Can Super Bundles Save Streaming? | Analysis

- Oops!Something went wrong.Please try again later.

The landscape of streaming has transformed over the past year. Legacy media companies that plowed billions into growing direct-to-consumer operations are now facing profitability pressure from Wall Street, restive consumers ready to cycle on and off services for particular shows and continued competition from cash-rich tech players with their own agendas for growing subscription businesses.

This month saw a previous wave of consolidation become real. Warner Bros. Discovery officially rolled out Max, which combines the libraries of HBO Max and Discovery+, on Tuesday. The day before, Paramount revealed that the previously announced integration of Paramount+ and Showtime would take place on June 27. And earlier this month, Disney CEO Bob Iger made a surprise announcement that Hulu and Disney+ would combine into a single app by the end of 2023.

All of those combinations were the result of mergers or acquisitions: Discovery Communications and WarnerMedia into Warner Bros. Discovery, Viacom and CBS into Paramount, and Fox’s entertainment business along with its Hulu stake into Disney.

Also Read:

Wall Street Wants Streamers to Make More Money – but Consumers Want to Pay Less | Chart

The next wave is already taking shape — and it may not require corporate-level consolidation. David Zaslav, the architect of Warner Bros. Discovery and the merged company’s CEO, recently offered a proposal that set off buzz within the industry: bundling Max with its streaming competitors.

“For me, it seems very clear that if we were to package this great product that we have with others… if we were marketed with two or three [streamers] for a specific price, it would be great for consumers and would probably reduce churn,” he said at at MoffettNathanson’s first-ever Technology, Media and Telecom conference last week. The result, he said, wouldn’t just be a better price but a “broader package” of content — the same thing he achieved by smashing together HBO Max and Discovery+, but taken to the next level.

Welcome to the bundle, we got fun and games

The concept, commonly referred to as the “super bundle,” is a strategy in which multiple types of subscription services, often from more than one company, are bundled together under one price. It’s a familiar strategy from the cable world, where multiple pay-TV networks are often offered along with non-media services like phone and broadband service.

Zaslav warned that if legacy media companies don’t take action to consolidate themselves through bundling, tech companies would gladly step in.

Also Read:

Why Disney CEO Bob Iger Has Done a 180 on Buying Hulu | Analysis

“If we don’t do it to ourselves, I think it’ll be done to us,” he added. “It’ll be Amazon that does it, it’ll be Apple that does it, it’ll be Roku that does it. They’re already starting to do it.”

All three already market Max through their channel stores, after sometimes-contentious negotiations to secure deals.

As Warner Bros. Discovery found when hashing out those carriage deals, bundling is easier said than done. And while the idea of super bundles isn’t exactly new, Zaslav’s remarks still puzzled some.

“This idea that Max would bundle content with a Netflix or Disney or anyone else, that’s not living in reality, that’s fantasy,” streaming media analyst Dan Rayburn told TheWrap. “It’s not going to happen.”

Even though consumers might love a super bundle at a single price, “that is not what’s best for these companies from a business standpoint,” he added.

A Warner Bros. Discovery spokesperson declined to comment.

Rayburn also distinguished what Amazon, Apple and Roku are doing as aggregation, not true bundling. Though carriage deals for app or channel stores typically include revenue sharing, there’s no discount for signing up for multiple services and, aside from occasional promotions, the price offered is typically the same from one store to the next. Consumers also have to sign up for separate accounts for each service.

Also Read:

New Max App Prioritizes HBO Over Discovery | Analysis

What might get companies over the hump of giving up some control over pricing and customer relationships is the promise of lower costs.

Philip Inghelbrecht, the chief executive officer of the data-driven TV advertising firm Tatari, said that a super bundle would make a lot of sense because there’s “strength in numbers.”

“Subscriber retention is more important than customer acquisition right now, and if streaming [services] bundle, it’s much harder for subscribers to leave than it is to drop a single subscription,” he told TheWrap.

He believes possible bundling partners that would offer a lot of value to Warner Bros. Discovery would be Fubo, an OTT cable substitute, and UFC, given their focus on sports.

Also Read:

Jennifer Lopez Wins the Mother’s Day Streaming Battle for Netflix | Charts

In addition to potential cost savings, churn reduction and added value for consumers, super bundles can “help find audience synergies between different streaming services,” said Kantar Research Consumer Insights director Hannah Avery. Max and Netflix, she pointed out, have strongly overlapping subscriber bases, suggesting an “opportunity for a partnership.”

Will the tech titans pounce?

Further consolidation isn’t out of the question. Apple and Amazon could theoretically utilize their large cash positions and valuable equity to acquire smaller streamers in an attempt to build out their own offerings. And Amazon already bought MGM to bolster Prime Video. But antitrust regulators are applying fresh scrutiny to tech deals, and experts don’t think the larger tech companies need to buy smaller media companies to execute their strategies.

Given Apple’s size, buying subscribers “doesn’t move the needle on their financials,” Rayburn said. And shareholders would probably disapprove.

“I personally don’t want high-margin tech companies going into low-margin media,” said Gerber Kawasaki Management CEO Ross Gerber.

Also Read:

Inside Disney’s Billion-Dollar ‘Star Wars’ Galactic Starcruiser Hotel Bust | Exclusive

‘Subscription saturation’

According to Hub Research’s latest survey of 3,000 U.S. consumers, the average consumer has about 12.7 total sources of entertainment, only half of which are considered “must-have.” And those aren’t just video streaming — some of the top options range from reading to Spotify to PlayStation Plus subscriptions.

“People have hit this subscription saturation,” Hub Research founder Jon Giegengack told TheWrap. The biggest reason for dropping a streaming subscription, his firm’s survey found, wasn’t price but a lack of use. Finding shows across multiple subscriptions is also a pain point.

The streaming wars are “probably the epicenter of this subscription fatigue that people have, but it’s certainly not limited to that,” he added.

As consumers continue to feel the bite of inflation, Giegengack warned that they will scrutinize streaming subscriptions more. A multi-service bundle “could be a pretty compelling offer for consumers,” he added.

Also Read:

10 Takeaways from the 2023-2024 Upfronts: Few Celebs, Lots of Questions

What’s in a super bundle?

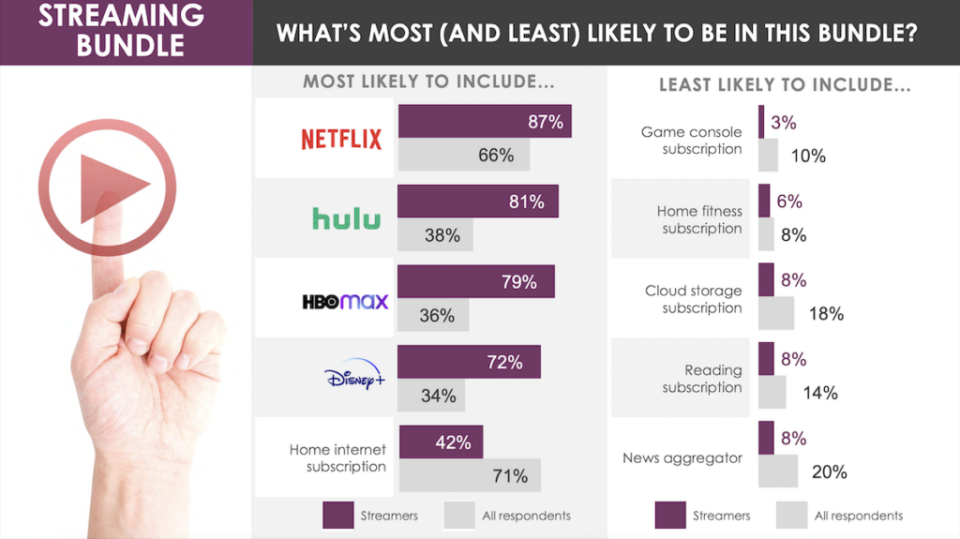

Hub Research asked consumers what they would put in a streaming bundle. A typical popular bundle would include four of the top five streaming services — Netflix, Hulu, Max and Disney+. Consumers seemed most open to Netflix offering the package, followed by Amazon, Verizon, AT&T and Comcast.

There are some examples of bundles already, including the Disney Bundle, which includes Disney+, Hulu and ESPN+; Hulu with Max; Walmart+ and Paramount+; and Amazon Prime and Apple One, both of which include several non-streaming services.

Also Read:

‘We’ve Been Here Before': Studios and Writers Got Unexpected Preparation for a Long Strike

Paramount+ and Peacock are two larger examples of services that have “struggled to scale” despite the “depth of their content libraries and notable sports rights,” said Third Bridge senior analyst Jamie Lumley. On Tuesday, Comcast introduced a new service, Now TV, which bundles Peacock with a cord-cutting cable replacement package of conventional linear channels.

A Paramount spokesperson pointed to CEO Bob Bakish’s remarks about the company’s streaming growth on its most recent earnings call, where he said it was “scaling at a rapid rate.” Paramount+, which is available in 45 markets, reported a total of 60 million subscribers at the end of its latest quarter. Comcast’s NBCUniversal division recently touted Peacock as the “fastest-growing U.S. streamer in 2022” at its NewFronts presentation with a total of 22 million paid subscribers since launching three years ago.

Avery said the bundles that will be most successful should allow for the “sharing of content catalogs” or cut costs.

Hulu with Max is an example of a service bundle that doesn’t exactly deliver: It puts HBO shows in the Hulu app, but requires shared customers to go to the Max app for other shows. And the add-on costs the same as a regular Max subscription.

Avery pointed out that the “high-cost” Disney Bundle — $12.99 a month with ads and $19.99 without — was particularly vulnerable, despite the advertised savings of 44% to 49% over the individual services, because ESPN+, she believed, “may often go unused.” For subscribers who don’t want ESPN+, Disney offers a $9.99 per month Duo Basic bundle with Hulu and Disney+

Disney declined to comment.

Also Read:

Facing the Writers’ Strike, Streamers Can Lean More on Unscripted Shows | Charts

The super bundle faces superb hurdles

Despite Zaslav’s apparent enthusiasm for the concept, Warner Bros. Discovery Chief Financial Officer Gunnar Wiedenfels recently admitted to investors that while streaming bundles offer a benefit to consumers, they’re difficult to pull off.

“It’s very hard to get perfectly aligned interests in a setup like that,” he said during JPMorgan’s Global Technology, Media and Communications Conference Wednesday. “So I do think it’s compelling to think about some form of rebundling but I don’t think it’s an easy thing to pull off and I certainly don’t expect anything to happen in the short term here.”

Gerber said the major lesson is that legacy media companies need to start looking at streaming as being a part of a bigger strategy.

“There’s lots of ways to leverage streaming in a profitable manner to complement your other businesses,” he said. “But if you don’t really have that, streaming on its own as a stand-alone business just turns out to not be that good.”

Zaslav faces a lot of pressure to prove his critics wrong. He’s promised that Warner Bros. Discovery’s direct-to-consumer businesses will turn profitable this year, earlier than previously expected. Though the company’s stock is up 22% since the beginning of the year, it’s slid in recent weeks, a trend that the launch of Max didn’t reverse. If the super bundle skeptics are right, he may need to pull off some other heroic move to turn things around.