Target earnings, Fed minutes — What you need to know in markets on Wednesday

After a big rally to start the week, stocks leveled out on Tuesday as the major indexes logged a mixed close.

The Dow, which lead markets on Monday, was the laggard on Tuesday, falling 178 points, or 0.7%, while the S&P 500 was down 8 points, or 0.3%, and the tech-heavy Nasdaq lost 15 points, or 0.2%.

Tuesday was a big day in the retail sector, as shares of TJ Maxx parent company TJX rose xxx after results that topped expectations, while J.C. Penney (JCP) shares fell to a new all-time low after the company’s CEO Marvin Ellison left for the same job at Lowe’s (LOW).

Homebuilding stocks were also big losers Tuesday, as results out of Toll Brothers (TOL) sent shares of the luxury homebuilder down as much as 8%. Peers KB Home (KBH), Pulte Home (PHM), and Lennar (LEN) each traded lower on the news.

On the economics side, Wednesday will bring investors the week’s busiest day with preliminary readings on manufacturing and service-sector activity in the month of May due out from Markit Economics in the morning.

And in the afternoon, the minutes from the Federal Reserve’s latest meeting will be released, offering investors insight into the conversation had by policymakers ahead of their May 2 decision to keep interest rates unchanged. The Fed will announce its next monetary policy decision on June 13.

And on the earnings side, notable results expected out Wednesday should include Lowe’s (LOW), Tiffany (TIF), Target (TGT), Ralph Lauren (RL), and L Brands (LB).

Investors will be closely watching Lowe’s earnings after Tuesday’s news that it will have a new CEO, as well as results from Target, with investors looking for an update on its e-commerce efforts after the company acquired Shipt for $550 million in late 2017.

Americans on the financial edge

On Tuesday, the Federal Reserve released its 2017 report on the economic well-being of U.S. households.

With the economy in its tenth year of expansion following the financial crisis-induced recession, things are getting better — on balance — as you’d expect. When the Fed did this survey in 2013, 13% of respondents said they were struggling to get by; last year, that number fell to 7%.

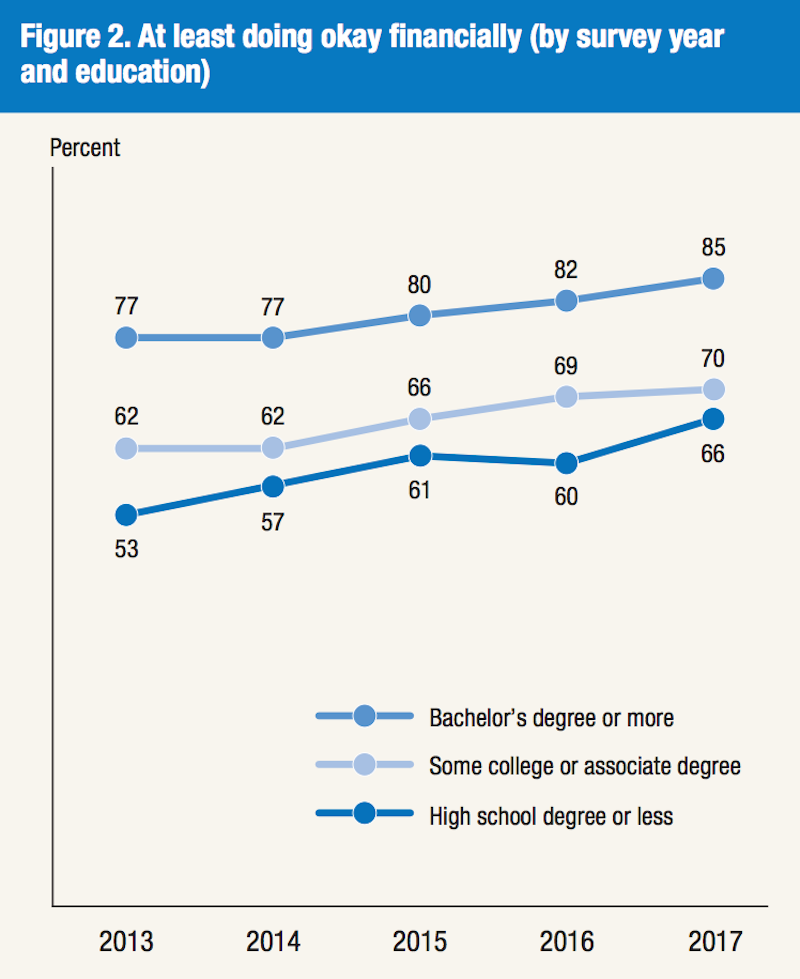

Additionally, two-thirds of adults with a high school education or less now say they’re doing at least okay financially, up from 53% back in 2013. Among those with a college degree, the percentage of those indicating they are doing at least okay hit 85% in 2017.

For many Americans, however, their financial situation remains dire and is on the edge of falling apart.

Four in 10 adults, according to the Fed, would either not be able to cover or would be forced to sell something to cover a $400 unexpected expense. Additionally, over one-fifth of adults can’t pay all of their current months’ bills, and one-fourth of adults skipped necessary medical care in 2017 because they couldn’t afford it.

So while the economy is improving overall as the unemployment rate drops, wages rise, and the stock market rallies, many Americans are still being left behind, unable to afford basic services like medical care or an unexpected car repair.

As the Federal Reserve continues to raise interest rates, more commentators begin to discuss the end of the economic cycle — when will it happen? what will it look like? how deep will the downturn be?

Recent data show Americans are starting to struggle paying off credit card debt. And though the overall financial health of consumers is far better than it was ahead of the financial crisis, stresses are beginning to show.

And as the Fed’s data revealed Tuesday, for many Americans, things are far worse than that.

—

Myles Udland is a writer at Yahoo Finance. Follow him on Twitter @MylesUdland