In the Streaming Wars, Peacock May Not Be a Turkey After All

By most accounts, including ours, Peacock got off to a rough start. But the NBCUniversal streaming service may have teeth – er, beak? – after all.

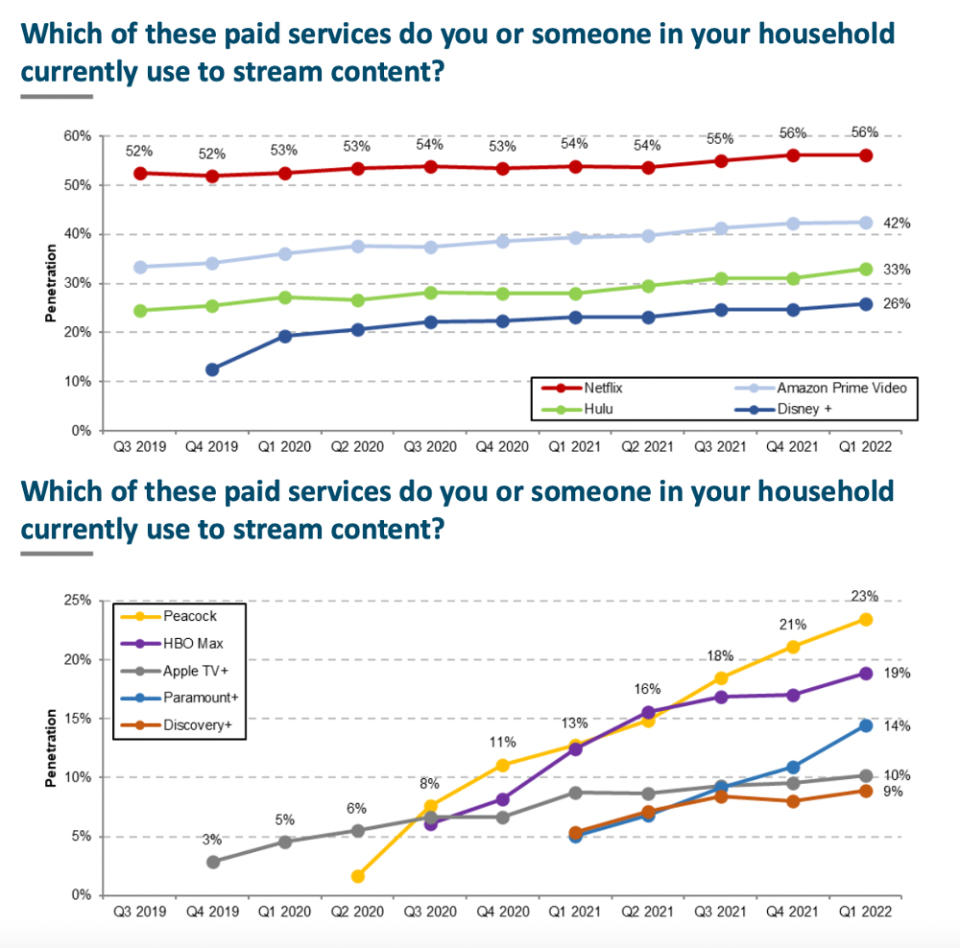

In the first quarter of 2022, usage of Netflix, Amazon Prime Video, Hulu, and Disney+ were all relatively flat, according to market research and consulting company HarrisX. The data came from a survey with 22,839 respondents between January and March, which was analyzed and reported Monday by media analysts MoffettNathanson.

More from IndieWire

Peacock (and Paramount+, for that matter) experienced “tremendous growth,” they wrote. “The star of these charts is the rocket ship that is Peacock,” MoffettNathanson said.

Take a moment to read that sentence again: “star… rocket ship… is Peacock.”

MoffettNathanson tacked on a few caveats to that bold statement. Peacock’s ad-supported tier likely serves to exaggerate its growth; the Winter Olympics and the Super Bowl also served to goose the quarter. Being a relative newcomer that’s only begun getting the benefit of original content tends to be a good look for a quarterly snapshot.

Now home to “The Office” as well as the WWE Network, Peacock had more than 9 million paid subscribers at the end of 2021, Comcast executives noted in January. Most come from the service’s cheaper, $4.99-per-month, ad-supported option as opposed to the $9.99 ad-free option. (There’s also the totally free sign-up option, but it’s limited.)

All told, Peacock had nearly 25 million monthly active accounts, the NBCUniversal parent company said in its fourth-quarter earnings release, and made about $10 per user when including advertising. (At the time, Peacock tacked on another 7 million monthly users from Xfinity bundles; Peacock President Kelly Campbell told Vulture last month that 75 percent of Peacock’s viewership comes from paid and bundled consumers.)

See Peacock the rocket ship blast off below in yellow; the disparity between the big players and the bit players here is so large, HarrisX and MoffettNathanson analysts split the line graph in two.

MoffettNathanson/HarrisX data

The vertical trajectory, as depicted, is only made possible by how late NBCUniversal got into the streaming game and how slowly Peacock started. Covid delayed the 2020 Summer Olympics, which were supposed to be Peacock’s big launch moment. It also clogged the development pipeline at a time when Peacock needed content.

Those circumstances clipped its wings out of the gate, but within its first 18 months Peacock launched 70 original series and grew its catalog by more than 500 percent, Campbell said. Peacock aims to tack on “50 to 60” more original series this year, and the library is set to explode after NBCU decided to remove its next-day programming from Hulu in favor of its own streaming service.

Weeks after the Tokyo Olympics were postponed, during a soft launch for Comcast cable customers in April 2020, Peacock decided to open up streaming access in exchange for email addresses it could theoretically monetize later. A relatively robust free tier wasn’t originally in the plans; today, it is a driving introductory force. TV Rev co-founder and lead analyst Alan Wolk, the guy who created the FAST (Free Ad-Supported Streaming TV) acronym back in 2018, told IndieWire that he believes Peacock stumbled into a triple-decker setup that is “where the whole industry is headed.”

Wolk believes the SVOD business is maxing out on high-value subscribers, but FAST and AVOD services can produce more ad revenue – especially in poor countries. As cord-cutting continues, free-streaming services provide needed reach for advertisers. Subscription options are tiered like wedding cakes, with free as the large and stable base that allows streamers to attract catch-up viewing, convert window shoppers, and create unique marketing opportunities.

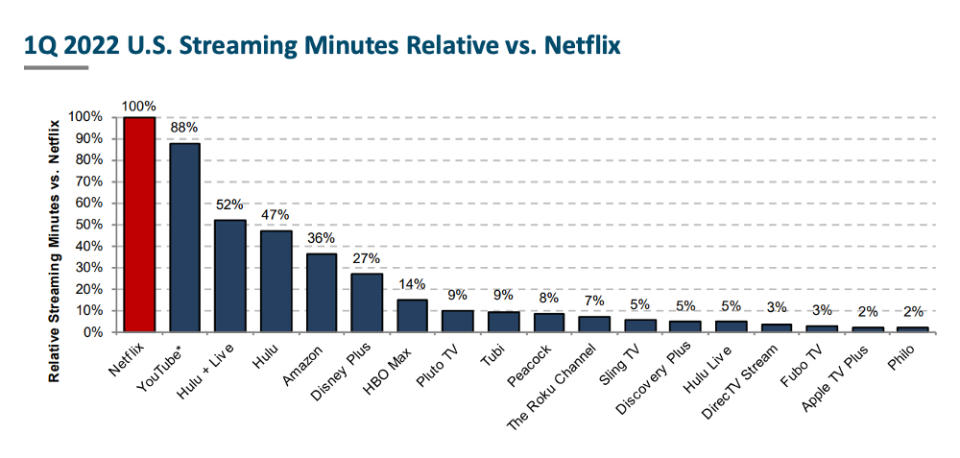

Peacock is still mired in bird poop when it comes to time viewed, especially when compared with industry leader Netflix. According to Nielsen, the NBCU service gets just eight percent of Netflix’s minutes viewed, ranking behind most of the well-known streaming options (minus Discovery+ and Apple TV+) as well as FAST platforms Pluto TV and Tubi. At least Peacock beats the Roku Channel — by a very thin margin.

MoffettNathanson/HarrisX data

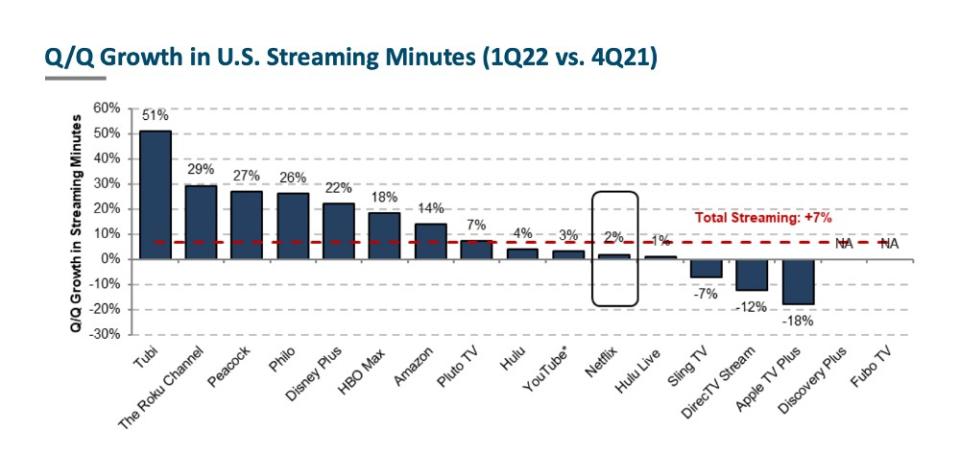

If the streaming wars were the Olympics, Peacock would earn the bronze for viewership-minutes growth with Tubi taking the gold and Roku landing the silver. Here again, it is the Olympics and Super Bowl making the Q1 advancement possible for Peacock, which also launched the anticipated “Fresh Prince of Bel-Air” dramatic reimagining, “Bel-Air,” in February. “Bel-Air” has been Peacock’s most successful original to date and its third biggest series. (Likely behind “The Office” and “Yellowstone.”) The day-and-date release of Jennifer Lopez movie “Marry Me” was also a bright spot, quickly becoming the most-watched movie ever on Peacock.

From the end of last year to the beginning of this one, Philo, Disney+, HBO Max, and Amazon Prime Video showed double-digit growth in minutes streamed. Apple TV+ is the big loser here with a decline of 18 percent — this despite “CODA” winning the Oscar for Best Picture Oscar in the final days of Q1. “CODA” should help more in Q2, but a pair of key fourth-quarter series made for this unfavorable (and perhaps unfair) comparison.

“The Morning Show” Season 2 premiered September 17, 2021; sci-fi show “Foundation” debuted September 24, 2021. With Apple TV+ sticking to a weekly episodic rollout, it is not surprising that Q4 2021 outperformed Q1 2022 – though readers really should be watching “Severance,” which premiered on February 18.

MoffettNathanson/HarrisX data

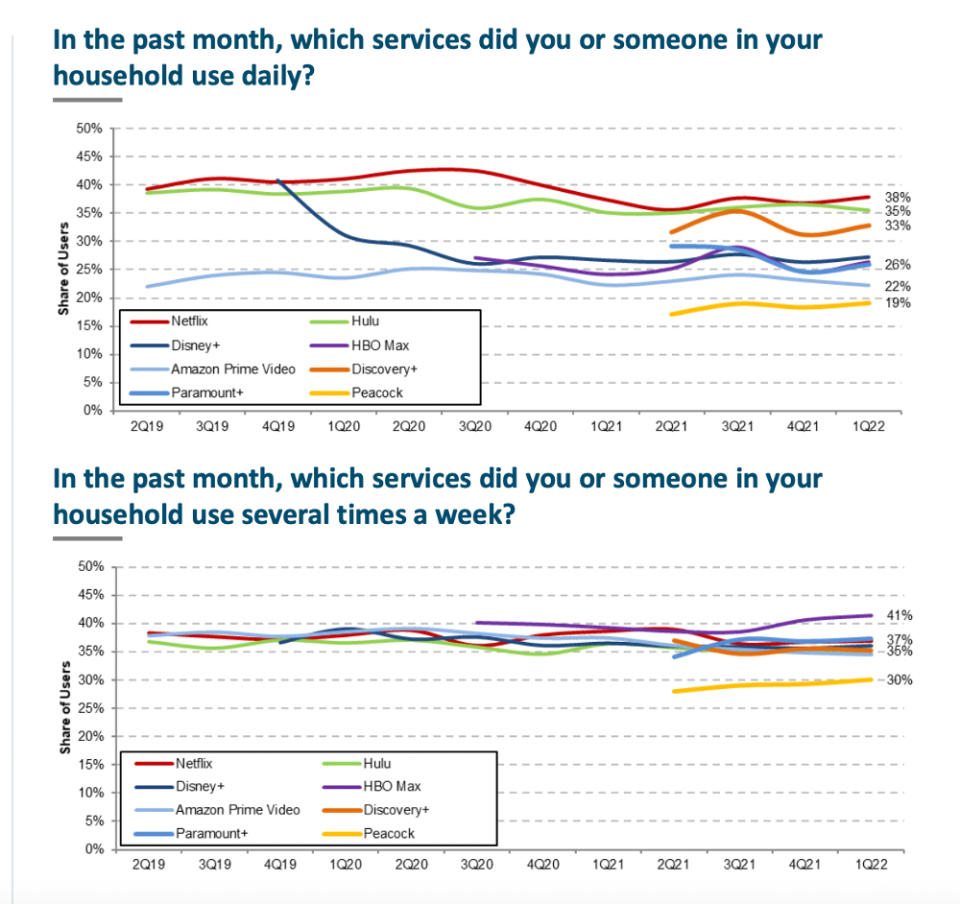

Despite impressive quarter-to-quarter growth, daily usage is definitely an issue for Peacock. Among Netflix, Disney+, Amazon Prime Video, Paramount+, Hulu, HBO Max, Discovery+, and Peacock, guess which still ranks dead last in daily and weekly usage? It’s Peacock, according to HarrisX – and it’s not even particularly close.

Like Peacock, Discovery+, does not have a ton of subscribers. (Discovery, Inc. ended 2021 with 22 million streaming subscribers; most of those come from Discovery+.) But what Discovery+ lacks in sheer numbers it makes up in regular usage, which is attractive in its own right to the advertising community. Among streaming services with a commercial option, only Hulu gets more daily usage. (Netflix has the most daily usage overall, but no commercials – yet).

MoffettNathanson/HarrisX data

Peacock also resides in an area where a SVOD service might like to rank dead last: password sharing. (Having a strong free tier is one reason for that.) That also could be interpreted as an indictment on the range and relative attractiveness of a platform’s programming, so we won’t celebrate this one too much — and neither should Peacock.

“Peacock just needs a couple of big hits,” Wolk told us. Or they need to merge with Paramount+, but that’s a whole different story.

You know who doesn’t tend to swap passwords? (Other than Peacock users?) Old people. Old people are also who watch Peacock. While Disney+ skews dramatically young, as does Hulu, Peacock peaks among viewers in their early 50s. Executives should like to see that brought down by about a decade – but at least there’s disposable income among the oldest Gen Xers.

Comcast’s first-quarter 2022 earnings come out April 28. We should get a Peacock-subscriber update then – and a whole bunch of Olympics- and Super Bowl-boosted peacocking.

Best of IndieWire

Sign up for Indiewire's Newsletter. For the latest news, follow us on Facebook, Twitter, and Instagram.