REITs Continue Drop Amid Waning Economy

Real Estate Investment Trusts (REITs) have continued their slide in recent months as global economic circumstances remain flimsy. The Real Estate Select Sector (XLRE) ETF's approximately 6% surplus downturn compared to the rest of the S&P 500 is a sign of the times, and it's unlikely to change anytime soon in my opinion. In fact, I think REITs are still overpriced; here's why.

Inflation isn't uniform

REITs usually garner momentum whenever inflation exceeds its historical mean. The thought behind it all stems from the idea that rents and appraisals are positively correlated with inflation rates. Although the argument is fundamentally correct and has historically held true, fault lines present themselves in the current environment as inflation isn't uniform.

Inflation has different causes and outcomes. For instance, inflation in the 1970s was characterized by robust economic growth prior to the period of moderation. However, inflation today stems from an array of supply-side concerns and artificial demand induced by expansionary economic policy during the Covid-19 pandemic. Therefore it's unlikely that today's inflation is primarily due to organic growth.

Furthermore, monetary policy is in shambles. Interest rates can't be raised too abruptly as it would cause a systemic economic collapse. Additionally, further expansionary economic policies aren't welcome as they would exacerbate the current inflation rates.

Resilient inflation and slowing core demand is terrible for real estate as it's a cyclical domain. Thus, based on fundamental indicators, it's likely that REITs won't be popular anytime soon.

Valuation concerns

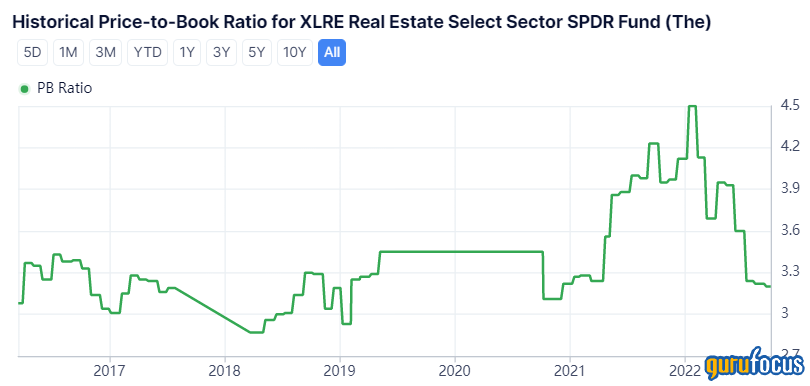

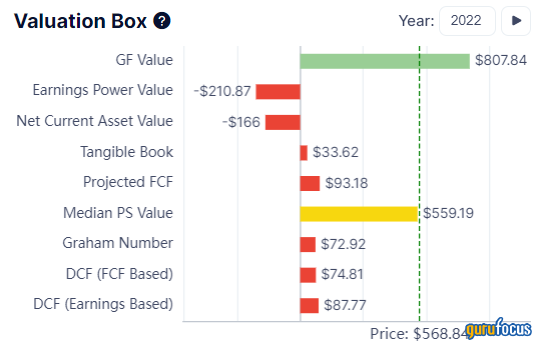

The Real Estate Select Sector (XLRE) ETF is trading at more than three times its book value, conveying the disparity between traded prices of real estate assets and their actual values.

Retrospectively, the era of moderation, which was characterized by moderate growth and inflation, allowed the majority of securities to trade well beyond their intrinsic values. However, as moderation ends, we'll likely see slowing economic growth, which means that investors will likely demand higher real value than before. Thus, we could be about to see a sustained correction of traded assets, with cyclical sectors such as real estate leading the way.

Lastly, it's worth mentioning the recent introduction of niche REITs such as data centres. Although they're promising concepts, many of these REITs are overhyped, causing a systemic valuation problem in the REIT space. For instance, the popular data centre REIT Equinix (NASDAQ:EQIX) is trading at a premium to its tangible book value of more than 17 times.

Final word

Real estate's sustained downturn shouldn't come as much of a surprise. Growing economic concerns and misinterpretation of inflation have caught investors unaware. Furthermore, there are some serious valuation concerns in the REIT space, which could be exacerbated as we exit an era of moderation.

This article first appeared on GuruFocus.