Warner Bros. Discovery Reaches Elusive Full-Year Streaming Profit. But Netflix Did it First | Chart

Last week, Warner Bros. Discovery reported its Q4 earnings for 2023. There were several numbers for CEO David Zaslav to celebrate, but perhaps the most tempting fact to shout from the rooftops was that WBD became the first major Hollywood conglomerate to record a full year streaming profit — but only when counting HBO, which WBD did.

But benchmarking against other legacy entertainment companies conveniently leaves Netflix out of the picture. Netflix has already reached profitability, and many are ready to declare it the winner of the streaming wars.

The WBD share price was down by 13% at the open on Friday following the company’s earnings report. Analysts attributed the drop in part to the lack of concrete 2024 guidance from the company even though David Zaslav said the company has an “attack plan” for this year.

Markets have not been kind to the stock prices of these companies in recent years. Below are a few data points on stock price changes as of Feb. 26:

Since merging Warner Media and Discovery in April 2022, the share price of WBD is down about 65%. In that same time, Netflix’s stock price is up 69%.

Since the Viacom-CBS merger at the end of 2019, the price of a share of Paramount Global is down by 73% while Netflix’s stock price has almost doubled over that time (+93%)

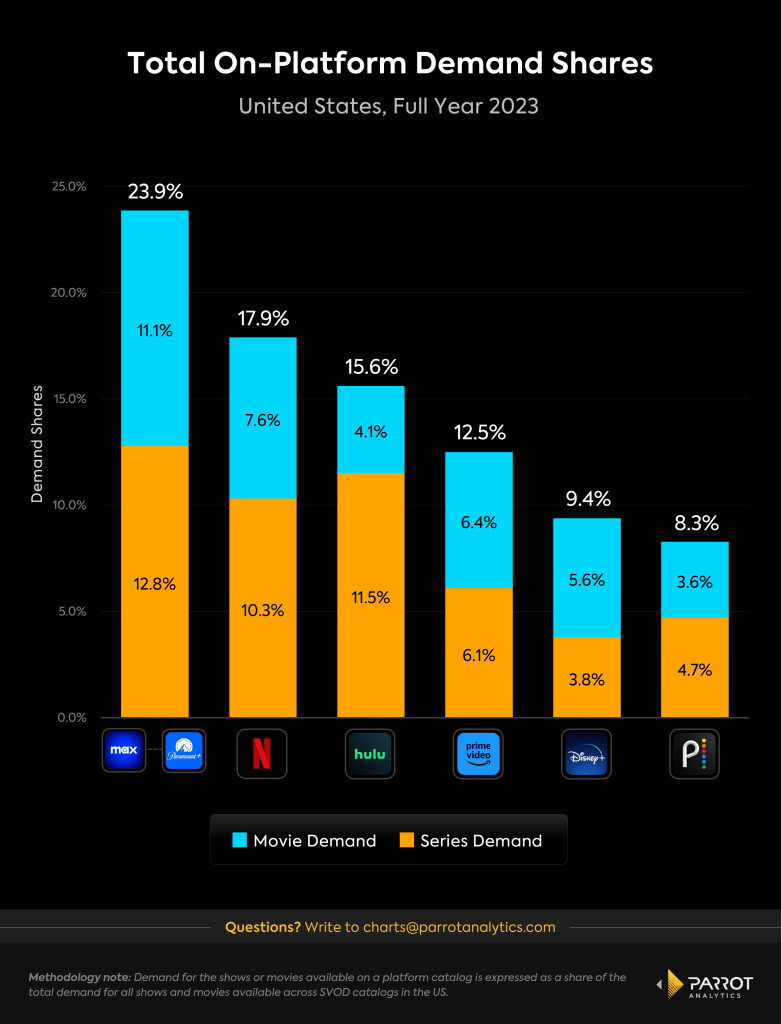

Given these companies’ fortunes since their mergers, it is perhaps not surprising that WBD and Paramount recently cut off talks about merging. Even though a combined Warner Bros. Discovery – Paramount would have been a market leader in terms of its corporate share of demand for shows and the demand for all shows and movies on a combined Max/Paramount+ platform, it looks like that will remain strictly hypothetical.

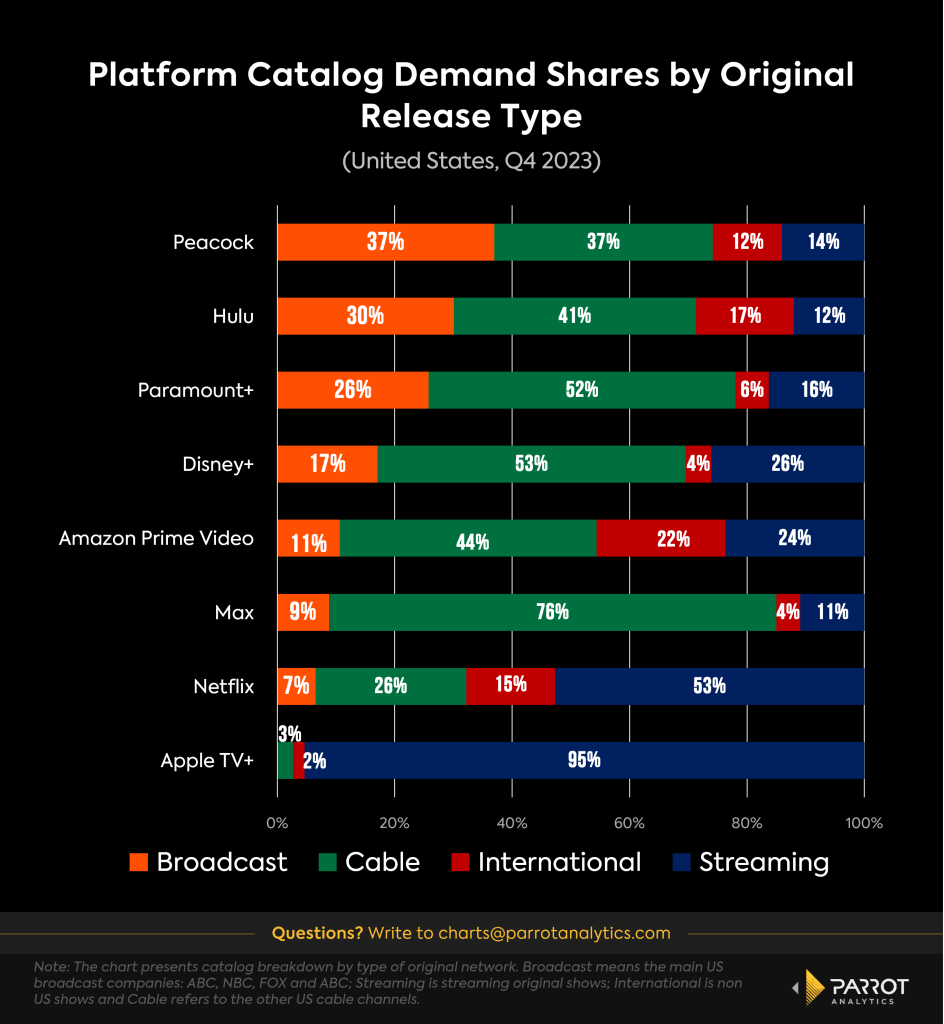

Whether WBD decides to pursue some other type of M&A deal or continue fighting Netflix’s streaming dominance on its own, it is clear that WBD’s premium cable assets are a unique strength it brings to the table. More than three-quarters of demand for all shows on Max at the end of 2023 was for a show that originally premiered on a cable channel. This is more than any other major SVOD in the U.S.

Specifically, HBO shows accounted for over 20% of demand for all shows available on Max. This underscores the importance of premium HBO content to the value proposition of the platform but also highlights the risks when new seasons of this content are delayed. Some of HBO’s flagship series were the kind of content that was the most heavily impacted by last year’s strikes. “House of the Dragon” will debut its second season this summer, but new seasons of zeitgeist-defining hits “The Last of Us,” “Euphoria’” and “The White Lotus” won’t arrive until 2025.

While the pipeline of premium HBO content may be looking a bit thinner this year as the effects of last year’s strikes on content production continue to reverberate, the recent success of “True Detective” is a good reminder that even long gaps between new seasons of content don’t necessarily dull audience enthusiasm. Demand for the latest season grew 167% with U.S. audiences compared to Season 3, which aired in 2019. Here’s hoping that Zaslav’s “attack plan” includes a new season of “True Detective” sooner than 2029.

Christofer Hamilton is a senior insights analyst at Parrot Analytics, a WrapPRO partner. For more from Parrot Analytics, visit the Data and Analysis Hub.

The post Warner Bros. Discovery Reaches Elusive Full-Year Streaming Profit. But Netflix Did it First | Chart appeared first on TheWrap.