Trump Says His Tax Plan Is A 'Middle-Class Bill.' Americans Don't Agree.

The tax reform plan espoused by President Donald Trump and Republican members of Congress doesn’t have many supporters, recent polls show ― and most don’t believe the president’s claim that it’s “a middle-class bill.”

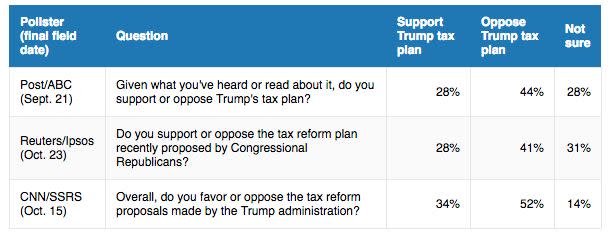

In surveys from CNN/SSRS, Washington Post/ABC and Reuters/Ipsos, support for the proposal hovers between 28 and 34 percent, with opposition ranging from 41 percent to just over half of the public.

Most Americans, polling suggests, are not intimately acquainted with the details of Trump’s plan ― just 12 percent told AP-NORC they had heard a lot about the proposal. And reactions thus far seem largely to cleave along political lines: Seventy-nine percent of Americans who approve of Trump also support the president’s plan, according to CNN/SSRS, while 81 percent of those who disapprove of him dislike the plan.

Nearly 70 percent of Americans expect large corporations to benefit under Trump’s plan, with 60 percent expecting wealthy individuals and families to share in the gains, according to the AP-NORC poll. Just 43 percent, however, expect the plan to help middle-income families, and just a third believe they’ll personally benefit.

In a Politico/Harvard survey, a 52 percent majority expected high-income Americans to reap the most benefits from Trump’s plan, with less than 30 percent expecting benefits to accrue mostly to middle-income individuals. In the Post/ABC survey, a similar 51 percent believed the plan would reduce taxes for the wealthy more than for the middle class.

The Republican plan would reduce tax rates for businesses and individuals while eliminating a host of deductions and exemptions that largely benefit middle-class households, some of which could see their taxes increase under the plan. An analysis by the nonpartisan Tax Policy Center found that the changes in the framework would overwhelmingly benefit the rich, with 79 percent of the gains going to the top 1 percent of taxpayers.

Republicans are still hashing out the details of the plan, however, and could release a formal draft as soon as next week.

Also on the subject of taxes: Two-thirds of Americans would still like to see Trump release his returns, according to CNN.

Love HuffPost? Become a founding member of HuffPost Plus today.

This article originally appeared on HuffPost.