Small business and inflation — What you need to know in markets on Tuesday

Tuesday will bring investors some of the most important economic news of the week.

At 8:30 a.m. ET, the latest data on consumer prices will be released, with Wall Street economists forecasting the consumer price index rose 0.2% over the prior month in February. In January, consumer prices rose 0.5% over the prior month.

On a “core” basis, which excludes the more volatile costs of food and gas and which the Federal Reserve prefers to focus on when judging inflation pressures in the economy, prices are expected to rise 1.8% over the prior year, below the Fed’s 2% target.

Elsewhere in the economic data, Tuesday morning will also feature the release of the latest small business optimism index from the National Federation of Independent Business, which is expected to hit a new high after having been near record levels since President Donald Trump’s election in November 2016.

On the earnings calendar, headline results are expected to include Dick’s Sporting Goods (DKS), DSW (DSW), and HD Supply Holdings (HDS).

Tech stocks at a new record

The early February sell-off is starting to feel like a distant memory. At least, if you’re a tech investor.

On Monday, the tech-heavy Nasdaq hit another new high, its second in a row since breaking out to a new record on Friday amid a broad market rally that followed a stronger-than-expected February jobs report.

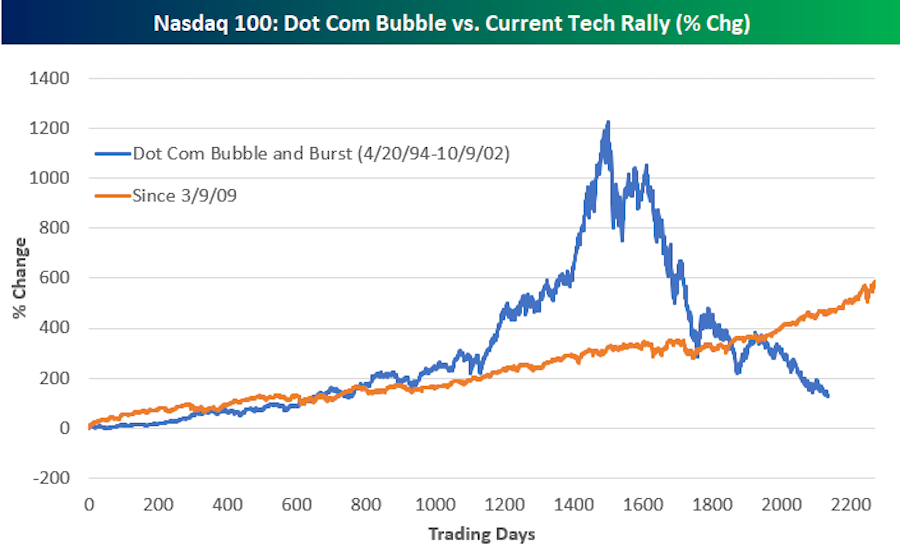

And with this latest push to record highs, the oft-discussed 2017 fears of a new tech bubble emerging in markets will get renewed discussion. But as Bespoke Investment Group notes, when comparing the Nasdaq’s climb since the crisis to what was seen before the tech bubble, the recent rally looks fairly tame.

From the 2009 bottom, the anniversary of which was marked last Friday, the Nasdaq has gained about 600%. From the spring of 1994 through the peak of the bubble popping in March 2000, the tech index gained over 1,200%.

And when comparing the market’s valuation from then until now, it’s not really a close contest.

The tech index currently trades at around 27 times last year’s earnings, well below the 80 times trailing earnings investors were paying for the index in 2000.

So, yes, the run in tech stocks has been breathtaking, especially when it comes to the gains in shares of companies like Facebook (FB), Amazon (AMZN), Netflix (NFLX) and Apple (AAPL). Bespoke notes that the $418 billion in market cap Amazon has gained since the start of 2017 is more than the entire market value of all but six S&P 500 companies.

Comparing the current tech run to the sector’s biggest-ever bubble, of course, does not take away from the fact that tech stocks have been the defining asset class of the latest leg of the post-crisis bull market.

But that stocks in a certain sector have gone up a lot does not, in a vacuum, mean they have to go down, will go down, or can’t go higher.

—

Myles Udland is a writer at Yahoo Finance. Follow him on Twitter @MylesUdland

Read more from Myles here:

A few major topics were missing from Warren Buffett’s latest annual letter

The Trump tax cut earned Warren Buffett’s Berkshire Hathaway $29 billion in 2017

Goldman Sachs says U.S. economic data right now is ‘as good as it gets’

One candidate for Amazon’s next headquarters looks like a clear frontrunner

Tax cuts are going to keep being a boon for the shareholder class

Auto sales declined for the first time since the financial crisis in 2017