Sun Valley Welcomes Back a Chastened Class of Media Moguls

The forecast for Sun Valley, Idaho, is clear with highs in the 80s this week. But as moguls from Hollywood, Silicon Valley and Wall Street assemble for Allen & Company’s annual conference starting Tuesday, there will be at least a metaphorical cloud over the gathering.

This year’s conference comes during a difficult time for legacy media giants, who have been cutting costs left and right as investors have shifted their focus from streaming growth to profitability. Linear television continues to decline. If anything, cord-cutting has accelerated, eroding the cable profits that once fueled the media business. Movie theaters are still struggling to get audiences off their couches to come see the latest blockbuster. New productions are facing disruptions from the Writers Guild of America strike, as well as a possible one by actors with SAG-AFTRA’s recently extended contract talks extended to Friday, the last day of the Sun Valley event.

“Industry consolidation will likely be on everyone’s mind in Sun Valley,” Third Bridge senior analyst Jamie Lumley told TheWrap. “With rising pressure to make streaming profitable, companies are increasingly asking themselves whether they have the scale to make streaming work while also managing the decline of legacy TV entertainment distribution.”

Also Read:

What Every Major Hollywood Chief Executive Got Paid in 2022

The people whose job it is to figure out that math will be gathered together at what’s been nicknamed the “summer camp for billionaires.” The event is well known as a hotbed for dealmaking, with handshakes there having led to Jeff Bezos’ purchase of the Washington Post and Disney’s purchase of Capital Cities/ABC, to name a few.

The presence of so many media moguls creates a “gravitational pull on future strategies,” said Comscore senior media analyst Paul Dergarabedian.

But the dealmakers face other forces which may make merging their way out of their current troubles harder than in years past.

A fading merger mania

The world has changed in many ways since the last Allen & Company event, but the most significant change for mergers may be that the Federal Reserve has raised rates seven times in the past 12 months.

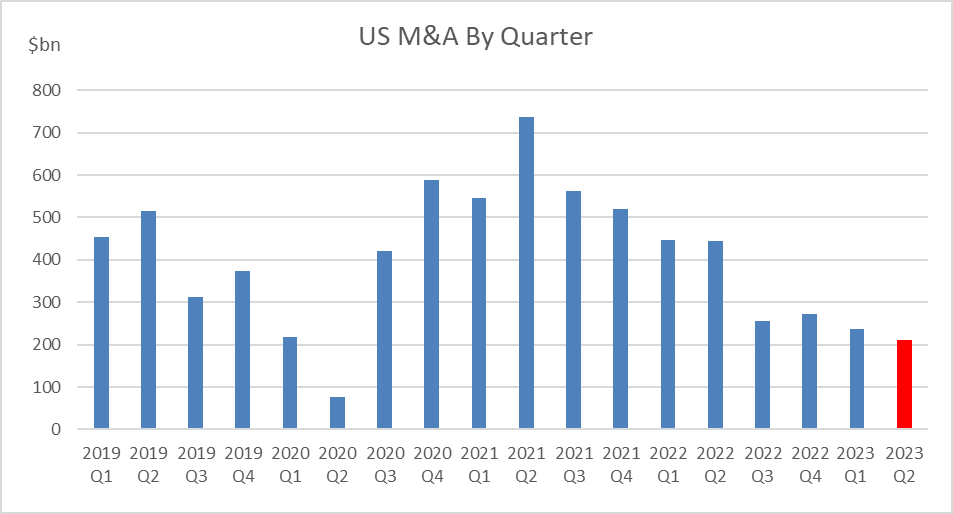

Tech, media and telecom mergers totaled $25.1 billion in the second quarter, down 24% from the first quarter’s total of $32.8 billion. That outpaced the 8% quarter-over-quarter drop in overall M&A. The total value of mergers and acquisitions in the second quarter of 2023, at $219 billion, was less than a third the value of the M&A market at its peak in the first quarter of 2021.

Dealmaking “has been significantly impacted by the uncertainty around further interest rate increase,” KPMG’s global head of M&A Phil Isom said. “However, there are deals being made for quality assets as companies divest to both raise cash and focus on their core businesses.”

Don’t expect 2023 to be a “big year for M&A at Sun Valley,” David Offenberg, an associate professor of finance at Loyola Marymount University, told TheWrap.

“That said, history tells us that this is a great time to make a move,” he added. “There’s a small chance that a company with a great vision will step out onto the dance floor soon, surprise us all, and get the ball rolling on a new round of deals. The more likely outcome is a few small deals in the AI space.”

In the meantime, companies should prepare themselves for the reopening of the M&A window, Isom said.

Also Read:

Inside Pixar’s Existential Crisis and How It Can Bounce Back After Disney+ Stole Its Mojo

On the guest list

Hollywood heavyweights who received an invite to this year’s event include media moguls like Warner Bros. Discovery CEO David Zaslav, Paramount Global non-executive chair Shari Redstone, returning Disney CEO Bob Iger and Disney Entertainment co-chair Dana Walden, Netflix executive chairman Reed Hastings and co-CEOs Ted Sarandos and Greg Peters and Fox Corporation chairman Rupert Murdoch.

Tech titans like Meta Platforms CEO Mark Zuckerberg, Google CEO Sundar Pichai, Apple CEO Tim Cook and Microsoft CEO Satya Nadella and co-founder Bill Gates are also expected to attend. OpenAI CEO Sam Altman will likely draw attention for his company’s buzzy ChatGPT tool.

Also Read:

Netflix and Disney’s Ad Tiers Win 85% of New Subscriber Sign-Ups, Survey Finds | Exclusive

The deals to watch

For this year’s event, Needham & Company senior entertainment and internet analyst Laura Martin is keeping a close eye on who Shari Redstone talks to. Paramount, which has been viewed as an acquisition target by some on Wall Street in recent months, has been shedding real estate and trying to sell its majority stake in the BET Media Group and its Simon & Schuster book publishing division.

“Paramount needs to be sold. It’s too small to win the streaming wars,” Martin told TheWrap. “The two best buyers are Comcast and Warner Bros. Discovery, in my view, but Amazon or Netflix could buy it also.”

Paramount has struggled to grow its streaming business at the same pace as players like Disney or Netflix, Lumley said. He added that its “extensive catalog of films and IP could be very appealing to the right buyer.”

“Like other streamers, Netflix needs an influx of content,” Ian Greenblatt, J.D. Power’s managing director and GM, tech/media/telecom Intelligence, told TheWrap. “Paramount may be a good match.”

It helps that Netflix stock has rebounded strongly after a punishing 2022, giving it more currency to fuel a transaction. Disney and Warner Bros. Discovery shares have also made some gains, while Paramount’s stock has struggled this year, particularly after the company slashed its dividend.

In addition to Paramount, Third Bridge is keeping an eye on Alphabet, which may look to further expand its entertainment offerings after its YouTube business acquired the rights to the NFL’s Sunday Ticket, and Apple, which could look to bolster its content library and production capabilities by expanding licensing agreements or buying entire libraries. Both have stockpiled substantial amounts of cash.

“In an environment where borrowing costs are high and several companies are feeling the profitability crunch, players with cash on hand are in the driving seat,” Lumley added.

Also Read:

What Paramount+’s Recent Content Cuts Mean for Subscribers | Chart

Greenblatt sees the conference as an opportunity for Warner Bros. Discovery to combine with another company, like Comcast or Amazon.

“The library is incredibly rich, and Max is doing OK overall, even with the addition of Discovery content that might seem out of place,” he said.

Gerber Kawasaki managing partner Hatem Dhiab told TheWrap he’ll be watching whether WBD CEO David Zaslav might be willing to offload CNN.

“It’s not up for sale but as we say on Wall Street, nothing is for sale until you get the right price,” he added.

Dhiab also expects whispers about the fates of Hulu, ESPN and Paramount, as well as the next strategic steps for Disney CEO Bob Iger and Comcast CEO Brian Roberts.

Under a 2019 agreement, Disney can buy out Comcast’s minority stake in Hulu as early as January 2024, and Comcast can require that Disney do so. Both companies have suggested it’s likely Disney will buy the stake in recent statements, and Disney has moved to integrate Hulu with Disney+.

Also Read:

‘The End of an Era': Facebook’s Final Days of Partnership With News Media Are Here

Deals involving Disney, Paramount or Warner Bros. Discovery are unlikely to come out of the conference, Heritage Capital founder Paul Schatz told TheWrap, but he acknowledged “you can never be surprised if there is something from the streaming world with Reed Hastings being there.”

Schatz instead expects AI to be a dominant topic and predicts there “could be some strategic relationships” that come out of the event.

Chatter at the conference may also include the convergence between traditional media and entertainment and social media, AI’s impact on the media industry, content origination and marketing; public policy and regulation’s impact on digital advertising; gaming and subscriber retention; streaming profitability; and industry consolidation or video on demand partnerships in streaming, said CFRA Research Director Kenneth Leon.

Other topics Leon is focused on include U.S. regulatory approval for Microsoft’s $68.7 billion acquisition of Activision Blizzard; Paramount’s possible sale of Simon & Schuster; moves by leading streamers like Netflix to get into the free ad-supported streaming television (FAST) market and catch up with Pluto and Tubi; the Disney-Comcast negotiations over Hulu; what’s next for Warner Bros. Discovery under David Zaslav; and streamers’ plans around live sports and music events.

Also Read:

For Hollywood Attorney Elsa Ramo, ‘Creative’ Dealmaking and ‘Courage’ Are Key

Netflix has been “ramping up its M&A strategy after nearly 25 years on the low,” said Investing.com senior analyst Thomas Monteiro. Warner Bros. Discovery has been looking to find new ways to leverage its content, he added. He also believes that there will be a lot of buzz around AI with Big Tech bosses meeting with OpenAI’s Sam Altman.

“This can be a potentially game-changing moment, as more than measuring their business strategies against each other, they will share and discuss their views for the future, which is a topic of interest that goes beyond the stock market itself,” Monteiro said. “Still, with valuations running very stretched at the moment, I would be surprised to see any M&A there. Partnerships, on the other hand, seem possible.”

With four days to spend in sunny Idaho, the moguls won’t want to come home empty-handed.

Also Read:

Why Selling CNN Won’t Be Easy for Warner Bros. Discovery | Analysis