Walmart's sales numbers make Amazon look small

It’s well-known that online retail powerhouse Amazon (AMZN) is the big threat to traditional retailers from department stores to supermarkets and beyond.

But investors shouldn’t assume that Amazon is the biggest seller in retail simply because it’s the biggest threat to traditional retailers.

Walmart (WMT) by far is the sales leader in retail, generating $308 billion in US revenue in 2016. This doesn’t include any additional sales Walmart conducts for third-party sellers online. And this eclipses Amazon’s roughly $145 billion in US gross merchandise volume (GMV), an estimate from Bloomberg Intelligence that does include third-party sales.

Plus, while the Census Bureau estimates that online sales across the industry make up a sizable 15% of the $2.2 trillion non-food retail market, Amazon’s $145 billion in GMV represents a more moderate 6.5% of that market.

Today’s Amazon worries mimic Walmart worries in 2001

While it’s not the industry leader in sales, Amazon’s sales growth is red-hot with its US merchandise sales surging 15% in 2016, according to Bloomberg Intelligence Senior Retail Analyst Charles Allen. During that same period, Walmart’s overall US merchandise growth was closer to 3%.

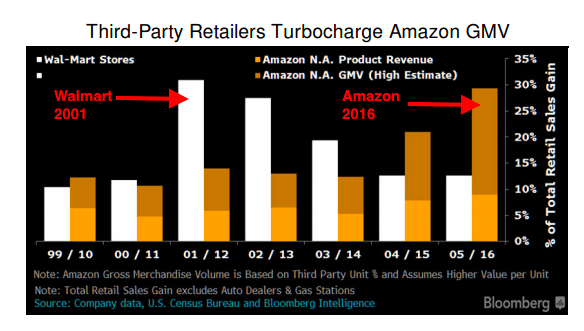

Amazon’s revenue growth during that period accounted for a remarkable 30% of total retail sales growth, Allen added. However, he says any concerns about Amazon’s growth may be overblown.

As shown in the chart below, Walmart’s revenue growth similarly accounted for about 30% of total sales growth in 2001, a time when its dominance was increasing rapidly.

“While Walmart was certainly disruptive, no one would say today that it has destroyed the industry,” Allen said. “Similarly, the predictions for Amazon’s dominance thus may be overblown.”

“People seem to have forgotten what Walmart was to the industry in the early 2000s,” Allen added. “While so many see Amazon now as an existential threat, people panicked in the same way about Walmart in 2001, and their worries haven’t panned out.”

While there are some comparisons, Amazon’s advantages in 2016 are distinct from Walmart’s in 2001—namely, online dominance and third-party seller growth. Walmart, which is making big investments online, recognizes this shift. Its own online net sales grew 60% in the most recent quarter. And the company’s August 2016 decision to purchase Jet.com for $3.3 billion brought in Marc Lore to run e-commerce and has led to more acquisitions (ShoeBuy.com, Moosejaw, Modcloth and Bonobos).

Now the big question is if online growth from other traditional retailers can keep up with the ambitions at both Amazon and Walmart. If they can, then maybe we can stop saying Amazon represents the death of retail.

Nicole Sinclair is markets correspondent at Yahoo Finance

Please also see:

Summers: Trump cabinet resignations like a ‘dam breaking’

Howard Schultz: ‘I come to you with profound, profound concern’

Why CEOs should stand up to Trump

Why so many CEOs have been silent about Trump’s handling of Charlottesville

Robert Shiller and Jeremy Siegel tell us what they think of each other’s market forecasts