Streamflation: Why Streaming Prices Keep Going Up | Charts

Streamflation has pinched viewers’ wallets: Nearly all the major services have hiked up their prices, in some cases multiple times, within the last year. And it may not be the end, as a new analysis suggests that some players have room left to increase prices.

The price hikes, along with cutbacks on content spending and marketing, are a key tool streamers have to curb their losses as Wall Street keeps a tighter rein on unprofitable streaming ventures. Though there are other options for squeezing more revenue from an existing customer base, like leaning into ad-subsidized services or cracking down on password sharing, raising prices is the most straightforward route to a stronger bottom line. And it doesn’t seem to be driving away streamers’ customers — yet.

Price increases on monthly subscriptions are the “quickest way to see immediate average revenue per user growth,” Omdia media and entertainment analyst Sarah Henschel told TheWrap. But she also acknowledged it can be a double-edged sword if it drives up customer dissatisfaction and potentially even churn.

Cable became known for aggressive price hikes, she pointed out, which eventually drove cord-cutting consumers to streaming services. Pay TV’s history could repeat itself if streamers make the same mistake.

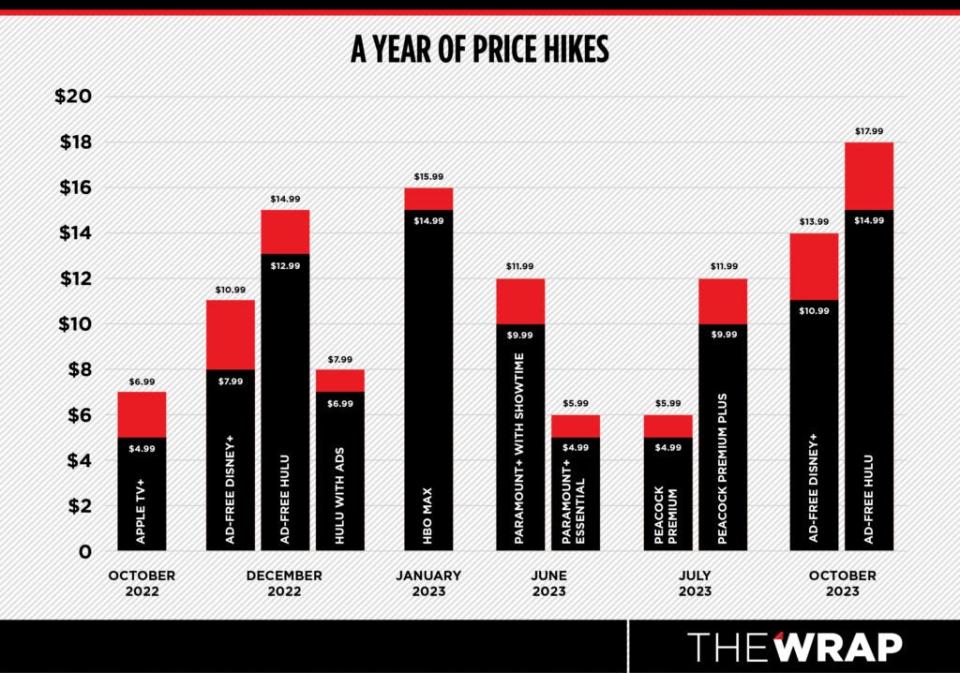

Since October 2022, Apple TV+, Disney+, Hulu, Max, Paramount+ and Peacock have all raised their prices. Netflix, which raised prices earlier in 2022, stopped offering its $9.99 per month ad-free basic tier in the U.S. and U.K. in July, pushing its cheapest ad-free option to $15.49 per month. Warner Bros. Discovery, meanwhile, added a $19.99 per month ad-free option with additional features when it rebranded HBO Max to Max in May. Disney+ and Hulu plan to increase the price of their ad-free versions to $13.99 and $17.99 per month, respectively, on Oct. 12 — a second increase in under a year.

The question now is how much room is left for streamers to raise their prices before consumers hit their breaking point and cancel?

When looking at Disney+, Hulu, Netflix, Max, Peacock, Paramount+, and Apple TV+ collectively, their cost has increased from $76.43 per month to $94.43 per month, a 24% increase in just one year, according to Bernstein Research sales specialist Mark Schilsky. (That figure, which is based on weighted prices that take AVOD and SVOD share data from Antenna into account, doesn’t consider Netflix’s implicit price increase through its password-sharing crackdown.)

Schilsky said he doesn’t think these companies are done raising prices, and some executives’ comments on recent quarterly earnings calls suggest the same.

Disney CEO Bob Iger said that the company was able to raise prices in nearly 50 countries around the world, with the impact on churn and retention coming in better than expected. The company is also “actively exploring” ways to crack down on password sharing, with plans to “roll out tactics to drive monetization sometime in 2024.” Likewise, Warner Bros. Discovery CFO Gunnar Wiedenfels said that driving growth through pricing and ARPU rather than volume would be a priority moving forward.

Churn and burn

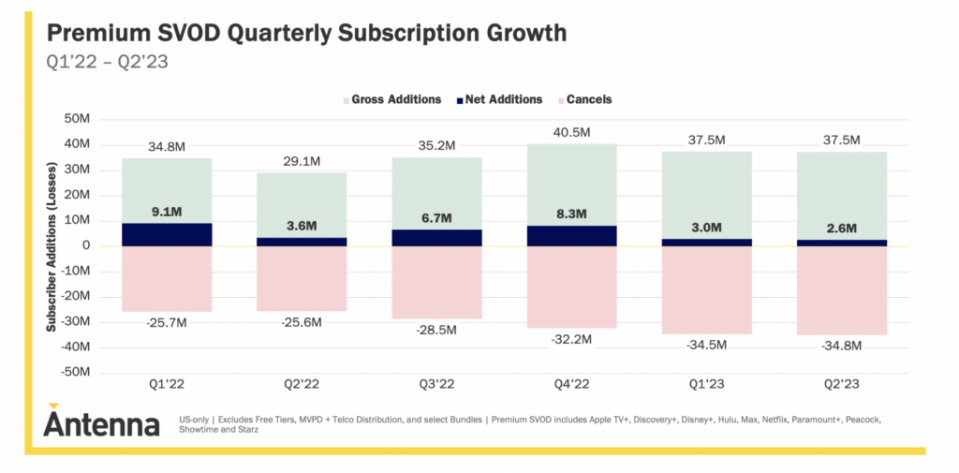

The latest data shows a brutal competitive landscape, with Netflix, Disney+, Hulu, Apple TV+, Max, Discovery+, Paramount+, Showtime and Starz scrapping for a shrinking pool of new streaming subscribers. In the second quarter, those streamers collectively signed up 37.5 million new subscribers while losing 34.8 million existing ones. They only added a net 2.6 million subscribers, according to Antenna.

And those gains are not distributed evenly. In June, Netflix accounted for 25% of U.S. gross adds, followed by Peacock (12%), Max, Paramount+ and Hulu (11% each), Apple TV+ (10%), Disney+ and Starz (7% each), Showtime (4%) and Discovery+ (3%).

The weighted average churn rate in the U.S. was 6.1% for the month. The streamers that did better than average were Netflix (3.6%), Disney+ (4.5%) and Hulu (4.8%). Apple TV+ (6.5%), Max (6.9%), Paramount+ (7.8%), Peacock (7.2%), Discovery+ (8.4%), Showtime (9.2%) and Starz (10.7%) fared worse on churn.

In an effort to drive more subscribers to its annual plan, Starz lowered its cost from $74.99 per year to $69.99 per year. The move comes after it hiked its monthly plan from $8.99 to $9.99 per month in June, its first increase since 2016.

Despite challenges with churn, streaming continues to grow its share of total viewing time, reaching a record 38.7% in July, according to Nielsen. Hub Entertainment Research founder Jonathan Giegengack argues that, while pricing plays a part in churn, content is the main driver of cancellations.

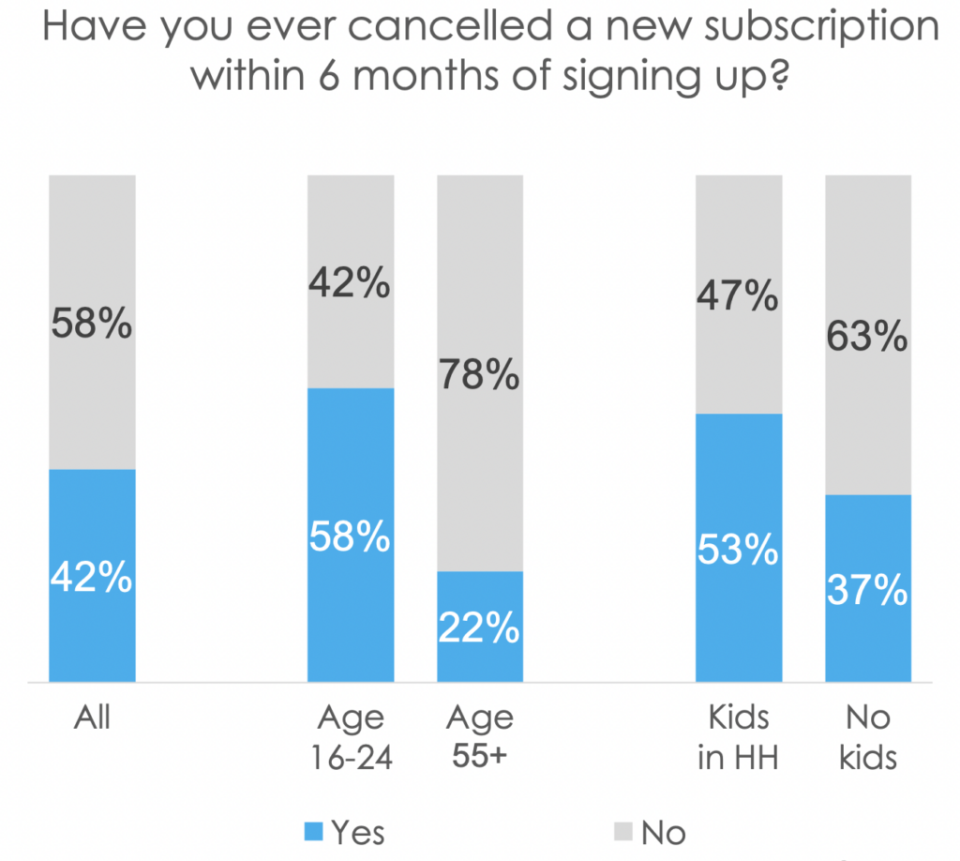

“When we ask people why they dropped a service, especially why they dropped one soon after signing up, the biggest reasons that they give are ‘I ran out of things to watch’ or ‘I wasn’t using it enough,’” Giegengack told TheWrap. “Both of those come up more often than ‘the service was too expensive’ or ‘I needed to save money.'”

A June survey conducted by Hub Entertainment Research found 42% of respondents signed up for a new streamer and dropped it within the first six months. Over 40% of respondents signed up for a subscription just to watch one show. Almost 60% of viewers under age 25 said they dropped a new subscription soon after signing up, as did more than half of viewers with four or more paid TV subscriptions.

About 44% of respondents said they were spending more on TV than they were a year ago, compared to 35% who said the same in 2020.

“Consumer perception around the new release catalogue size is all important here,” Ampere Analysis research director Richard Cooper told TheWrap. “Services that are able to show the volume of new high profile content additions will be able to command relatively higher prices. Those services that don’t have as many new TV show and movie additions, or are not able to advertise them as effectively to consumers, will not be able to charge as much or raise prices to the same extent.”

Go for a price hike

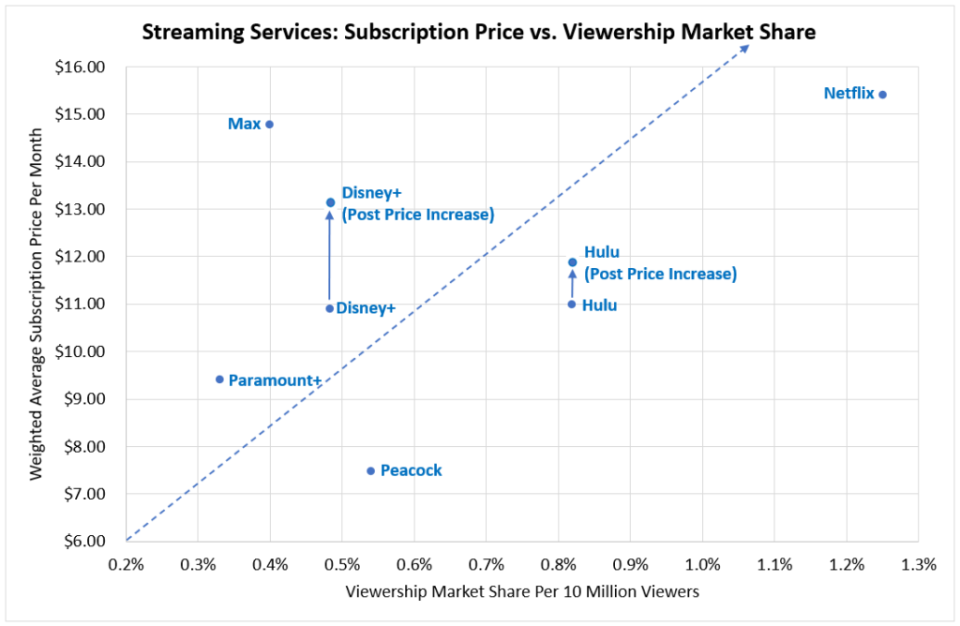

According to Schilsky’s analysis, Netflix, Hulu and Peacock may have more room to raise prices, while Max, Disney+ and Paramount+ may have more difficulty raising prices without inducing “materially higher churn.”

To determine this, Schilsky looked at each streamer’s market share of viewership using Nielsen viewership data. He then compared their weighted prices to that market share figure.

The dotted line of the chart below runs through the average price of the six SVOD services at around $11.50, with those to the right considered “cheap” relative to their peers and those to the left are “expensive,” Schilsky said.

The relative pricing power of an SVOD service can change with the launch of a hit show, he acknowledged, but noted that it historically has taken a long time for viewership share to shift significantly. He argued that consistent hits, not one-offs, are the best way to drive habitual viewership.

“Perhaps all these services are overpriced — I highly doubt it — and subscribers eventually recoil in the face of all these price increases, but I think it’s evident that U.S. SVOD subscribers are able and willing to accept most of these recently announced price increases,” he concluded. “And if they begin to balk? There is always AVOD.”

The post Streamflation: Why Streaming Prices Keep Going Up | Charts appeared first on TheWrap.