TKO Delivers Strong Q4 and Full Year 2023 Earnings as UFC and WWE Rise on Event Revenue and Sponsorship Pacts

- Oops!Something went wrong.Please try again later.

UFC and WWE logged record revenue and sponsorship deals in 2023, which added up to a strong fourth quarter for TKO, the newly formed parent company of both sports brands.

The strong numbers reported for TKO on Tuesday stand in contrast to the controversy that erupted last month when disturbing sexual assault allegations were leveled against former WWE chairman Vince McMahon in a lawsuit by a former WWE employee. McMahon, who was the longtime leader of WWE prior to its September marger with UFC, has strongly denied the claims, but WWE and TKO leaders were quick to distance the company from its longtime leader and majority owner, forcing him to resign as chairman of TKO. McMahon still holds a considerable stake in the company, which was formed last September after the WWE-UFC merger. Endeavor, which reports Q4 earnings on Feb. 28, has majority interest in TKO and consolidates its results.

More from Variety

On a conference call with Wall Street analysts, TKO CEO Ari Emanuel and Mark Shapiro, TKO president and chief operating officer, were pressed on whether there were discussions about McMahon’s future and his ownership interest in TKO. Shapiro sought to reinforce the fact that the company has put distance between WWE and McMahon in the wake of the lawsuit. Through his longstanding ownership of WWE, McMahon still owns a little more than 20 million shares representing about 25% of total outstanding Class A shares and about 12% of the economic value and voting power in the enlarged TKO through Class B shares that are not publicly traded. Last November, McMahon sold off 8.4 million shares for a total of $670.3 million, and at the time TKO bought back about $100 million worth of those shares. Shapiro emphasized that there have been no discussions with McMahon about further sales.

“He’ll do whatever he is going to do. We’re on the sidelines. We’ll have a look. We have no idea on timing. We’re not having any discussions with him,” Shapiro said. “He’s given us no point of view on his motive or if he plans to sell or not sell, or if he does, how much. So we’re going to wait around and find out just like you.”

In a Securities and Exchange Commission filing, TKO disclosed that McMahon forfeited 86,918 shares of unvested stock units, valued at $7.5 million, after he resigned under pressure from the TKO board.

As for its Q4 and full-year 2023 earnings, TKO issued its first-ever financial guidance to investors, projecting revenue of $2.575 billion to $2.650 billion and adjusted earnings before interest, taxes, depreciation and amortization of $1.150 billion to $1.170 billion. Moreover, the company asserts that will have an enviable rate of adjusted EBITDA to free cash flow conversion “in excess of 50%.”

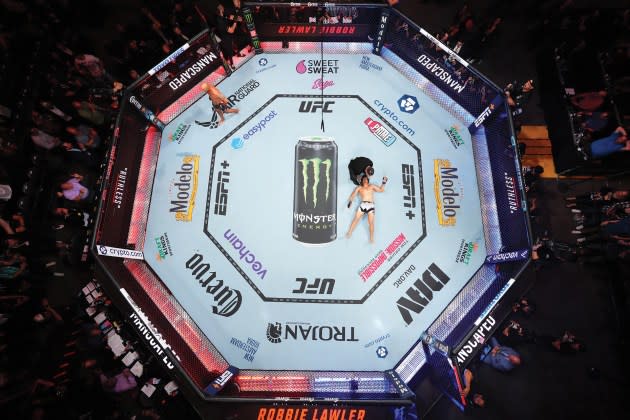

The final months of 2023 were a heady period for WWE and UFC, prior to the latest scandal to engulf McMahon, who previously faced sexual abuse allegations and WWE had to belatedly acknowledge settlement payments that were made in connection with claims against McMahon. In October, UFC signed what is described as the biggest sponsorship pact in its 30-year history with beer giant Anheuser-Busch. UFC and WWE both logged record revenue from live event ticket sales and sponsorship.

Total revenue for the quarter came in it $614 million, with adjusted EBITDA hitting $223.2 million. For the full year, the combined operations of UFC and WWE delivered $1.7 billion in revenue and $809.1 million in adjusted EBITDA. Net income was $175.7 million.

“TKO is off to a strong start following record financial performance in 2023 at both UFC and WWE,” said Ariel Emanuel, CEO of TKO and Endeavor. “We secured Anheuser-Busch as the official beer partner of UFC, delivered a transformative deal to bring WWE’s ‘Raw’ to Netflix beginning in 2025, and expanded our international footprint in important growth markets. We have more conviction than ever in the combination of these businesses and TKO’s ability to drive topline growth and margin expansion, generate meaningful free cash flow, and deliver sustainable long-term value for shareholders.”

UFC and WWE were close in revenue and adjusted EBITDA for the quarter. UFC came in at $142.9 million in adjusted earnings on $282.8 million in revenue. WWE delivered $141 million on revenue of $331.2 million.

For the full year, UFC revenue climbed 13% to $1.3 billion while adjusted EBITDA was up 11% to $756 million. For the year, including the January-September period prior to the TKO merger, WWE posted revenue of $1.3 billion (up 3% from 2022) and adjusted EBITDA of $533.1 million (up 4%). UFC’s growth was fueled by an 18% jump in advertising and sponsorship revenue, which hit $196 million for the year.

TKO executives were also pressed about the short-term future of WWE’s weekly “Raw” series. The series will end its run on USA Network in September but won’t premiere on Netflix until January 2025. The financial guidance provided for full-year 2024 does not include any “Raw” revenue, executives acknowledged. Shapiro vowed that “Raw” would be available in Q4 2024 on a platform to be determined.

“We feel pretty positive about it,” Shapiro said.

The WWE’s pact with Netflix made headlines last month because it marked the streamer’s first foray into regularly scheduled live sports programming. The 10-year deal is valued at just over $5 billion for TKO.

“That’s the big headline — doing almost a $5.2 billion deal with the best platform in the world, with the biggest audience in the world and arguably one of the best media content brands in the world. And by the way, they happen to be one of the best marketers in the world,” Shapiro enthused. “Just the idea of seeing ‘WWE Raw’ on the front page when you go to Netflix is something we’re really excited about.”

Best of Variety

Sign up for Variety’s Newsletter. For the latest news, follow us on Facebook, Twitter, and Instagram.