Viewers Want More Foreign Content – but the Mix Is Changing Dramatically | Charts

Streaming services have been investing heavily in global content production and licensing as American audiences grew more interested in foreign content in recent years. The demand for non-English digital originals grew from 5.9% of the total demand for streaming original shows in the first quarter of 2020 to 8.5% at the end of 2022, according to Parrot Analytics’ data, which takes into account consumer research, streaming, downloads and social media, among other engagement.

The goal now is to create hit shows that are successful around the world, including in the U.S., with examples like “Money Heist,” “Squid Game” and “Dark.” Although Netflix takes the lead when it comes to non-English content, rivals are trying to catch up.

According to the Wall Street Journal, Disney announced it would spend up to $9 billion a year on worldwide content for Disney+ by 2024. Meanwhile, HBO Max announced it would produce more than 100 local-language projects for Latin America alone during the next two years.

Also Read:

The Streaming Services That Are Priced Right – and the Ones That Miss the Mark | Chart

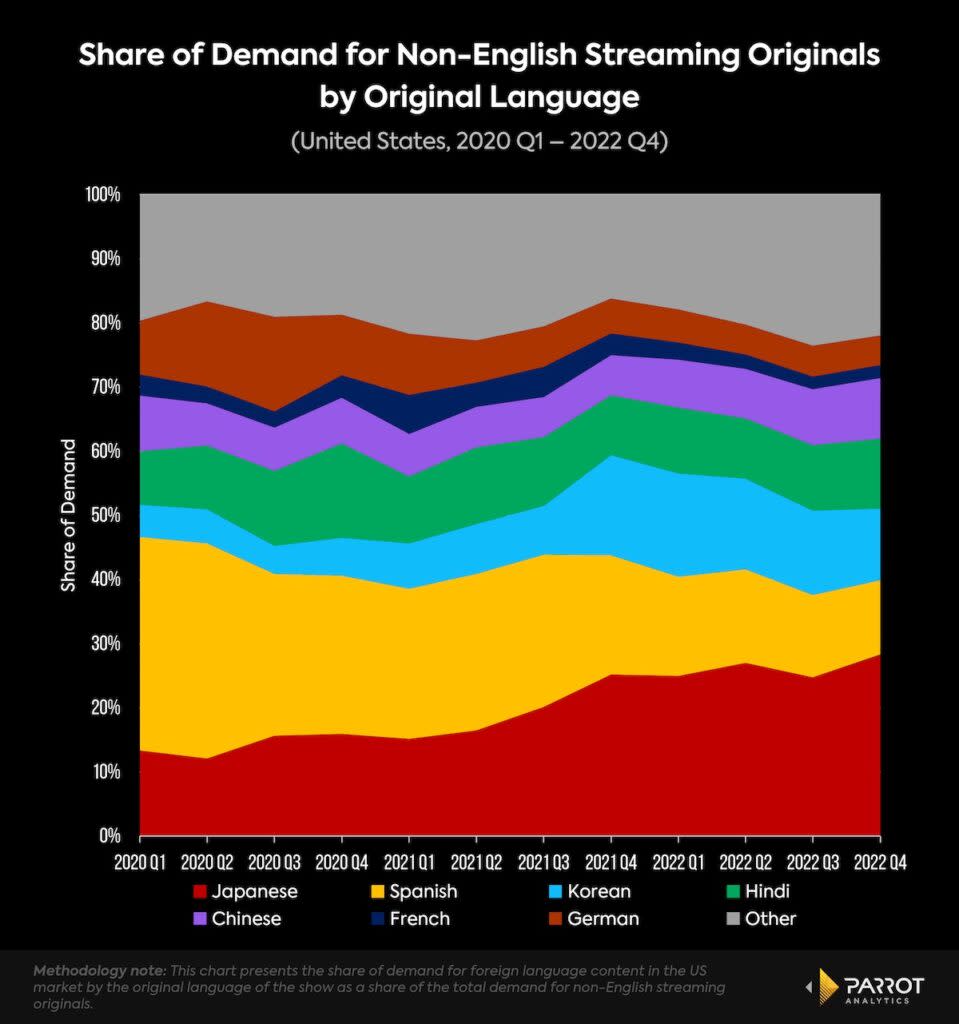

Over the last few years, the makeup of demand for foreign content in the U.S. has been changing. Demand for Asian content has soared as demand for content in European languages like Spanish, German and French has fallen. Combined, the demand for shows in these three languages fell from 45% of the total in the first quarter of 2020 to 18.2% by the end of 2022, while the demand for shows in Japanese, Korean, Chinese and Hindi grew from 35.4% to 59.8% in the same period.

A driving factor behind the growing demand for non-English content is the ascent of Japanese programming, which surpassed Spanish in the last quarter of 2021 to become the most in-demand foreign language in the U.S. Netflix is benefiting most from this transition as the company invests heavily in anime, the flagship genre of Japanese content. Shows like “Cyberpunk: Edgerunners,” “Alice in Borderland” and “Komi Can’t Communicate” are some of the most popular foreign-language fare in the U.S.

On the other hand, Spanish-language content has lost ground. Following the huge popularity of “Money Heist,” which had new seasons released from 2017 to 2021, Spanish-language content managed to carve a place as the most in-demand foreign language in the U.S. for several years. But its share began declining even before “Money Heist” finished. In the last quarter of 2022, the demand gap between Spanish and Korean content almost completely closed, and Korean-language programming is set to become the second most in-demand foreign language for streaming originals in 2023.

The demand for Korean shows is largely driven by the popularity of K-pop, which has exploded in recent years, especially among younger audiences. This has helped to drive interest in other forms of Korean media, largely benefiting Korean dramas. The demand for Korean content more than doubled between the third and fourth quarters of 2021 after the release of “Squid Game.”

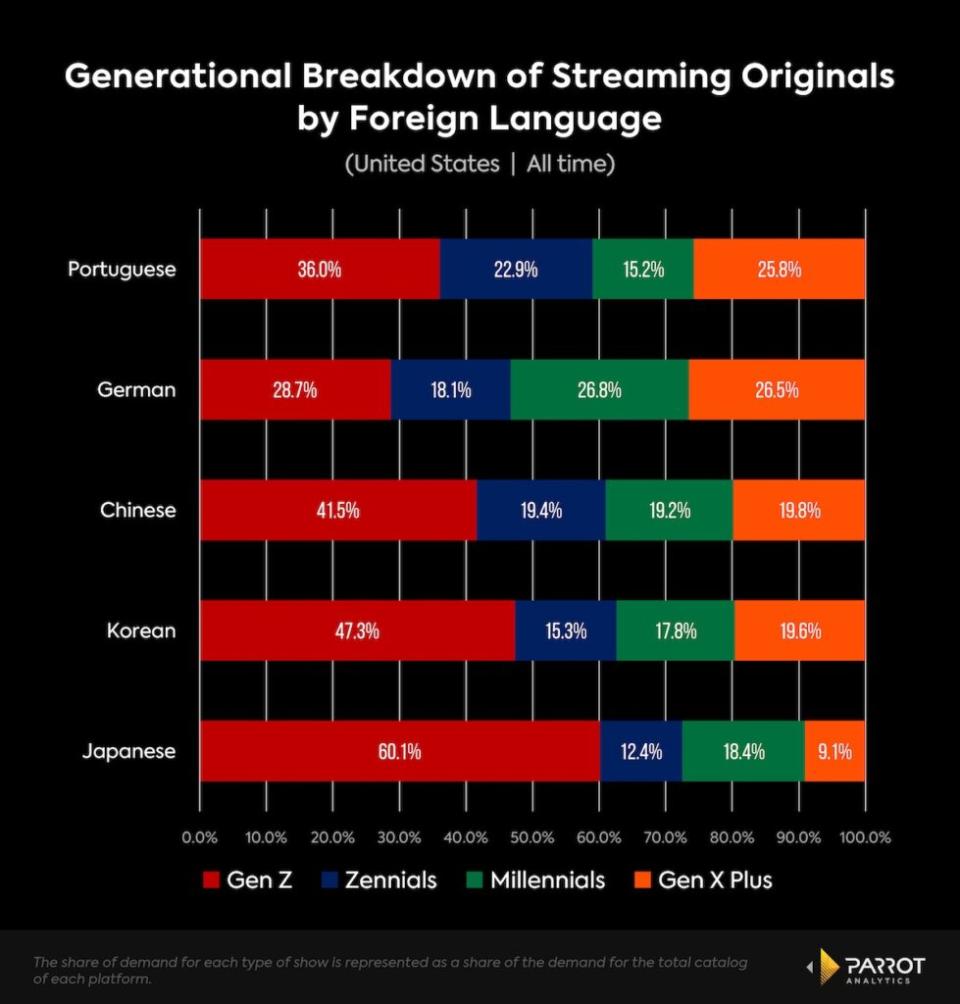

The generational breakdown of streaming originals’ audiences by foreign language shows that audiences for Japanese and Korean shows are heavily skewed toward younger generations (Gen Z and Zennials). More than 70% of the audience for Japanese shows and 60% of the audience for Korean titles is made up of people under 30. The genres that comprise the bulk of audience demand for these languages tend to overindex with younger audiences.

Chinese content is also very young-leaning, presenting a generational breakdown very similar to the one seen for Korean shows. This demographic breakdown, coupled with the increasing demand for Chinese content, suggests that Chinese shows may be following a similar path as Japanese titles recently. The most successful Chinese titles in the U.S. market are animated works and comic novels that engage with younger audiences like “The Daily Life of the Immortal King,” “Grandmaster of Demonic Cultivation” and “The Last Summoner,” the most in-demand Chinese titles this year.

Daniel Quinaud is a senior data analyst at Parrot Analytics, a WrapPRO partner. For more from Parrot Analytics, visit the Data and Analysis Hub.

Also Read:

Inside the Surging Demand for Foreign-Language Streaming Shows | Charts