Trump's plan will raise taxes, nearly one-third of voters think

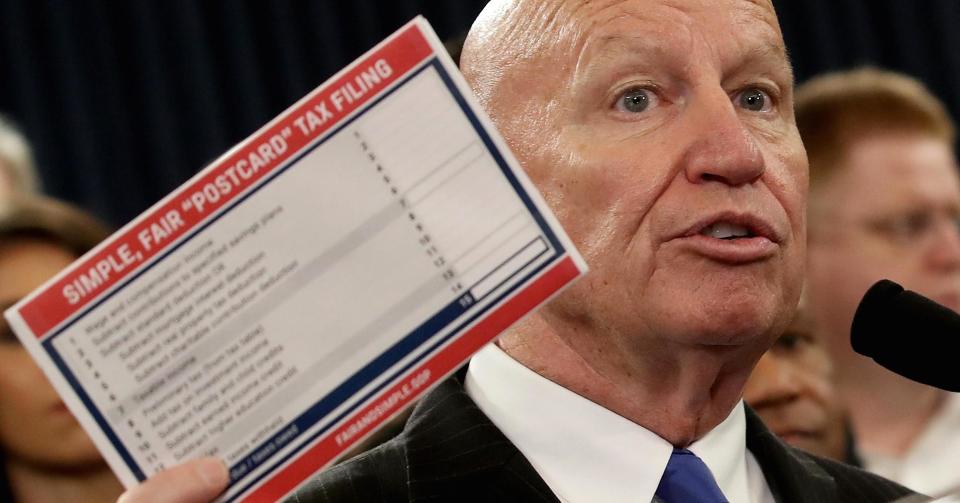

Republicans touting the new tax-cut plan released by the House of Representatives on Nov. 2 insist it will do wonders for the middle class. A lot of people don’t believe it.

In a new Yahoo Finance poll, 31% of respondents felt their taxes would go up under the GOP tax plan, while 42% said their taxes would go down. Twenty-three percent felt they’d end up the same and 5% weren’t sure. (Numbers don’t add to 100 because of rounding.)

Those findings suggest Republicans aren’t convincing people that their tax-cut plan will be good for the middle class, or the economy overall. House Speaker Paul Ryan says a typical family with two kids would save $1,182 in taxes per year under the plan. In our survey, however, 22% of voters in that income bracket — between $50,001 and $75,000 in annual household income — feel their taxes will go up. That’s a big messaging problem for Republicans, including President Donald Trump, who backs the House plan.

The sweeping House plan would revamp both the corporate and individual side of the income-tax code. It would slash the corporate tax rate to 20% from 35%, to make the United States a more attractive place for global companies to do business. On the individual side, it would replace seven income brackets with five and undoubtedly lower the tax burden for some filers. But by shifting deductions around, the House plan makes it difficult for any given family to tell whether they’d end up better off or worse off under the plan, leaving plenty of room for critics to demagogue the whole proposal.

Not surprisingly, people with higher incomes are more likely to believe their taxes will go up. Among people with incomes below $150,000 a year, 23% think their taxes will rise under the GOP plan. Above $150,000, 36% think they’ll face a higher tax bill. In a way, that’s by design. Since the GOP plan would put new limits on the deductibility of mortgage interest and state and local taxes— deductions typically claimed by wealthier filers — it’s likely to hit higher earners harder.

Even some Trump voters feel they’d pay more under the Republican plan. Of poll respondents who voted for Trump, 19% say their taxes will go up. Of those who didn’t vote for Trump, 39% think their taxes will rise. The gap could reflect the large portion of Democrats who presumably did not vote for Trump and live in high-income states such as New York and California.

More than 8,000 people took the poll, which we ran on Nov. 2 and Nov. 3. The full results are here. If there’s good news for Republicans, it’s that voters do think their plan would make taxes easier to navigate. Forty-five percent of respondents said the plan would make their taxes simpler, while just 6% said it would make their taxes more complicated. Thirty-seven percent expect no change and 11% aren’t sure.

But there’s deep skepticism about who the plan is really meant to benefit. Forty-nine percent of all respondents feel the plan would mostly benefit businesses, while just 7% feel individuals will be the main beneficiaries. That perception is likely to dog Republicans for as long as they’re negotiating a bill, and it could lead the Senate to temper many elements of the House plan. Republican senators could kill efforts to repeal the federal estate tax, for instance, or to limit the deduction for state and local taxes. They could also insist on bigger tax cuts for individuals and smaller ones for corporations.

The negotiations will be intense, with Trump insisting he won’t accept a corporate rate any higher than 20%. But there’s already strong opposition to the overall House plan from powerful lobbying groups representing the real estate industry, which argues that reining in itemized deductions will hurt homeowners. And the National Federation of Independent Business, another influential group, says the tax plan will leave too many small businesses in the dust. If the plan raises taxes on top of all that — or even leads some people to think their taxes will go up — voters can legitimately ask, what’s the point?

Confidential tip line: rickjnewman@yahoo.com. Encrypted communication available.

Read more:

Rick Newman is the author of four books, including Rebounders: How Winners Pivot from Setback to Success. Follow him on Twitter: @rickjnewman