Tubi Is Driving a Massive Surge in Demand for Free Streaming | Charts

The streaming market is increasingly adopting strategies to boost revenue, including hiking prices, clamping down on password sharing and introducing advertisement-supported tiers. While these tactics are designed to bolster the financial health of the companies, they might not always be favorably received by the subscribers.

Against this backdrop, there’s a potential opening for an alternative platform model to make headway in the market. Enter FAST (Free Ad-Supported Streaming TV) platforms, characterized by their no-contract, password-free approach.

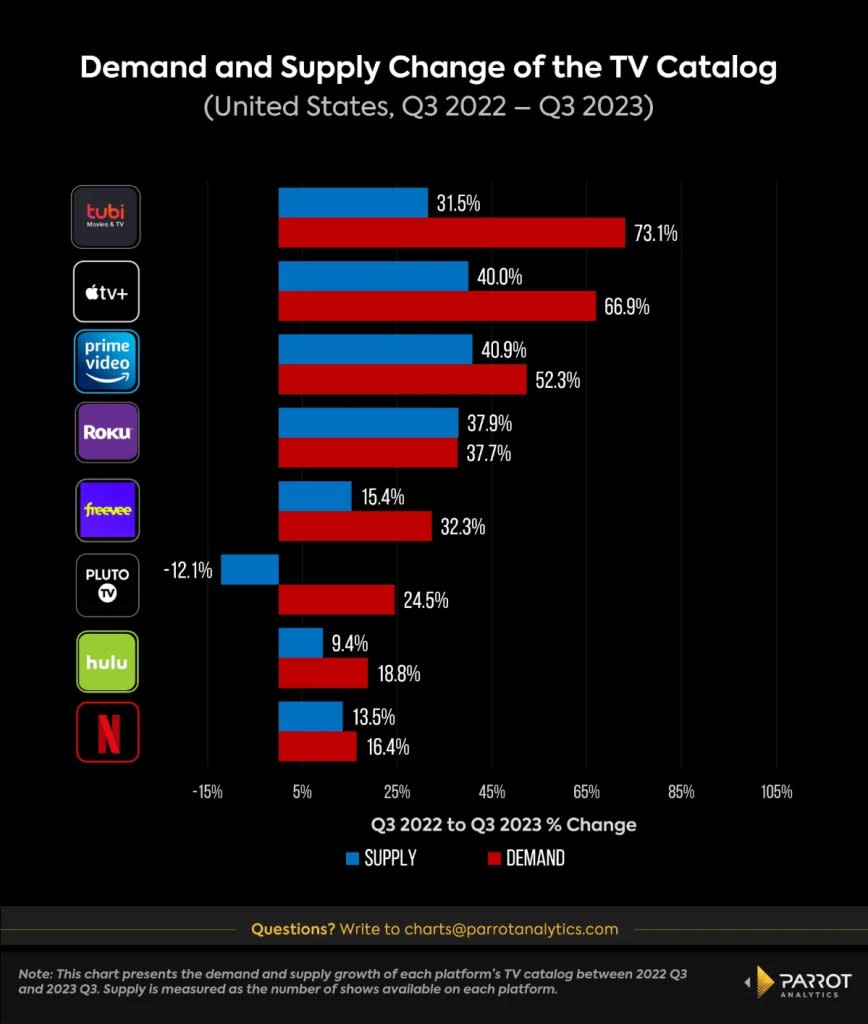

Demand data from Parrot Analytic reveals a notable surge in demand for the leading FAST platforms (Tubi, The Roku Channel, Freevee, and Pluto TV), which saw their combined TV catalog demand spike by 37.7% between the third quarters of 2022 and 2023. By comparison, the main SVOD (Subscription Video On Demand) platforms witnessed a 31.3% increase in the same period.

This uptick in FAST platform popularity is largely propelled by Fox’s Tubi, which reported a staggering 73.1% growth rate, outpacing other FAST and SVOD platforms. The other FAST platforms grew from 24.5% to 37.7% over 12 months.

Notably, this demand surge wasn’t solely due to an expanded show lineup. In most instances, apart from The Roku Channel, demand growth exceeded supply growth, indicating an increased average demand for existing shows. Pluto TV, for instance, experienced demand growth even as its TV catalog shrank.

As cord-cutting accelerates in the U.S., audiences may adopt FAST channels’ familiar linear-like interface as a no-cost entertainment substitute. However, it’s crucial to note that despite these impressive growth rates, FAST platforms still occupy a smaller market share than the SVOD group, both in overall demand and catalog size.

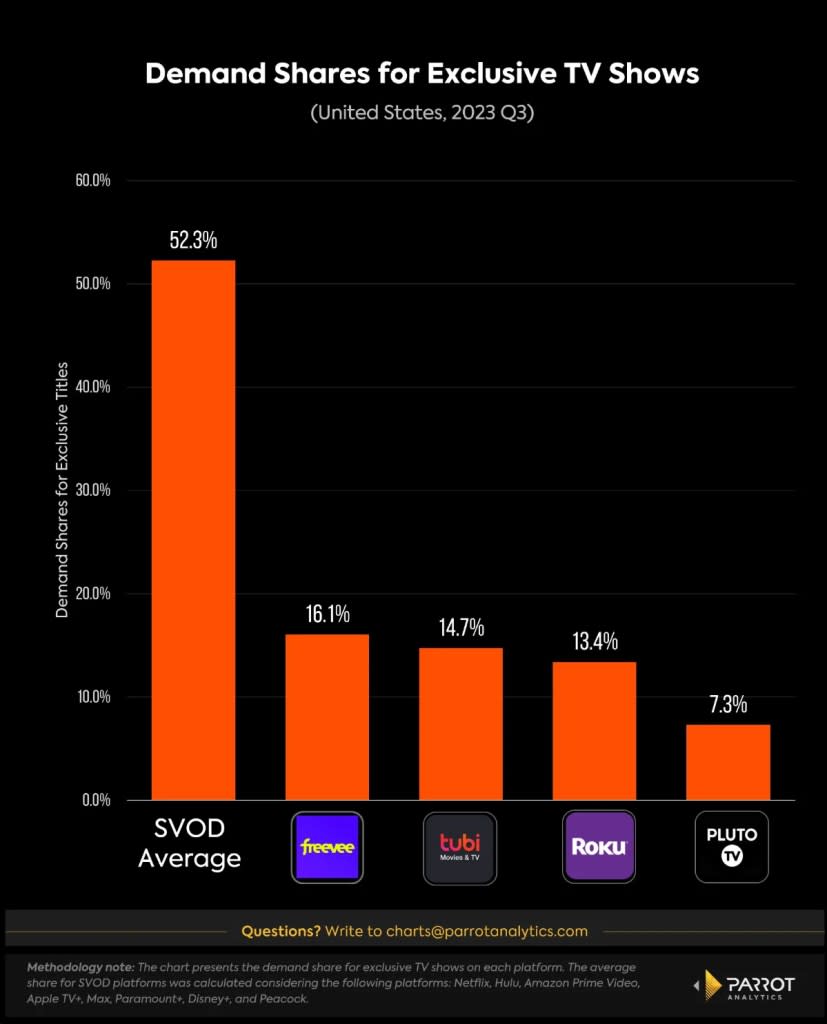

FAST and SVOD platforms distinguish themselves through their unique features and catalog compositions. FAST platforms, for example, typically have a smaller proportion of exclusive content. For instance, only 16.1% of Freevee’s TV catalog demand stems from exclusive series. This figure dips even lower for other platforms, with Pluto TV at 7.3%. By contrast, the main SVOD platforms boast an average exclusive demand share of 52.3%.

FAST platforms generally attract audiences for unscripted content and older scripted shows released on linear channels. On average, an exclusive show on a FAST platform was released 11 years ago and draws 1.5 times the demand of the average show as of November 2023. In contrast, exclusive shows on major SVOD platforms are typically newer and more sought-after, with an average release time of six years and a demand multiplier of 2.8.

Despite this, several highly popular exclusive shows on FAST platforms highlight their strengths. For example, Freevee boasts original shows like “Bosch: Legacy,” and licensed shows such as “Person Of Interest” and the original “Magnum, P.I.” Pluto TV focuses more on unscripted content, featuring shows like “Dr. Phil” and “Judge Judy.” The Roku Channel offers the comedy “2 Broke Girls” and select originals, while Tubi hosts all 26 seasons of the classic “Doctor Who” series.

Daniel Quinaud is a senior data analyst at Parrot Analytics, a WrapPRO partner. For more from Parrot Analytics, visit the Data and Analysis Hub.

For all of TheWrap’s Hollywood strike coverage, click here.

The post Tubi Is Driving a Massive Surge in Demand for Free Streaming | Charts appeared first on TheWrap.