How the Trump tax cuts will help one business, but hurt another

The employees at Eruptr, a health-care digital marketing agency near Sarasota, Fla., have a lot to look forward to if the Republican Congress passes a big package of tax cuts soon, as expected.

Kevin Minnelli, the firm’s co-founder, plans to convert nine staffers working remotely in seven states from independent contractors to regular full-time employees with benefits, even though that would cost around $80,000. He also plans to hire three or four new full-timers, pushing total employment to around 15. “Because I can see the tax cuts coming, this seems like the right time to do it,” Minnelli says. “Most likely, I’ll be paying a lot less in taxes, so I can take the same net for myself and reinvest in the business. Why not give some back to the employees?”

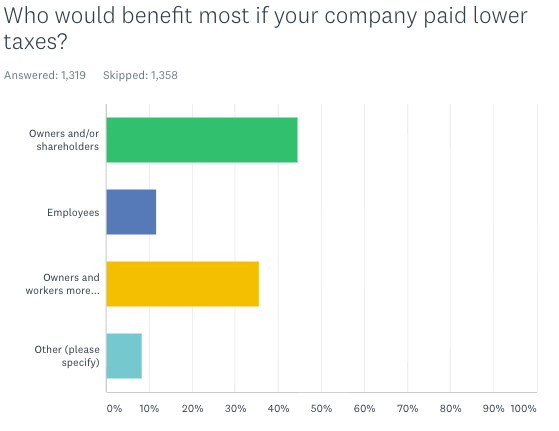

That’s exactly what President Donald Trump and Congressional Republicans want businesses to do if they pass the Tax Cuts and Jobs Act — spend more and hire more. Of $1.5 trillion in total tax cuts over a decade, about three-quarters would go to businesses rather than individuals, so it’s crucial to design cuts that will benefit the broader economy and not just enrich the shareholder class.

Proposed tax cuts are bad for some firms

But other business owners say the tax cuts would harm their firms, impede investment and slow hiring. Stephen Frankel runs a small law office in Mineola, N.Y., with another lawyer and a secretary. His firm, a sole proprietorship, would suffer due to one key provision in both the House and Senate version of the Tax Cuts and Jobs Act: either a sharp reduction or the complete elimination of the state-and-local-tax deduction, known as the SALT provision. “It’s a carve-out in the legislation meant to hurt small businesses like me,” Frankel says. Since his business income is taxed at individual income-tax rates, losing most or all of the SALT deduction would raise his tax bill and lower his after-tax income, leaving him less to reinvest in his firm. Frankel says he needs to hire another lawyer, “but this purported tax reform will have the consequence of me not hiring a new full-time employee. Maybe I’ll use a per-diem employee.”

Whether the tax cuts will help depends on your business

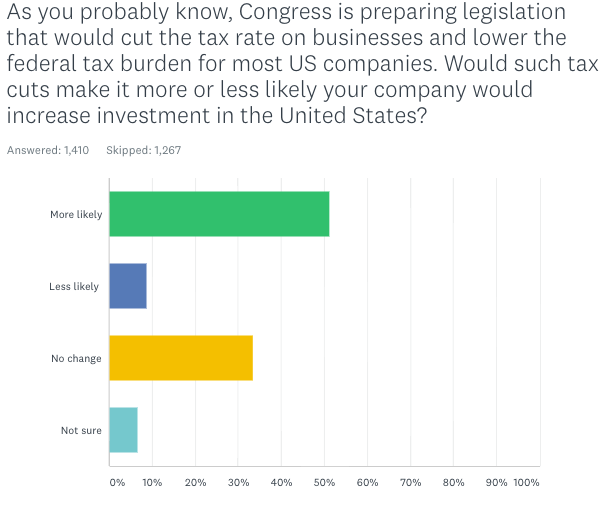

The impact of tax cuts, it turns out, seems likely to vary greatly based on the type of business and its location, along with arcane details Congress is still working out. So Yahoo Finance went straight to the source, conducting an online survey of more than 1,000 business owners from Nov. 20 – 22 and asking whether tax cuts would generate more spending and hiring, helping or hurting employees in the longer term.

The results suggest tax cuts won’t be the magic economic elixir some Republicans claim, but will still help some middle-class workers in tangible ways. Fifty-one percent of business owners told us tax cuts would make them more likely to invest in the United State, while just 9% said they’d be less likely to invest. Fifty percent of owners said they expected to hire more, while 52% expected tax cuts to help boost pay at their firms. (Check out the full survey results.)

There’s also some dispiriting news about the Republicans’ trickle-down approach to tax cuts: they’d probably benefit the owner class much more than ordinary working people. Forty-six percent of respondents said owners and shareholders would benefit most from the tax cuts Republicans are proposing, with just 12% saying employees would benefit most. Those portions might be flipped if politicians were proposing a large middle-class tax cut but little else, with the benefits of stronger spending “trickling up” to business owners instead of flowing the other direction. But that’s not happening, one likely reason the whole Republican tax-cut plan is unpopular with voters.

The benefits of tax cuts will also vary widely because of current discrepancies in the tax code, and Republican efforts to alter — some say exploit — those discrepancies. One of the most controversial elements of the GOP tax plan is the treatment of the SALT provision, which Senate legislation would kill completely and a House bill would limit to $10,000 in property taxes alone. About one-third of all taxpayers claim this tax break, but the portion is much higher among high-income taxpayers —including many small- and medium-sized business owners who pay taxes through the individual tax code, the way both Minnelli and Frankel do.

Minnelli of Eruptr would end up better off under the Tax Cuts and Jobs Act because he lives in Florida, which has no state or local income tax for him to deduct on his federal tax return. Florida does have property taxes, which Minnelli could deduct, but his total itemized deductions in Florida are considerably less than they’d be in a state with income taxes, and especially in one with high income taxes. Combine that with the new tax brackets in the GOP plans — which generally take a smaller bite of income — and the GOP cuts would be a “complete win,” Minnelli says.

Frankel would end up worse off because the attorney lives in high-tax New York, and he would lose a major tax break if the SALT provision goes away. So large, in fact, that other business-friendly measures in the GOP plans, such as lower rates and the elimination of the alternative minimum tax —still wouldn’t come close to making up what Frankel would lose from the end of the SALT provision. “The IBMs of the world have thousands of employees and they’re getting a big tax cut,” he says. “But the Steve Frankels of the world don’t matter.”

The Senate is still fine-tuning its tax plan, but could pass it soon. Congressional Republicans may then speed up the usual drawn-out process of melding differing House and Senate bills into a single piece of legislation for both chambers to vote on. So the Tax Cuts and Jobs Act could become law by the end of this year or early next year. Some businesses and their workers will undoubtedly be happy about that. Others, however, may find the new law woefully misnamed.

Confidential tip line: rickjnewman@yahoo.com. Encrypted communication available.

Rick Newman is the author of four books, including Rebounders: How Winners Pivot from Setback to Success. Follow him on Twitter: @rickjnewman