Warner Bros. Discovery Logs Big Q2 Loss on Content and Merger Costs

- Oops!Something went wrong.Please try again later.

Combining the former WarnerMedia with the company once know as Discovery Communications took a lot of work. Executives at the newly combined Warner Bros. Discovery can’t rest yet.

The New York owner of HBO, Food Network and TNT said it saw a loss in the second quarter due to more than $1 billion in restructuring charges and continued investment in sports rights and content creation as the company tries to outmaneuver its rivals in both streaming and linear TV.

More from Variety

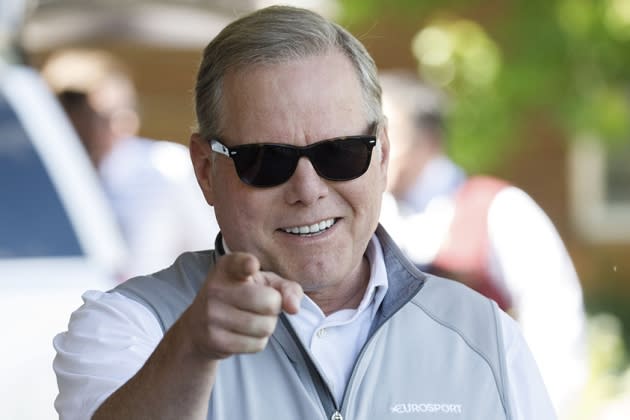

“We’re confident we’re on the right path to meet our strategic goals and really excel, both creatively and financially, and couldn’t be more excited about the future of our company,” said David Zaslav, the company’s CEO, in a prepared statement.

The company saw pro-forma revenue of more than $9.82 billion during the period, down 1% from the year-earlier period. But it reported a net loss of more than $3.41 billion, owing to more than $2 billion in amortization of various assets, more than $1 billion in restructuring and other charges, and $983 million in expenses related to the merger.

Shares of Warner Bros. Discovery fell as much as 12% in after-hours trading Thursday on the Q2 earnings report.

Warner Bros. Discovery said its studios segment notched revenue of more than $2,79 billion, up 3% on a pro-forma basis. The company’s TV networks saw revenue rise 1% to $5.74 billion, driven by a 2% increase in advertising that was bolstered by sports.

The company said HBO Max, HBO and Discovery+ subscribers combined were 92.1 million, up about 1.7 million from 90.4 million the prior quarter. That’s up 22% 75.8 million on a pro-forma basis versus a year earlier. But WBD’s streaming businesses lost subscribers domestically in Q2, dropping 300,000 — falling from 53.3 million in the first quarter to 53.0 million as of June 30.

VIP+ Analysis: WBD’s ‘Batgirl’ Blunder Spoils a Solid Strategy

Best of Variety

From 'The Sandman' to 'Blonde': Books Made Into Movies and TV Series That You Should Read

Jennette McCurdy's Provocative Book 'I'm Glad My Mom Died' Is Already a No. 1 Bestseller

Sign up for Variety’s Newsletter. For the latest news, follow us on Facebook, Twitter, and Instagram.