Uncarried! After More Than 4 Dutiful Years and 51 Loyal Billing Cycles, T-Mobile Tells Us to Pound Sand

- Oops!Something went wrong.Please try again later.

Cue John Facenda voice narration: No position in media trade journalism requires as many different skills as lazy weekend columnist. It demands a cool head ... and a tough butt. In the history of technology, media and telecom, many have played the position. But only few can be called ... the best ever.

DANIEL FRANKEL: Well, David, I'd say Happy New Year, but according to Larry David's statute of limitations, I'm probably past the deadline.

Are you heading to CES next week? I was. Now I'm not. Got a bad pool pump and a leaky roof. Both are problems you have to deal with quickly and head-on in Southern California this time of year.

BTW, what do you make of the NFL controlling 93 of the top 100 TV programming events in 2023? Seems like Roger Goodell should just expand the NFL Network, put all the games on it, and cut out the middle man? Here's the top 10 highest rated shows from last year:

1. Super Bowl LVII: Chiefs-Eagles (114.3M)

2. AFC championship: Chiefs-Bengals (53.12M)

3. NFC championship: Eagles-49ers (47.5M)

4. NFC divisional: 49ers-Cowboys (45.65M)

5. NFL on Thanksgiving: Commanders-Cowboys (41.76M):

6. AFC divisional: Bengals-Bills (39.32M)

7. AFC divisional: Chiefs-Jaguars (34.3M)

8. NFL on Thanksgiving: Packers-Lions (33.7M)

9. NFC wild card: Giants-Vikings (33.21M)

10. NFL on Christmas Eve: Cowboys-Dolphins (31.52M)

DAVID BLOOM: First, no one should take a Larry David TV show rule as a basis for living a just and decent life. So, Happy New Year, whenever you celebrate an arbitrary demarcation of the planet’s path around the sun, based on whatever calendar or faith or growing season moves you. Speaking of arbitrary markers of the year’s passage, CES returns to Las Vegas this week like a giant, bloated, impossible swallow alighting on the sainted mission at the Las Vegas Convention Center. I, however, won’t be alighting there too, unless Next TV decides to send me there so I can acquire a few random respiratory infections imported by 175,000 attendees from around the planet.

I do have one regret: pretty much all the major streaming services will be there, pow-wowing with brands, drumming up business for their suddenly much more important ad-supported operations. I would like to watch that scrum, and some of those over-the-top client dinners. But talk about eating everything on the plate! The NFL has nearly consumed the tattered broadcast and cable business. Just a couple of years ago, the NFL (and a few college games) comprised a mere three-fourths of TV's top 100 broadcasts. Now it’s nearly all of them. But that doesn’t mean the shield should drop broadcast and cable just yet. Cutting out the middleman cuts out the far broader audience and pop-culture prominence it brings. Even strictly streaming comes with downsides. Millions of casual fans who won't pay for a pricey add-on would no longer see a big mid-season matchup, or care about those divisional playoffs. Meanwhile, bedraggled legacy TV still connects to something like 65 million U.S. households. So, the mighty NFL should just focus on going 100 for 100 in 2024.

FRANKEL: I'm upgrading my family's mobile plan this weekend. And I've noticed that some of the major carriers, notably T-Mobile and Verizon, are now peddling the ad-supported version of Netflix for their "on-us" promotions. So you're right -- ad-supported models are hot, hot, hot.

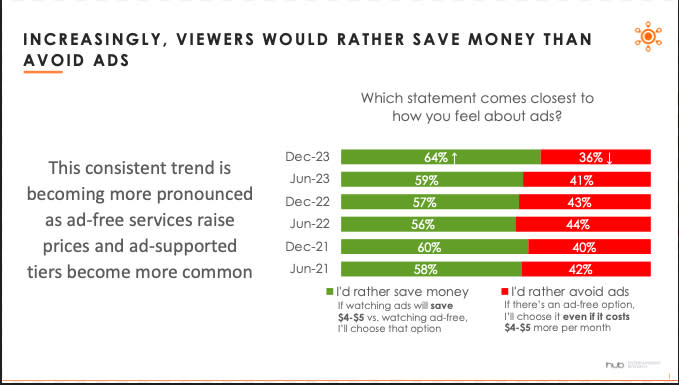

As the Hub Entertainment Research graphic published last week confirms, saving a few dollars on SVODs by watching commercials has become an acceptable tradeoff among consumers. We're not rollin' in the skrilla and flashin' the mad bling-bling at the South Los Angeles duplex supported by the feckless business of media trade journalism, I'll concede that freely. But after adopting a new way of watching "television" over the last decade of "Golden Age" bingeing, we can't bring ourselves to retreat to "basic with ads" tyranny for the sake of a few dollars each month. TV is our primary diversion from our life of grinding lower-middle-class, self-perpetuated purgatory. And I'm not sure I understand the impulse among the legions of others like us ... and those less well off. Despite the rightwing propaganda, job and wage growth are pretty solid. Inflation has been tamed. The stock market was just at a record high. What's going on here? Why do consumers suddenly feel so much more broke about streaming than they did in, say, 2020?

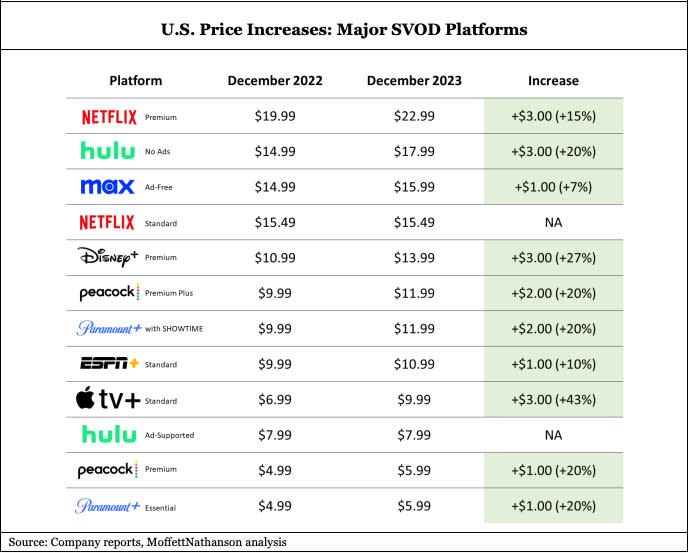

BLOOM: It’s ultimately about what the economists like to call “perception of value.” It’s no surprise that -- after a year of strong inflation (now moderating as supply chains improve), plus severe cuts in studio output thanks to deep spending reductions, program cancellations and six months of debilitating labor strikes -- there’s not much to watch on many of the leading subscription services. And that comes on top of really substantial hikes in prices (including last week’s Amazon back-door price hike: pay more or automatically get ads).

Also read: Why Amazon Is About To Blow Up the TV Ad Market (Wolk)

Studio executives seem to believe in another economics maxim that generally hasn’t proved successful in the past: charge more, provide less. Thus, your family’s decision process, and those of many others. We’re getting less, watching more ads, and valuing most of the content we’re being delivered in a harshly deliberative way. Basically, the services, and the studios behind them, aren’t giving us value, and don’t seem likely to do it regularly going forward.

I’m actually intrigued by a different move this week by the one money-making streaming service, Netflix. They recently signaled their ambitions to make increasingly sophisticated games beyond the relatively simple and free (to subscribers) mobile titles they’ve been making around some of their biggest franchises, like Stranger Things. Now, the Wall Street Journal reported late in the week, Netflix is going to try to figure out ways to make money from its game operations. That could mean in-app purchases for game assets, advertising, maybe even stand-alone subscriptions similar to Apple’s really quite excellent Arcade service.

The game business is connected with, but deeply different from the movie and TV business, and far more popular in terms of dollars generated and eyeballs attracted and retained. Now Netflix looks headed to finding ways to monetize this new-ish venture. It certainly makes sense, and suggests yet again how most of the traditional studios are lagging in important ways. Here, most view games as something they license out to game studios and publishers, a nice check, but mostly just that. They should be more smartly integrating game experiences with not just their features and series, at least the big ones, but also with live events, merchandise, and the rest. And all of it needs to be about keeping fans around as long as possible, engaged as long as possible, instead of churning out another service that has just dropped a buzzy show after months of not much.

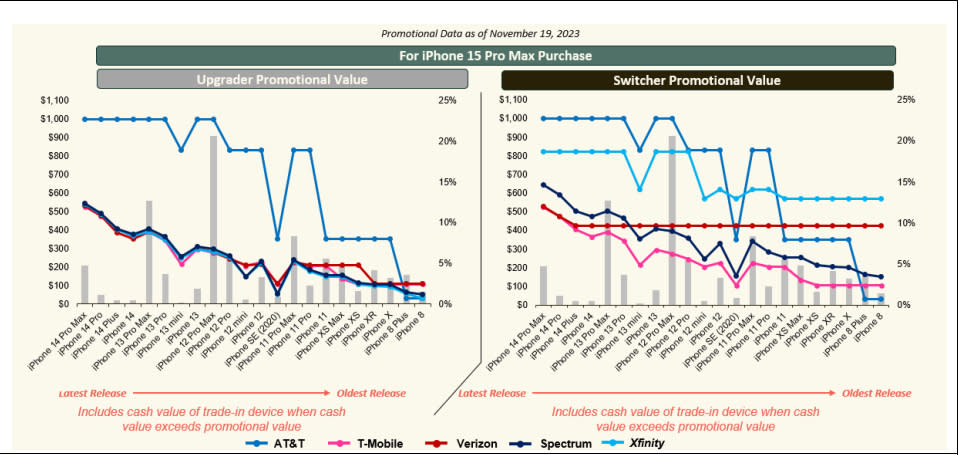

FRANKEL: So, since you're a gadget guy, I'm going to diverge into something different. With our iPhone 11s down to holding about 10 minutes of battery power more than four years after they were handed to us under great subsidy by T-Mobile, I approached the wireless company about acquiring some new hardware. Fifty-months straight of paying a $180 bill for four lines didn't get me a "sure, on us" response, but rather, "ah, you pay for it this time." In November, tied to Black Friday, MoffettNathanson did an interesting deep dive into the complex recipe of smartphone trade-in value, plan pricing, and promotional enticements for new and returning customers. Here's a graphic from that report:

Existing customers are still locked out of the best deals, just as it was in late 2019 when I fled AT&T for the same reasons. This time, after being told to essentially to pound sand by T-Mobile store rep in Mid-City Los Angeles, we ended up "churning" across the street to Charter and Spectrum Mobile. The cable guys offer far less trade-in value vs. incumbent wireless, but their per-line prices are much cheaper, their commitments are less arduous, and we shaved 40% off our existing Spectrum Internet wireline broadband bill via the Spectrum One bundle pricing. Verizon would have paid all but $190 of our new fancy iPhone 15 Pros, with trade-in. But they wanted the money for the hardware upfront. And they were charging $70 a month more than Charter is for four lines ... and they wanted a three-year contract. So you're going to pay about $160 to $190 a month for four lines and new gadgets from either the cable company or the wireless incumbent. You're not locked into a contract with cable, but you're obligated via the phone financing. As a "new" customer, it's kind of a much-of-a-muchness, but you can match your old bill and get the new equipment. But if you try to go back, the elevator only goes up. T-Mobile's take-it-or-leave-it was $290 a month. Tack on $110 a month to your $180 for phones, they told us. Now, I get that giving away hardware to the same customers twice probably isn't a winning business model for T-Mobile ... or for Charter in about three years, for that matter. But with the cost of acquiring customers so high, doesn't it make sense to at least try to do something to hold onto particularly loyal slobs (i.e. those who have been around for more than three years)? I mean, offer to help change our batteries? Do a "partly on us" deal. On the investor side, maybe start a line item in quarterly earnings reports, right next to "activations" that reads, "customer saves." It'd be a meaningful metric in no time.

BLOOM: Probably not a lot of lucre to be had in offering free $100 battery replacements on four-year-old consumer devices, so don’t hold your breath on that one. That said, the mobile Big Three are offering all kinds of other things: free/discounted phones, subscription-content bundles, multiple-line deals, in exchange for your John Hancock on higher service tiers for a few years. They’re trying to get and keep customers, while paying off the whopping $700 billion they’ve spent building their 5G networks.

Also read: Has the Wireless Industry's Wild 5G Party Hit the Hangover Stage?

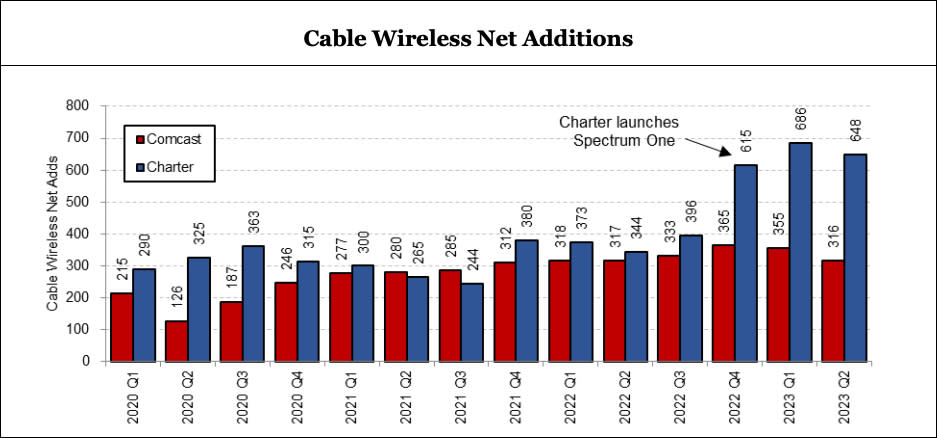

All those sign-up enticements may not be great, though: “Advertised discounts can be misleading,” MoffettNathanson warned in September. Those discounts cost the companies a lot too. That’s why the analyst rated T-Mobile, Verizon and AT&T shares at “market perform” (their version of “hold”), while rating Comcast and Charter, their new-ish mobile competitors, as “outperform” (“buy”). Your experience, at a moment when consumers want to more value, is exactly why the fading cable powers are now the growing broadband/mobile powers. They’re managing with lower cost structures, fewer regulatory headaches, and more flexibility. In an under-appreciated irony, it’s the exact inversion of what Comcast and Charter face with cable TV, where they’ve lost so many customers.

For those still shopping for a mobile deal, avoid Dish and its Boost Mobile subsidiary. Last week, Dish re-merged with satellite provider Echostar, also the name for the combined operation. Charlie Ergen’s latest financial machination has been coolly received: S&P rated Echostar/DISH debt at junk-bond levels (CCC+) because of repayment risk. And MoffettNathanson’s Craig Moffett wrote after the merger that “the most likely outcome for Dish remains bankruptcy.” Ouch. All of which suggests that times are tough for more than the Hollywood studios when it comes to older distribution models and providers.

Also read: Charlie Ergen Buys a Little Time as Dish-EchoStar Merger Closes

FRANKEL: I guess the Justice Department's bid to offset the loss of Sprint with Dish isn't going to work out. The way Moffett and gang see it, EchoStar only buys Charlie Ergen a little time. Eventually, they think he's going to run out of cash and credit before Dish can get its 5G network built. Which relates to a bigger picture question: When is the last time the consumer-friendly narrative for one of these major telecom deals actually worked out for all of us?

BLOOM: I’m searching my admittedly faulty memory and keep coming up with lots of crummy big telecom, media and tech deals of all kinds. When Gulf+Western owned Paramount, how did that go (other than letting Robert Evans and FF Coppola make The Godfather)? How about everyone who tried to buy MGM from Kirk Kerkorian (still the greatest businessman I’ve ever seen)? TimeWarnerAOL? AT&T-TCI? AT&T-WarnerBros.? That Fox/News Corp. split, the Paramount-CBS re-merger, or Disney’s big Fox deal? It’s a long list of expensive, mediocre-to-disastrous deals that mostly just made investment bankers rich and workers unemployed. That track record doesn’t bode well for Paramount Global.

That said, I’m actually kinda happy about one deal: ESPN with the NCAA for eight years and about $920 million to televise championships in 40 men's and women’s sports, including international rights for all of these plus March Madness. It’s triple the previous deal’s value, and will give even more visibility to non-football college athletes who labor in relative obscurity. It might further boost their opportunities in name, image and likeness revenue, more than the handful of breakout stars such as Iowa’s sharpshooting women’s basketball guard Caitlin Clark and LSU gymnast/social-media superstar Olivia Dunne.

FRANKEL: I just realized we didn't get to Sunday night's Golden Globes, an awards show owned, produced, covered ... and sold, all by the same publishing company that was largely responsible for running the previous nonprofit stakeholders out of business. Big winners Christopher Nolan and Oppenheimer apparently weren't the only ones throwing a big party. (Update: Richard Rushfield also wrote about this "massive conflict of interest" in The Ankler Monday.)