Small business optimism — What you need to know in markets on Tuesday

America’s small businesses will be the highlights on Tuesday in a day that will ease investors into a busier back half of the week.

In the morning, the latest reading on small business confidence is set for release from the National Federation of Independent Business. This has been one of the stronger readings since the election, and economists have particularly focused on small business intentions on hiring and wage pressures.

On Monday, markets were fairly subdued as the bond market was closed for the Columbus Day holiday. Monday also saw the awarding of the latest Sveriges Riksbank Prize in Economic Sciences in Memory of Alfred Nobel — better known as the Nobel Prize in Economics — to Richard Thaler for “contributions to behavioral economics.”

Confident corporate America

Since the election, confidence among American small businesses and consumers have been notable standouts on the economic report card.

But this does not mean that corporate America has felt left behind.

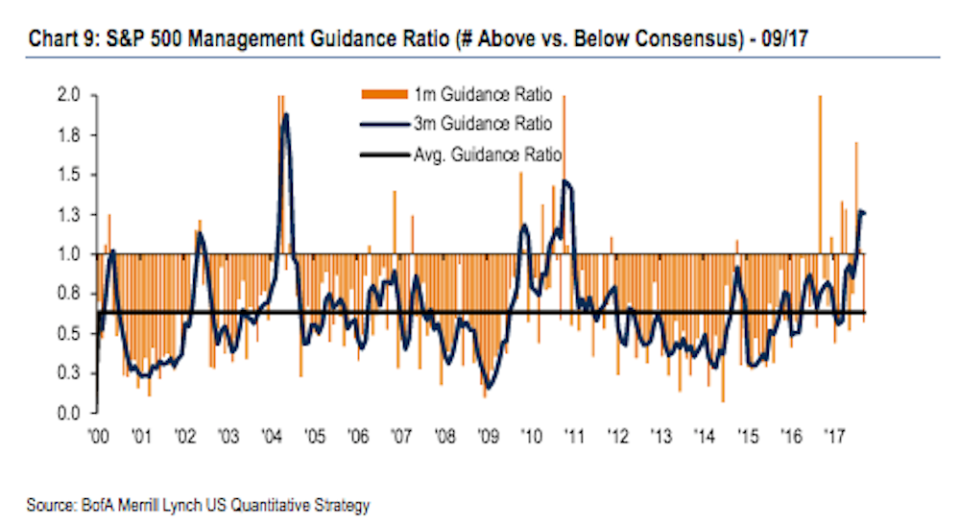

In a note to clients on Monday, Savita Subramanian and her team at Bank of America Merrill Lynch highlighted that positive guidance is being issued ahead of negative guidance by corporates at the fastest rate in about seven years. And reading earnings outlooks as a measure of corporate confidence, things haven’t look this good in the corporate sector since Obama’s first term.

“Guidance trends heading into earnings season have remained strong,” BAML wrote, “the three-month ratio of above– vs. below consensus earnings guidance sits at 1.26 as of September month-end, essentially flat from August and at its highest levels since late 2010.

“Last earnings season we had expected corporates could temper their guidance giving the growing uncertainty around the timing/magnitude of tax reform/stimulus, along with elevated geopolitical uncertainty, but guidance trends have actually consistently improved since early 2017.”

Subramanian notes that this rise in guidance has been, in large part, due to the improved outlooks for multinationals given the weaker U.S. dollar. A weaker U.S. dollar is a positive for companies that sell goods overseas as it improves the purchasing power of their customers.

But this trend also bears watching as we head into an earnings season that begins with stocks at a record high while earnings expectations have been steadily downgraded as investors now expect another quarter of slowing year-on-year earnings growth.

Consensus expectations are currently looking for 3% earnings per share growth in the third quarter with sales set to rise 4%. All eleven S&P 500 sectors should see slower earnings growth than the prior quarter.

So the news on the corporate side doesn’t look terrible, but with corporate expectations having risen one wonders if investors won’t be quicker to punish poor results and reluctant to reward strong numbers.

—

Myles Udland is a writer at Yahoo Finance. Follow him on Twitter @MylesUdland

Read more from Myles here: