Roku Accounts, Engagement and Revenue All Surge in Q3, Beat Forecasts ... But Company Warns Investors About 'Uneven' Recovery

Roku surged in after-hours trading Wednesday after the streaming company reported strong third-quarter growth in active accounts, user engagement and revenue, beating equity analysts' forecasts and sending its stock surging over 15% on the Nasdaq in after-hours trading.

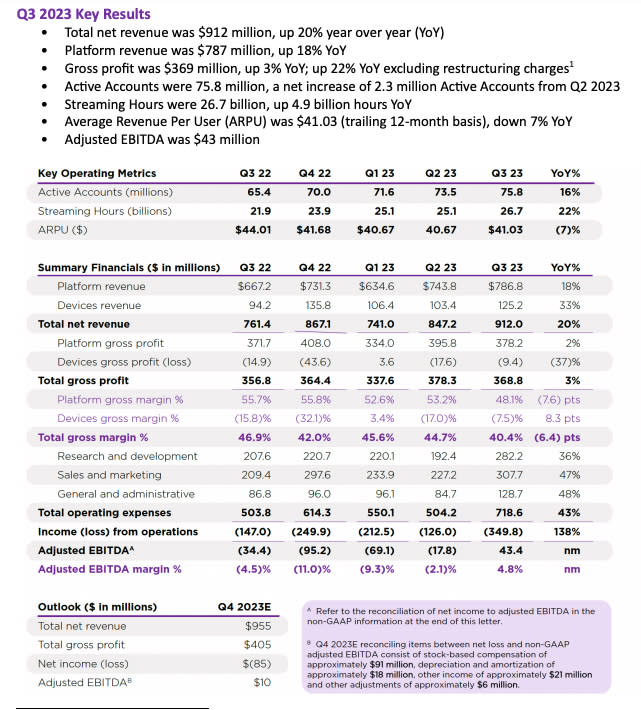

Total revenue was up 20% vs. Q3 2022 to $912 million, with "platform" revenue (which is primarily advertising) surging 18% to $786.8 million in the quarter. Device revenue surged, too, by 33% to $125.2 million, although Roku continues to lose money, at least directly, on making streaming pucks, sticks and smart TVs.

But all in all, total revenue soundly beat equity analysts' forecast for total revenue of around $853.2 million.

Active accounts reached 75.8 million, up 2.3 million from the second quarter and 16% year over year.

Also read: Roku’s Roller Coaster Ride Continues

And hours spent by users globally on the Roku platform were up 22% year over year to 26.7 billion, an increase from 25.1 billion in Q2.

Roku continues to lose money, however, with net red ink totaling $330.1 million in Q3 vs. a quarterly loss of $122.2 million a year prior. Forecasts called for the company to lose slightly less than that in the third quarter.

All in all, things seem to be looking a little better for Roku, which has famously tumbled on Wall Street since a share price zenith in the summer of 2021. In short, many investors just don't believe the company has a longterm future in the global TVOS race against Amazon and Google.

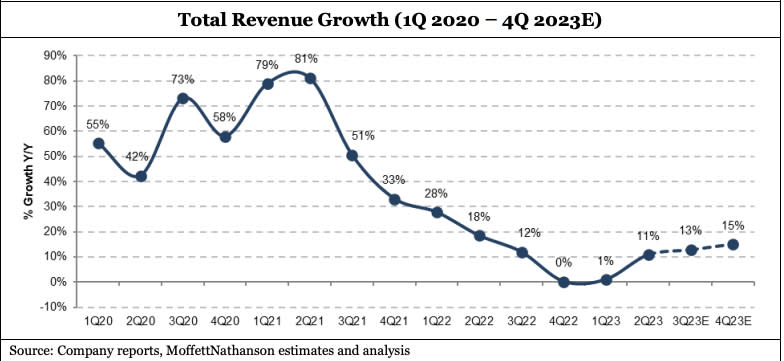

Notably, however, even the more reserved forecasts of equity analysts prior to Wednesday's earnings report showed a resurgence in revenue growth, driven by an improvement in the advertising market. Analyst Craig Moffett, who upgraded Roku from "sell" to "neutral" on Tuesday, published this graphic:

Roku itself isn't quite as bullish about the near-term future, forecasting 10% revenue growth to $955 million for Q4.

"We had a solid rebound in video ads in Q3 and we expect the YoY growth rate of video ads in Q4 to be similar," the company said in its Q3 letter to shareholders. "However, we remain cautious amid an uncertain macro environment and an uneven ad market recovery. Additionally, we will face difficult YoY growth rate comparisons in content distribution and M&E which will challenge the YoY growth rate of platform revenue in Q4."

Notably, Roku also charmed equity analysts in Q3 by laying off 10% of its workforce, liquidating some of its Silicon Valley real estate and taking down all those short-form shows it purchased from failed startup Quibi two years ago. It took a $62 million write-down in the quarter over the latter.

Roku remains far from profitable, but there's at least a notion among equity analysts that the company is now on the right path.

"Despite our concerns about rising competition in Roku's two key revenue segments -- devices and advertising -- we believe that the intensifying focus on achieving real profitability and free cash flow (not just adjusted EBITDA) reduces the risk of the shares from de--rating further. As such, we are upgrading Roku from Sell to Neutral," Moffett wrote in a note to investors Tuesday.