result in up to $5.3 billion in restructuring charges before taxes, including up to $3.5 billion in content impairment and development write-offs.

During Morgan Stanley’s Technology, Media & Telecom Conference in March, chief financial officer Gunnar Wiedenfels said Max would be “absolutely critical” to Warner Bros. Discovery’s streaming efforts.

“For the first time, we’re going to be able to put all the content together. We believe that that’s going to have positive impacts on engagement, on churn, on subscriber acquisition,” Wiedenfels explained. “So, all the way through that entire value driver tree, we believe we’ll see improvements.”

Also Read:

Warner Bros. Discovery Faces Mountain of Debt on ‘Road to Profitability’

On the company’s fourth-quarter earnings call, Wiedenfels warned that the combined offering would increase marketing and content costs in the short term. He reaffirmed the company’s plan to break even on streaming in 2024 and deliver $1 billion in profit in 2025, and said the company continued “to track above our internal plans.”

The company ended the year with $45.5 billion in debt on its balance sheet and $3.9 billion in cash on hand. It has repaid $7 billion in debt since the WarnerMedia merger closed in April 2022, including $1 billion during the fourth quarter. But those debt repayments mean the cash available to invest in shows is constrained. Zaslav didn’t address the company’s financial picture in Wednesday’s consumer-oriented show.

“Wall Street only cares about profitability,” Rayburn added. “Success is going to be defined by, can you organically grow a streaming service while at the same time increasing your [average revenue per user] and getting the service to profitability? I think that’s the only way we should be defining ‘success.'”

Ross Gerber, CEO of wealth management firm Gerber Kawasaki, said the company is taking a big risk by setting the price of its Max Ultimate Ad Free tier at $19.99 per month while dropping the HBO name from the service.

“People are super price sensitive, especially younger people,” he said. “I think the market is looking around and saying, ‘Hey, is this realistically going to make their business better?’ And the answer is no…they just got rid of one of the most respected brands that spent 30 years building up respect.”

Also Read:

For Hollywood, Video Games Are the New Comic Books