Stocks have done worse ahead of a conflict than 'when the bombs started to fall'

Tensions between the U.S. and North Korea have escalated, causing a spike in market volatility and a drop in stock prices. It’s tempting to conclude that markets would deteriorate much more should the saber-rattling evolve into a war.

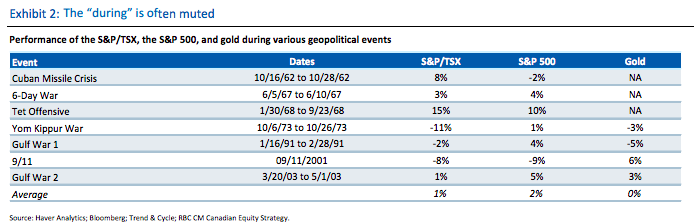

“In fact, the actual beginning of conflict has often marked ‘the beginning of the end’ in terms of poor market performance,” he wrote.

To be sure, the seven events that RBC identifies may not be comparable to a potential nuclear conflict, which has escalated in recent days.

On Friday, President Trump reiterated his prior comments that he would not rule out a preemptive strike against North Korea.

Barasch explained looking at the market reaction is instructive when thinking about the market reaction to current conflict.

Donald Trump could ‘blunder’ into Third World War with North Korea threats, warns former US intelligence chief

In some instances, once the conflict was resolved a prolonged bull market ensued. These examples, including the Cuban Missile Crisis and both Gulf Wars, represented key buying opportunities. For now, despite the escalating threats and rhetoric, the market is still less than 2% off its all-time highs.

Nicole Sinclair is markets correspondent at Yahoo Finance

Please also see:

How Marriott plans to beat Airbnb in winning over Chinese travelers

Fast food chains are coping with their labor cost problem

Short-sellers have lost $7.1 billion betting against this year’s hottest tech stocks

America doesn’t need to be the world leader to prosper