The latest cryptocurrency rout is about more than South Korea

After a South Korean Justice Minister said on Thursday that the country is preparing a bill to ban bitcoin trading, every major cryptocurrency plummeted.

“There are great concerns regarding virtual currencies and the justice ministry is basically preparing a bill to ban cryptocurrency trading through exchanges,” Justice minister Park Sang-ki said at a press conference, according to Reuters.

South Korea is one of the world’s largest markets for cryptocurrency activity, and this week officials raided the offices of two of the country’s largest bitcoin exchanges, Coinone and Bithumb.

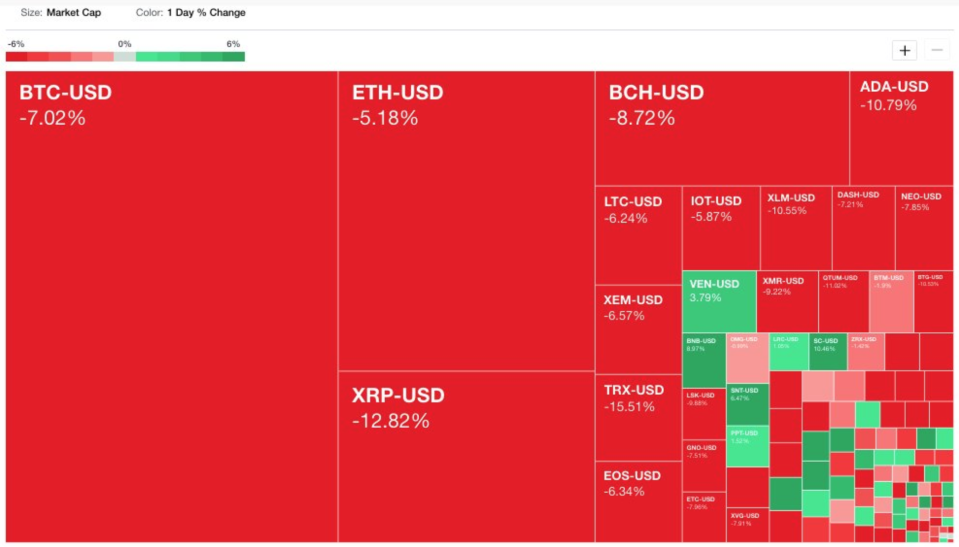

Just before markets opened in New York on Thursday morning, the crypto market was seeing red across the board on Yahoo Finance’s cryptocurrency heatmap. Bitcoin, ether, ripple, bitcoin cash, and litecoin all fell by between 5% and 12%.

But by the end of the day on Thursday, South Korea had appeared to pull back its stance: President Moon Jae-in said that Park Sang-ki’s claim is, “not a finalized decision and will be finalized through discussion and a coordination process with each government ministry.”

Coins rallied in response.

There’s more to this story: South Korea is just the latest country to indicate that it wants to take a strong stance, either positive or negative, toward trading of cryptocurrencies.

China banned initial coin offerings (ICOs) back in September of last year, and South Korea soon followed suit. The next month, China shut down all Chinese bitcoin exchange sites, and now there are reports that China would like to shut down mainland bitcoin mining operations next.

On the other hand, last April Japan officially recognized bitcoin as legal currency and will regulate it accordingly, which quickly boosted trading volume on Japanese exchanges and has helped make Japan the new No. 1 by daily trading activity. One month after Japan’s move, in May 2017, Australia followed suit in recognizing bitcoin as legal currency.

What we are seeing, then, is that as the bitcoin and overall cryptocurrency market matures and heats up, countries with hot activity are eager to set official policy. In other words: regulation is coming.

In some cases, a country’s new stance or announcement regarding crypto doesn’t move the needle much in one way or the other in terms of price. (For example, when the SEC has twice issued public guidance warning about ICOs.)

In the case of South Korea, Thursday’s news had an instant impact and caused a rout. By Thursday night, all of the major coins were already back in the green thanks to Moon Jae-in’s comments cautioning that the South Korea ban is not yet final.

It was a reminder of the resilience of this market—even when there’s bad news, the top coins typically regain their losses within a day or two.

Stay tuned as more countries begin to publicly tease out their regulatory stance toward cryptocurrencies.

—

Daniel Roberts covers bitcoin and blockchain at Yahoo Finance. Follow him on Twitter at @readDanwrite.

Read more: