The tumbling dollar 'reflects the transition from post-election hope to reality'

The US dollar continues to tumble against the world’s major currencies, with the US Dollar Index (DX-Y.NYB) sitting near a 15-month low. The move completely erases the gains that followed President Donald Trump’s election in late 2016.

Analysts note that U.S. economic growth has been lagging the pace of growth in much of the developed world. But they further make clear that the failings of the Trump administration are also to blame.

“The reversal of dollar strength also reflects the transition from post-election hope to reality,” Goldman Sachs’ David Kostin said. “The US dollar rose by 5% between the US Presidential election and year-end 2016 driven by expectations of fiscal stimulus. However, gridlock in Washington, D.C. has led investors to reduce their expectations for potential policy reforms.”

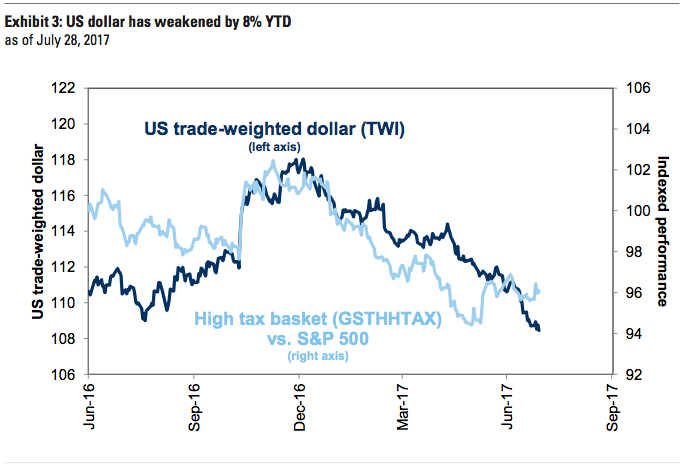

Stocks with high tax rates are a good proxy for these expectations. One of Trump’s bigger policy promises was tax reform. But as those expectations have waned, Goldman Sachs’ basket of high tax stocks have underperformed the market significantly. As you can see in the chart below, this proxy has had a tight correlation with the declining dollar.

Kostin, who is Goldman Sachs’ chief US equity strategist, argues this is great news for big companies that do lots of business overseas.

“S&P 500 (^GSPC) sales benefit from a lower USD because firms generate almost 30% of total revenues overseas,” he said. “Dollar weakness contributed to a 14% rise in EPS during 1Q, the highest pace of growth since 2011. We estimate that a 10% decrease in the trade-weighted US dollar relative to our baseline expectation should boost S&P 500 EPS by $3/share (3 percentage point increase in EPS growth).”

Indeed, as the US dollar has tumbled, US stocks have surged to set new all-time highs. Trump has been quiet about the former, though he hasn’t been shy about talking about the latter. By talking up the stock market, Trump — whether he recognizes it or not — is celebrating the benefits of globalization and how those benefits are flowing to wealthier Americans. Ironically, Trump campaigned with a protectionist message targeting poor, unemployed Americans.

But this narrative might not last forever.

Over the next 12 months, Goldman Sachs’ currency strategists expect the dollar to turn around, strengthening 7% against the Japanese yen, the British pound, and the Chinese yuan. Kostin says this is a headwind for stocks exposed to these regions.

–

Sam Ro is managing editor at Yahoo Finance.

Read more: