TikTok Ban Could Create Financial Windfall for Meta, Alphabet and Snap | Analysis

Sharks are circling TikTok after House lawmakers last week passed a bill that if signed into law would essentially ban TikTok in the U.S. — unless China-based owner ByteDance sells it to a company without ties to the Chinese Government.

Should the ban take effect, three of TikTok’s competitors stand to benefit the most: Meta, Alphabet, and Snap Inc. These companies could see a bump in engagement on their short-form video platforms and get a split of billions in revenue, Wall Street analysts said.

“Given the enormous usage and engagement of TikTok in the U.S., banning TikTok would be a windfall for Meta, Google and Snapchat,” Lightshed Partners analyst Rich Greenfield wrote in a blog post on Thursday. “Snap shares would likely be the biggest winner in market cap appreciation on a percentage basis and Meta the biggest winner in terms of absolute dollar market cap appreciation.”

As of the close of trading on Monday, Alphabet had a market cap of $1.84 trillion, while Meta Platforms had a market cap of $1.27 trillion and Snap Inc. had a market cap of $18.26 billion.

But analysts say that neither the proposed ban nor a sale of TikTok are very likely. While President Biden has pledged to sign the bill, it must first pass the Senate, where there is already strong opposition. Analysts also emphasize that potential buyers would need deep pockets — they value TikTok at $100 billion — and approval from the Chinese government, which opposes any forced sale.

How rivals would benefit

In 2023, TikTok generated $16 billion in U.S. revenue, according to the Financial Times. In the event of a TikTok ban, Meta could capture about 75% of the total, while Alphabet and Snap could capture 15% and 10% respectively, Deepwater Asset Management co-founder and managing partner Gene Munster told TheWrap.

That could translate to between $5 billion and $20 billion for Meta, $1 billion and $4 billion for Alphabet and up to $2 billion for Snap, Munster estimated.

“It’s measurable,” Munster said. “Not a game changer for Meta, but a billion here and a billion there starts to add up.”

CFRA Research analyst Angelo Zino told TheWrap that he sees a TikTok ban moving the needle for Snap Inc. the most, as the two platforms’ user bases have the “greatest overlap.”

But he argued that YouTube is poised to be the biggest beneficiary, due to its engagement levels and installed base being the “most attractive option for advertisers.” YouTube ad sales climbed 7% year-over-year to $31.5 billion in 2023, accounting for 13% of Google’s total $237.86 billion in advertising revenue for the year.

In recent years, TikTok has shaken up the social media landscape with its short-form video format catering to the Gen Z demo. While its user base is still smaller than that of both Meta and Google, TikTok is growing at a much-faster clip. “Banning TikTok would remove a major potential threat that it will continue to take ad dollars/market share away, especially given the projected growth trajectory this company is on over the next three to five years,” Zino said.

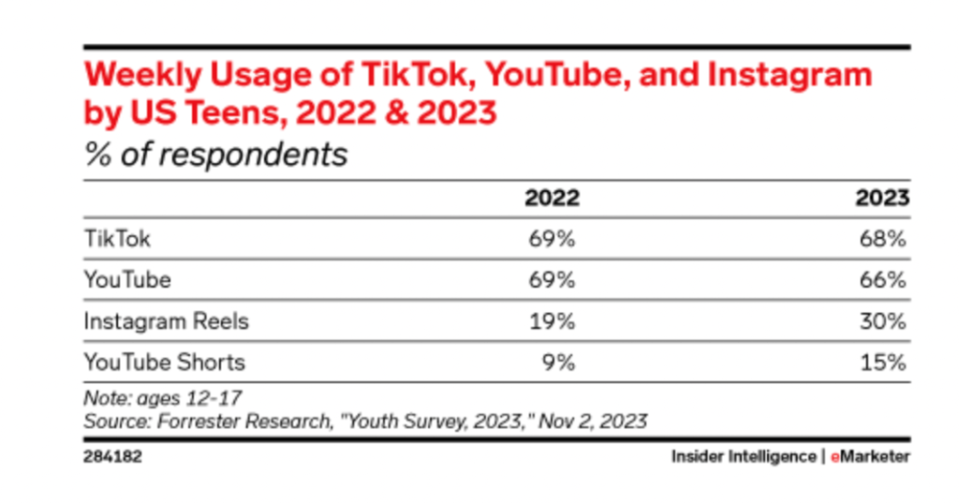

In November, a Forrester Research survey of nearly 5,000 people between ages 12 and 17 found that TikTok accounted for 68% of weekly usage by teens in 2023, compared to YouTube at 66%, Instagram Reels at 30% and YouTube Shorts at 15%.

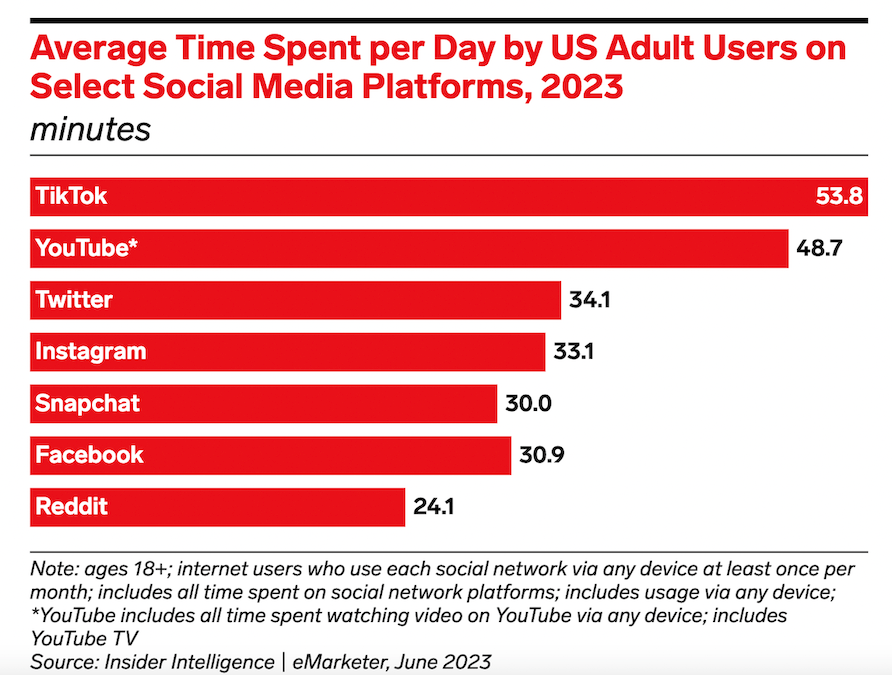

In June, Insider Intelligence estimated the average U.S. user spent 53.8 minutes per day on TikTok, versus 48.7 minutes on YouTube, 33.1 minutes on Instagram and 30.9 minutes on Facebook. It expects TikTok to beat Meta in overall time spent by 2025.

According to a recent survey of over 1,000 TikTok users conducted by marketing and communications agency MGH, nearly 60% said they would begin using Instagram Reels regularly if the app were banned, while 52% said they would use YouTube Shorts and 49% said they would use Facebook Reels.

A ‘matrix of outcomes’ and possible buyers

Following the House vote, former Treasury Secretary Steven Mnuchin revealed plans to form a consortium of investors to buy the platform.

Mnuchin’s Liberty Strategic Capital, which raised $2.5 billion in 2021, is focused on strategic investments in technology, financial services and fintech, and “new forms of content.” Its backers include Saudi Arabia’s Public Investment Fund and SoftBank’s Vision Fund. Softbank also holds a minority stake in ByteDance. In September, Liberty bought a $31 million stake in Lionsgate.

Though he declined to name who would be a part of the group, he said existing U.S. investors would be given the opportunity to roll over their TikTok stakes with the caveat that no entity would have more than 10% control. Mnuchin also said that he won’t approach any tech companies with competitive products about joining the investor group.

Other parties that have expressed interest in acquiring the app include the video platform Rumble, former Activision CEO Bobby Kotick and “Shark Tank” investor and businessman Kevin O’Leary. Potential strategic buyers that could still emerge include Oracle, Microsoft and Amazon. Oracle previously won a bid to acquire TikTok in 2020 that was later shelved; it owns the servers that house the platform’s U.S. user data through its Project Texas initiative.

“It’s kind of a matrix of outcomes here,” Munster said. “If we already have one [bidder] coming out of the woodwork, there’s going to be multiple.”

While tech giants like Microsoft, Google and Meta would likely express interest, they may encounter obstacles due to antitrust concerns, Dhaval Moogimane, the leader of West Monroe’s high-tech and software practice, told TheWrap. He added that private equity firms or consortiums would be “stepping into one of the largest PE deals ever envisioned.”

TikTok’s algorithm and source code are a key roadblock

Analysts pegged the likelihood of a ban or a sale at 25% each, compared to a 50% chance that nothing changes.

Munster predicted it could take three to four months for the bill to get through the Senate and signed by President Biden. At that point, ByteDance would have six months to sell TikTok before the ban takes effect, and would likely wait for the outcome of the 2024 election before making any moves.

“Trump is currently saying that he’s against the forced sale. So ByteDance is going to play the waiting game on this,” Munster told TheWrap. “If Biden wins and they know that they have to sell, they will sell. They’re not going to walk away and just shut it down.”

But even if an investor group or strategic buyer could get the deal done structurally, there’s another key issue: Any sale must be approved by the Chinese government and it’s unlikely Beijing would agree to one that included the source code for TikTok’s algorithm.

Following the Trump administration’s attempt to force a TikTok sale, China revised its export control rules in 2020 to cover technologies that it deemed sensitive. Two years later, a Commerce Ministry spokesperson said China is opposed to a forced sale of TikTok on those grounds.

“There would be massive technology and regulatory hurdles to a deal with China,” Wedbush analyst Dan Ives told TheWrap. “ByteDance is not going to sell this asset with source code.” He estimated that TikTok’s $100 billion valuation would fall to $40 billion without it.

Mnuchin has said he would look to find a solution in which the Chinese government would allow TikTok to be sold “without taking what they believe is critical technology.”

TikTok hits back

The House Bill specifically targets what it calls “foreign adversary-controlled applications,” in this case TikTok owner ByteDance, which critics contend is controlled by the Chinese government.

Testifying before congress a year ago, TikTok CEO Shou Zi Chew said that roughly 60% of ByteDance is owned by global institutional investors such as BlackRock, General Atlantic, Carlyle Group, Sequoia and Susequehanna International Group, while 20% is owned by the company’s founders and the other 20% is owned by its employees, including 7,000 Americans.

The Chinese government owns 1% of ByteDance subsidiary Douyin Informaion Service. Co in accordance with the country’s laws. The company insists Beijing has no effect on operations outside of China.

Our CEO Shou Chew's response to the TikTok ban bill: pic.twitter.com/7AnDYOLD96

— TikTok Policy (@TikTokPolicy) March 13, 2024

In a video posted to X after the bill was passed, Chew called the House vote “disappointing.”

“This bill gives more power to a handful of other social media companies,” he said. “It will also take billions of dollars out of the pockets of creators and small businesses, it will put more than 300,000 American jobs at risk and it will take away your TikTok.”

Chew argued that TikTok would do everything it can, including exercising its “legal rights,” to protect the access of the 170 million U.S. users and 7 million businesses on the platform.

“We believe we can overcome this together,” Chew concluded. “I encourage you to keep sharing your stories, share them with your friends, share them with your family, share them with your senators. Protect your constitutional rights. Make your voices heard.”

The post TikTok Ban Could Create Financial Windfall for Meta, Alphabet and Snap | Analysis appeared first on TheWrap.