Universal Did Netflix a Big Favor in Its Streaming Movie Deal | Charts

Two years ago, Netflix struck a deal that’s now proving crucial to driving demand for its movie catalog.

Universal agreed to license its animated films — after a four-month window where they would stream on Peacock — to Netflix in July 2021. With DreamWorks Animation and Illumination now having a hot hand at the box office, that’s paying dividends for the larger streamer.

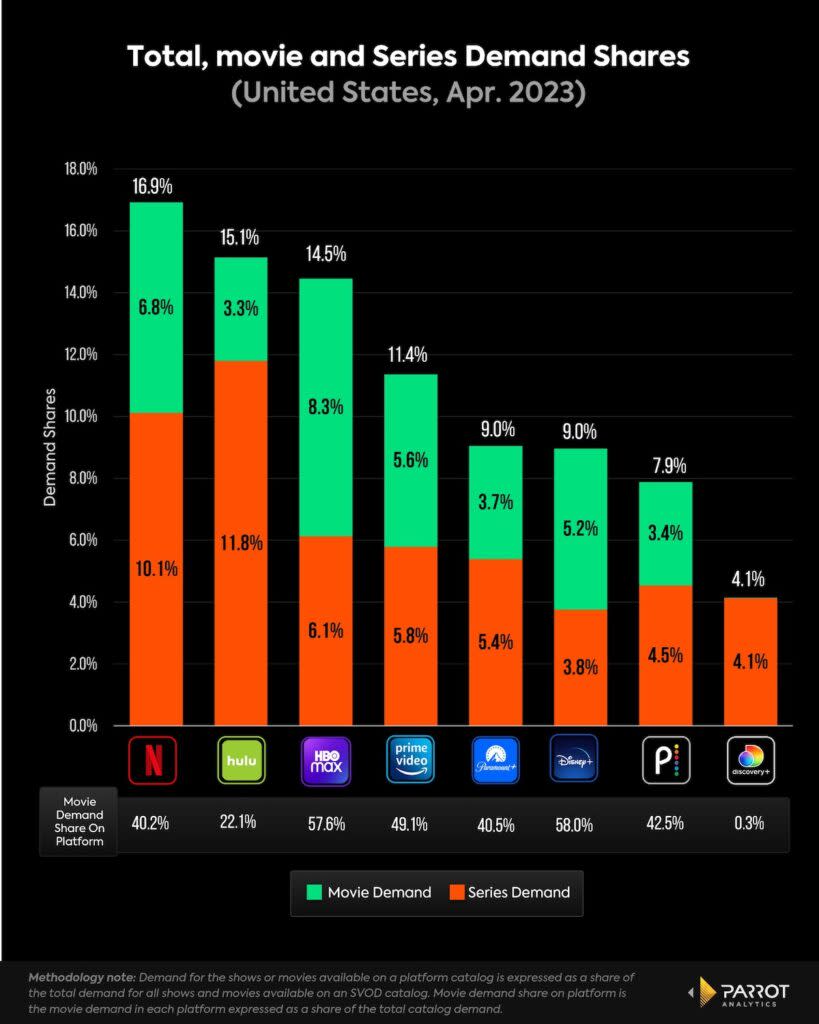

Even though you might think of Netflix as the home of bingeable TV shows, its movie catalog had the second largest share of demand in the U.S. as of April, according to Parrot Analytics‘ data, which takes into account consumer research, streaming, downloads and social media, among other engagement. It was behind only HBO Max (now just Max), which benefits from its pipeline of Warner Bros. films, and ahead of Disney+ and Amazon Prime Video.

Despite that strong demand, Netflix relies less on movies to attract and retain viewer engagement compared to other services. Movies constitute 40% of total demand (inclusive of both TV and movies) for Netflix’s offerings. In contrast, services like HBO Max and Disney+ derive nearly 60% of their total catalog demand from films.

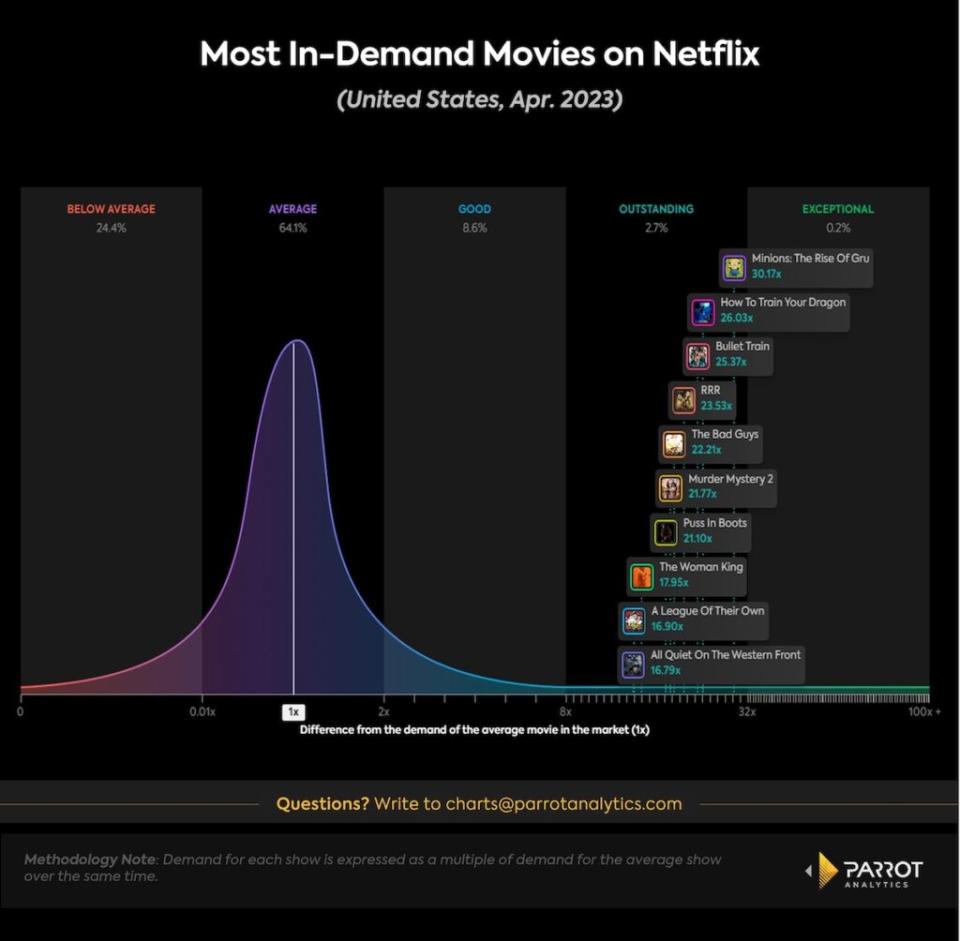

These figures potentially illuminate Netflix’s recent restructuring of its film division. The company is concentrating on smaller-scale projects while reducing the number of new releases to maintain high-quality output. Despite having produced several hit titles in recent history, Netflix’s latest offerings have somewhat surprisingly failed to secure critical acclaim, a prominent cultural footprint or extraordinary demand.

That means its movie slate is highly dependent on licensed films. Only two of the top 10 most in-demand movies in April, “Murder Mystery 2” and “All Quiet on the Western Front,” were Netflix originals. The two most in-demand movies, “Minions: The Rise of Gru” and “How to Train Your Dragon,” came from Universal, as did “The Bad Guys” and “Puss in Boots.” Given the popularity of animated fare with kids and families, Netflix was smart to lock up this supply.

Daniel Quinaud is a senior data analyst at Parrot Analytics, a WrapPRO partner. For more from Parrot Analytics, visit the Data and Analysis Hub.

Also Read:

For Hollywood, Video Games Are the New Comic Books