Theater Chains to Studios: Please Send Us More Movies

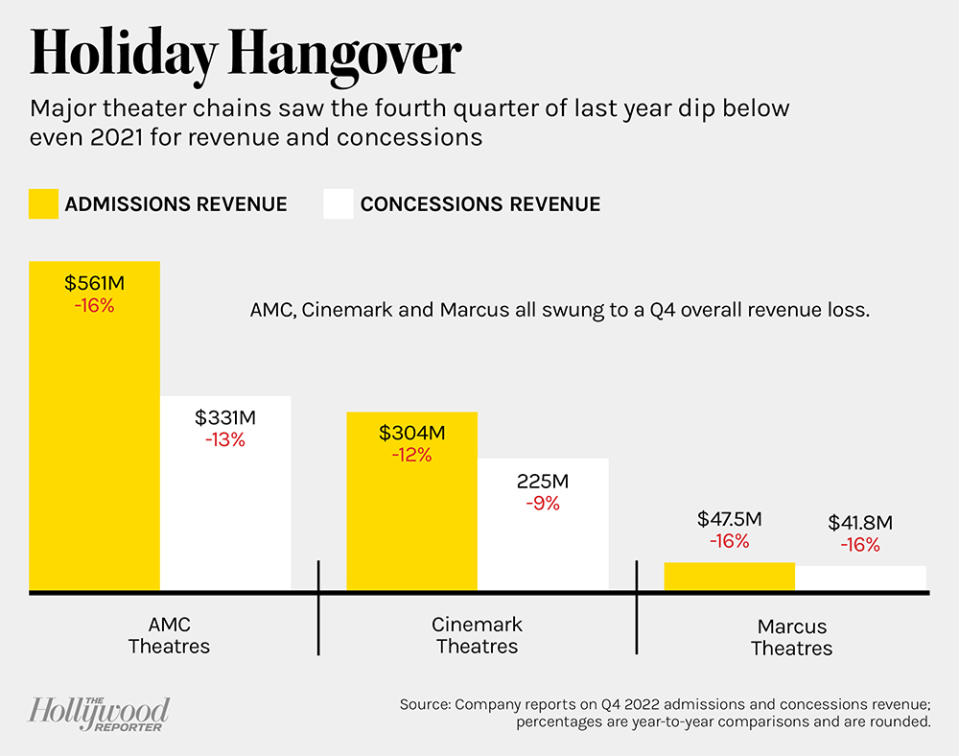

After a disappointing late summer and fall, major movie theater chains pinned hopes on a run of tentpoles that could help prop up the box office — and their bottom lines — from Black Adam to Black Panther: Wakanda Forever and Avatar: The Way of Water. But, one by one, in reporting fourth-quarter earnings in February and early March, the top chains all posted revenue that fell short of even the comparable quarter in 2021, when the industry was in the thick of the pandemic.

While the impact of The Way of Water, the $2.2 billion grosser that opened Dec. 16, won’t be fully felt until exhibitors report first-quarter results in the spring, the fourth-quarter numbers aren’t encouraging. That’s especially so when studio executives, from Warner Bros. Discovery CEO David Zaslav to Paramount Global chief Bob Bakish, have touted the important flywheel effect of launching their tentpoles in theaters instead of sending them directly to streaming services to pump up subscriber numbers. If the theatrical ecosystem can’t fully recover, then it won’t be much of a launchpad for ancillary markets, either. The good news: Domestic box office revenue this year is up more than 37 percent. The bad: That’s down 22 percent from 2019.

More from The Hollywood Reporter

In what’s shaping up to be a make-or-break year for exhibitors with steep debt loads, the challenges facing the industry include wage and inflationary pressures on the expense side and Netflix and the streaming revolution still pushing movies straight to video-on-demand. Listening to the chatter around recent analyst earnings calls, with company chiefs over peak pessimism as their theaters have reopened, it’s easy to see why the industry’s fortunes are tied to Hollywood’s film supply to the multiplex picking up.

AMC Theatres, which operates 950 theaters globally, saw attendance hit 49.5 million, down from 60 million during the year-earlier period as its quarterly loss increased to $287 million, up from $134 million in 2021. On an earnings call Feb. 28, CEO Adam Aron told analysts after unveiling a sharp fall in attendance that he didn’t see a full box office recovery before 2024 or 2025 at the earliest, although he bullishly predicted “a 75 percent increase in the number of major movie titles grossing $100 million or more compared to last year.” (In 2022, the number of features hitting the $100 million mark globally was about 40.) Aron also noted that the No. 2 chain by theater count, Regal owner Cineworld, is now in bankruptcy court, as if to say, “See, things could be much worse.”

Also on the brighter side for AMC Theatres, as analyst Eric Handler noted in a post-earnings take, “AMC produced in 4Q22 what we believe is an industry-high $19.98 average revenue per patron at its U.S. theatres,” above rival Cinemark’s $17.43 per patron.

Speaking of Cinemark, the No. 3 chain that operates nearly 520 theaters domestically and in Latin America saw 39 million patrons buy tickets in the fourth quarter, down from 48 million customers a year before, leading to a loss of $98.8 million compared with a year-ago profit of $6.4 million. CEO Sean Gamble, on a Feb. 24 call with analysts, pointed multiple times to studios’ release volume as a factor in the decline, noting optimistically that he expects 100 to 105 theatrical releases in 2023. That’s down from a pre-pandemic level of 130 in terms of all films but still up from the past two years. (There were only 67 features released in 2,000-plus theaters in 2021 and 71 last year, compared with 112 in both 2019 and 2018, per Comscore.)

“Studios are looking at some of the other films they had originally been contemplating for streaming platforms and considering if those could be released theatrically instead,” relayed Gamble on the call.

Credit rating firm Fitch wasn’t sold, revising Cinemark’s debt ratings outlook on March 3 to “negative” from “stable” to reflect concerns that near-term attendance growth may not reach expected levels, which would hold back plans to reduce the company’s debt load. “While studios have publicly committed to theatrical release windows, there is no guarantee those films will drive attendance improvement,” the agency pointedly noted. A MoffettNathanson analyst team added: “Depressed supply levels coming out of the pandemic have certainly limited audience levels, so it remains to be seen as to whether elevated supply levels will do the inverse.”

Marcus Theatres, the No. 4 chain, with 84 locations in the U.S., is seen as shielded partly from some economic headwinds because its parent corporation also has a hotel division and owns real estate for the majority of theaters it operates. Admissions revenue fell to $47.5 million in the fourth quarter, from $56.8 million a year earlier. On an earnings call March 2, Marcus Corp. CEO Greg Marcus said the exhibitor won’t “throw in the towel” on hoping to recover to pre-pandemic revenue levels, noting that “there are a lot of content providers who make content who haven’t been playing theatrically,” referencing the hope that tech giants like Amazon or Apple would send more films to theaters.

Seeing theatrical as the engine that drives Hollywood’s movie train, Cineplex CEO Ellis Jacob on his Feb. 7 fourth-quarter analyst call pointed to Netflix giving a short theatrical release for Glass Onion: A Knives Out Mystery and Amazon planning an exclusive theatrical window for the Ben Affleck- and Matt Damon-starring Nike film Air. “These examples and others like them continue to highlight the power of theatrical exhibition in elevating the overall success of movie content,” argued Jacob, whose Cineplex chain operates 160-plus theaters in Canada. (Cineplex saw net income rise in its fourth quarter, to $10.2 million, compared to a net loss of $21.8 million in the same period of 2021.)

In all the calls with investors, exhibition executives stressed that the prescription for bringing theatrical attendance and box office back to historical levels includes releasing more volume and diversity of films instead of just relying on the next superhero blockbusters. They also cautioned that recent revenue gains came from ticket price hikes, strong high-margin concession sales and premium big-screen play for tentpoles.

Even big-screen exhibitor Imax, viewed by Wall Street as a beneficiary of theatergoing as a “premium experience,” posted fourth-quarter revenue of $98 million, down 10 percent from a year-earlier $108.6 million. But CEO Richard Gelfond on a Feb. 22 call struck a bullish note about the recovery of China’s theatrical market, where Imax has 800 screens and more exposure than in the U.S.

Eric Wold, analyst at B. Riley Securities, saw positive signs and forecast Imax “to return to pre-pandemic box office revenues in 2023. Management confirmed this projection by guiding to 2023 global box office revenues of $1.1B (up from $850M in 2022), in line with our $1.13B estimate and above the consensus estimate of $1.07B.”

In a nod to Avatar, which delivered $140 million in box office to Imax during the last two weeks of December alone, Gelfond leaned into optimism during the call with investors: “We saw a correction coming to the economic model for streaming services. It’s easy to forget now, but there are a lot of folks who doubted Top Gun and Avatar before their releases. But we were bullish on those blockbusters from the beginning, and we were right.”

Pamela McClintock contributed to this report.

A version of this story first appeared in the March 8 issue of The Hollywood Reporter magazine. Click here to subscribe.