The Republican Tax Plan Is Chaos and Suicide

The only things one can be sure of regarding whatever it is that the Republican congressional majorities come up with for a tax plan is that it will shove more of the nation’s wealth upwards, that the math will be mostly magical thinking, and that there will be various strategies employed to keep the country from noticing these first two characteristics. From Politico, we learn that, yes, the Republicans are pretty much a mess on this front, too.

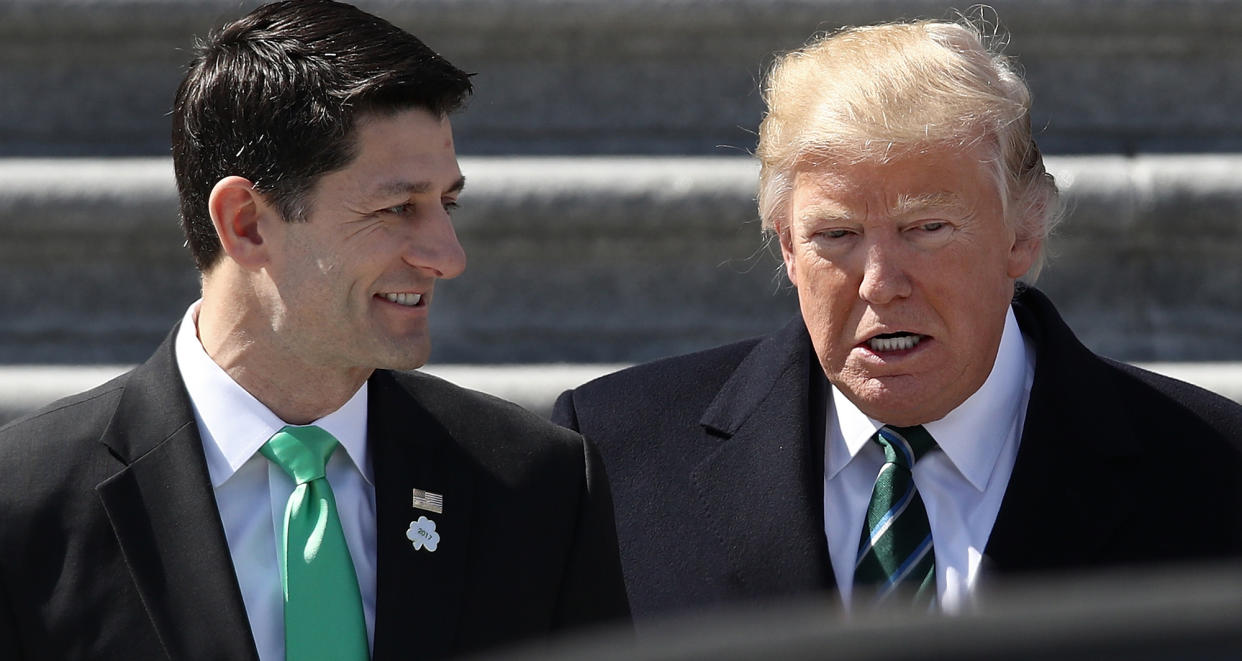

Some details of the bill started leaking out Tuesday after Speaker Paul Ryan briefed conservative leaders on text that had been finalized. The proposal, sources in the meeting said, would lower the corporate tax rate to 20 percent, meeting their initial goal. They’ve also decided to keep the current top 39.6 percent tax rate on the wealthiest individuals - though they have not settled on which incomes would be hit by that rate. Ryan told conservative group leaders Thursday that the income threshold for the top rate would likely be higher than it currently is, likely between $750,000 and $1 million. He said the estate tax would likewise be repealed but may have to be phased out to save money in the short term. But it's the unresolved issues that caused Ways and Means members the most heartburn this week - and ultimately led to the delay. Those include: how to win over GOP lawmakers from high-tax states that are balking over curbing the state and local tax deduction, which their constituents rely on. There are also question about how to ensure that wealthy individuals don’t take advantage of the lower 25 percent small business or “pass-through” rate. Many of the unresolved items are hot-button issues, including what to do with 401(k) retirement plans.

Presumably, they have unanimity within the caucus that taxes should still be paid in American dollars, but who can really say?

Look at this mess. Speaker Paul Ryan, the zombie-eyed granny starver from the state of Wisconsin, who is perhaps the worst legislative politician since the Five Minutes of Bob Livingston passed into history, desperately needs this win. Passage of this tax bill is the only reason he’s put up with the antics out of Camp Runamuck at the other end of Pennsylvania Avenue. But, unfortunately, those pesky 2018 midterms have put the gallows in everyone’s eyes, especially Ryan’s.

He has salivated for most of his career simply to do away with the estate tax, but he knows that’s also political poison, and that it would help balloon the deficit, which is something he’s supposed to care about, so he’s suggesting they phase it out, in the hopes that nobody will notice that the whole purpose of the thing is to give people like the president* and Paul Ryan the ability to make sure their grandchildren don’t have to work a day in their lives. Tampering with the state and local tax deductions will kill Republicans in high-tax states, where the party’s weak anyway. Capping the deduction for 401(k) contributions is another easy way to turn the middle-class into a ravening horde of angry beasts, and Ryan knows that, too. This would be a tough needle to thread even if Ryan were Sam Rayburn and, as a legislative leader, he’s proven to be closer to Gene Rayburn.

Those pesky 2018 midterms have put the gallows in everyone’s eyes, especially Ryan’s.

And they can’t raise revenues to keep the deficit under control because that’s something that their donor class spends millions of dollars a year on lobbyists to prevent. So it’s all smoke and mirrors and delay and misdirection in the hope that nobody notices their pockets are being picked. And, apparently, nobody’s quite figured out how to do that.

In fact, Republican tax writers could be heard speaking in raised voices during a more than two-hour meeting at the Capitol Tuesday night. Sources say there is some unhappiness among rank-and-file members who feel the plan has been written largely by party leaders without their input. “Members on the committee feel their views are not being listened to,” the source said. A Republican tax lobbyist said he sees less than a 50 percent chance that the bill will be ready Thursday - though others close to Ways and Means are more bullish it will happen.

However, according to ABC’s reliable conservative mole, Jonathan Karl, there seems to be a growing possibility that the House may go for the gold on all of the controversial issues: limiting the deductibility of 401(k) contributions, eliminating the estate tax all at once and altogether, and killing the deduction for state and local income taxes. If they do all of this, it ought to be politically suicidal. If the Democratic Party can’t muster a campaign in response that gets them a 200-seat majority in the House, then something’s really gone screwy in this country.

[editoriallinks id='c9b78b5e-d31f-467c-83ce-9445a6e7cde7'][/editoriallinks]

Respond to this post on the Esquire Politics Facebook page.

You Might Also Like