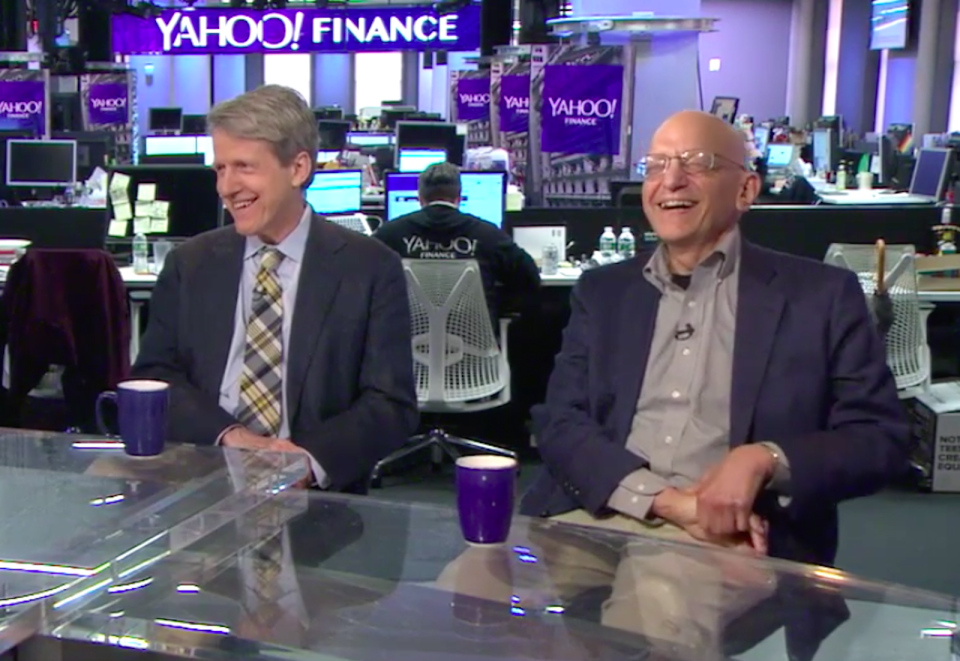

Robert Shiller and Jeremy Siegel tell us what they think of each other's market forecasts

Robert Shiller, a Nobel Prize-winning economist and Yale professor, warns that the stock market is in dangerous territory. Jeremy Siegel, the legendary Wharton finance professor and MIT classmate of Shiller’s, thinks we could see the Dow rally to 24,000 by year-end.

While these appear to be conflicting views, both acknowledge that investors shouldn’t rule out the likelihood of the other’s call.

“I give a probability of maybe a third that maybe Jeremy’s right,” Shiller said.

“That is higher than I thought Bob would give me, actually,” Siegel responded.

Shiller asked Siegel, ‘”You don’t have a probability of one on that, do you?”

“No, no, no,” Siegel acknowledged.

Siegel added that his Dow prediction is conditional on progress in President Donald Trump’s legislative agenda.

“The market is high relative to history. I don’t think it’s high relative to fundamentals. I think with corporate tax reform, we still have some legs to the rally that we’ve seen since November,” he said.

Shiller, on the other hand, is more concerned about the stock market based on his valuation method, the cyclically adjusted price-earnings (CAPE) ratio, which is based on an average of 10 years’ worth of earnings. The ratio, which currently stands at over 30x, has only been this high two times since 1881: once in 1929 right before the stock market crash, and again at the end of the dot-com bubble in 2000.

“That’s why, among other things, I’m worried we could see a correction or a bear market coming up,” Shiller said.

While Siegel doesn’t agree about a pending market correction, he did say he sees lower returns today relative to history.

“I do believe actually that we’re not going to see as high returns in the stock market as we have historically,” Siegel said. “We’re in a slower growth period, lower real interest rates. I think that’s going to be for quite a long period of time. So I think returns everywhere are going to be lower in aggregate, including the stock market.”

Both Shiller and Siegel said they agree on the relative value of investment opportunities outside the United States, where valuation is lower.

“We have the highest CAPE ratio in the world of all major markets,” Shiller said. “You don’t have to invest in the United States. Most of your listeners are probably—if they’re from the US—over-concentrated in the US….People should diversify and international diversification is a good thing.”

Siegel agreed.

“Half the world’s equity capital, stock value, is outside the United States,” he said. “And that probably —when you look at India, China, emerging markets—is going to grow over time.”

For more from Shiller and Siegel:

Robert Shiller and Jeremy Siegel share what they think of unusually low volatility

Jeremy Siegel: ‘On the whole, we have nothing replicating 1999’

Siegel: If Trump doesn’t bring reform we could have trouble in the markets

Jeremy Siegel and Robert Shiller tell us what’s next for the economy

Robert Shiller and Jeremy Siegel face off and answer 7 key questions

Nicole Sinclair is markets correspondent at Yahoo Finance

Please also see:

How Marriott plans to beat Airbnb in winning over Chinese travelers

Fast food chains are coping with their labor cost problem

Short-sellers have lost $7.1 billion betting against this year’s hottest tech stocks

America doesn’t need to be the world leader to prosper