What’s at Stake as Warner Bros. Discovery Is Set to Reveal Its New Streaming Plan | Analysis

When AT&T decided to offload WarnerMedia on Discovery Communications, a big part of the deal’s premise was creating a “stronger competitor in global streaming.” Nearly two years after the deal was first announced and a year after the merger was completed, Warner Bros. Discovery is finally set to unveil details about a new service that combines HBO Max and Discovery+ on Wednesday.

Much has changed for the company and the industry in the intervening time since its creation. Where Wall Street once pressed companies to grow streaming subscribers, analysts and investors are now closely scrutinizing plans to turn direct-to-consumer businesses profitable.

Warner Bros. Discovery, which faces a heavy debt load, has been undergoing a major restructuring, one it expects to complete by the end of 2024. The company estimated in December that it would incur up to $5.3 billion in total pre-tax restructuring charges, including up to $3.5 billion in content impairment and development write-offs. The cost cuts have provoked howls of complaint from Hollywood to Washington.

Also Read:

HBO Max ‘It’ Prequel Series Casts Taylour Paige, Jovan Adepo and Chris Chalk

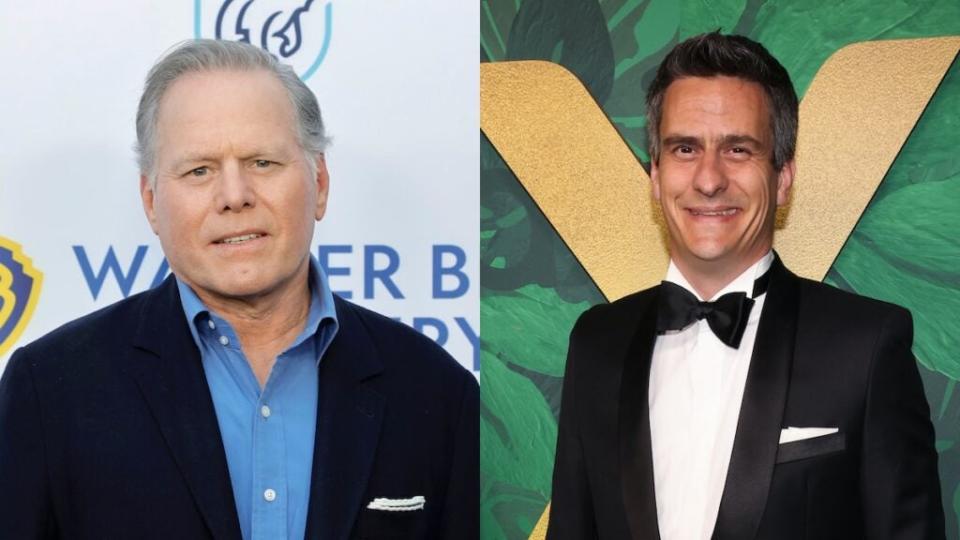

CEO David Zaslav has a lot riding on Wednesday’s unveiling of the new streaming service, with many constituencies to please, from creative talent to fickle consumers to even some members of Congress who are scrutinizing the company’s plans. He may not be able to please everyone. But it’s a key test for a company that says it prizes storytelling to see if its leader can shift the narrative around Warner Bros. Discovery.

With all that in mind, let’s delve deeper into the stakes for WBD going into Wednesday’s streaming event.

A “critical” combination

Warner Bros. Discovery views the combination of its services as “absolutely critical” to its streaming efforts, Chief Financial Officer Gunnar Wiedenfels said at Morgan Stanley’s Technology, Media & Telecom Conference in March.

“For the first time, we’re going to be able to put all the content together. We believe that that’s going to have positive impacts on engagement, on churn, on subscriber acquisition,” Wiedenfels explained. “So, all the way through that entire value driver tree, we believe we’ll see improvements.”

During the company’s fourth-quarter earnings call, Wiedenfels said the launch of the combined offering would increase marketing and content costs in the short term.

“However, we remain very enthused about the trend line here, and I have greater and greater confidence in our ability to achieve our long-term segment targets of breakeven in the U.S. in 2024 and $1 billion of profitability in 2025 globally,” he added. “And we continue to track above our internal plans.”

Also Read:

‘Westworld’ and ‘F-Boy Island’ Among Axed HBO Max Shows Now Streaming on Roku

As of the end of 2022, Warner Bros. Discovery had a total of 96.1 million DTC subscribers across HBO Max and Discovery+. In the fourth quarter of 2022, the direct-to-consumer division posted an operating loss of $217 million, a $511 million year-over-year improvement, on revenue of $2.45 billion. Average revenue per user for the DTC business was $7.58, with domestic ARPU at $10.83 and international ARPU at $3.71.

Value for the increasingly cash-strapped consumer

According to Bloomberg, the combined service is expected to maintain HBO Max’s current pricing, charging subscribers $10 per month for its ad-supported tier and either $15 or $16 per month for its ad-free version.

Sources also said that a new, higher-priced subscription tier will also be available for $20 per month, offering better video quality and other features.

The streamer will also reportedly add thousands of unscripted reality titles from Discovery at no extra cost to HBO Max subscribers, while Discovery+ will continue as its own separate, lower-priced service.

Also Read:

How HBO Max Can Poach Customers From Disney+ and Paramount+ (and Vice Versa) | Charts

Washington is turning up the heat

On Friday, Sen. Elizabeth Warren (D-Mass.), Rep. Joaquin Castro (D-Texas), Rep. David Cicilline (D-R.I.) and Rep. Pramila Jayapal (D-Wash.) sent a letter to Attorney General Merrick Garland and Assistant Attorney General Jonathan Kanter calling on the Department of Justice to investigate the company.

The members of Congress wrote that the merger of Discovery and WarnerMedia appears to have enabled the company to “adopt potentially anticompetitive practices that reduce consumer choice and harm workers in affected labor markets” and that new ownership is “hollowing out an iconic American studio” by cancelling projects in various stages of development, such as the $90 million “Batgirl” film that was scrapped before release, and removing content from HBO Max entirely, like “Westworld,” “Minx” and “The Nevers.”

The lawmakers criticized the media company for cancelling films like “Batgirl” and pulling other shows, calling the moves a “de facto ‘catch and kill’ practice, vastly limiting consumer choice.”

Additionally, the letter criticized the company’s new streaming service, which the lawmakers said “leaves questions unanswered about whether a lower-priced platform will have reduced quality from the current product — while consumers are paying the same price and lack the transparency necessary to fully evaluate the plans and their relative prices.”

“With fewer alternatives available to consumers, there is less competitive pressure on WBD to innovate or provide a variety of quality content,” they added.

Discovery closed its $43 billion merger of WarnerMedia in April 2022, which was ultimately not challenged by the DOJ after a review. A spokesperson for Warner Bros. Discovery declined to comment. Representatives for the Department of Justice didn’t immediately respond to TheWrap’s request for comment.

Also Read:

Warner Bros. Discovery CEO David Zaslav Earned $39.3 Million in 2022

The FAST strategy is still a question mark

The increased pressure on profitability and the rising interest in revenue from advertising and licensing has made FAST (free ad-supported streaming TV) channels increasingly appealing to companies that once reserved content for their own streaming services.

In January, Warner Bros. Discovery struck deals with Roku and Fox’s Tubi to license 2,000 hours of content from HBO, HBO Max, Discovery Channel, HGTV, Food Network, TLC, Warner Bros. Pictures and Warner Bros. Television and launch a series of channels to carry its movies and television shows. The company’s leadership has stated these deals are just the beginning.

“The Roku and Tubi deal was really just a toe in the water, if you will, 14 channels, a beginning for us, but there’ll be more to come as we go through the year, and we do want to have a bigger presence in that space because we do see consumer behavior continuing to shift and having a very robust amount of consumers around the world, who will want to consume ad-supported content,” Wiedenfels explained during the earnings call.

Also Read:

Warner Bros. in Talks to Produce ‘Harry Potter’ TV Series for HBO Max

He continued, “And with the breadth and depth of content that we have across the company, we think we’re very uniquely able to do that without jeopardizing or risking the subscription business, the theatrical business or some of our upstream windows, which we’ll obviously continue to focus on.”

Consequently, Warner Bros. Discovery plans to launch its own FAST service this year. It’s not clear if the company will offer more details about that service Wednesday.

Wall Street is hoping for more

Though Warner Bros. Discovery belatedly decided to open up the Wednesday event to interested consumers, it was originally planned for just media, investors and analysts. Many will be tuning in to see if the details offered change their financial forecasts for the company.

Truist, which has just initiated coverage on the company’s shares with a Buy rating and a $19 price target, expects the relaunch to result in a “period of renewed momentum behind gross subscriber adds and retention and pricing (consumer ARPU) and ad ARPU.”

“We also see upside optionality around premium tiers (leveraging WBD sports media rights and news) and a FAST service (to monetize library content and convert top-of-funnel free users to paid tiers),” Truist analyst Matthew Thornton added.

The firm anticipates an upside to the company’s adjusted EBITDA, with the potential to generate $12.9 billion in 2024, topping the Wall Street estimate of $12.4 billion. Zaslav and other executives recently received adjustments to their compensation plans that emphasize increased free cash flow.

As of Monday, Warner Bros. Discovery stock was up 61% year to date — but down 38% in the company’s first year of existence.

Also Read:

How the Major Streamers Stack Up Right Now in Subscribers and Revenue | Charts