Regulation will only make Facebook stronger, analyst says

This week, British regulators fined Facebook (FB) 500,000 pounds (about $660,000) for breaking data protection laws that led to the Cambridge Analytica scandal in March.

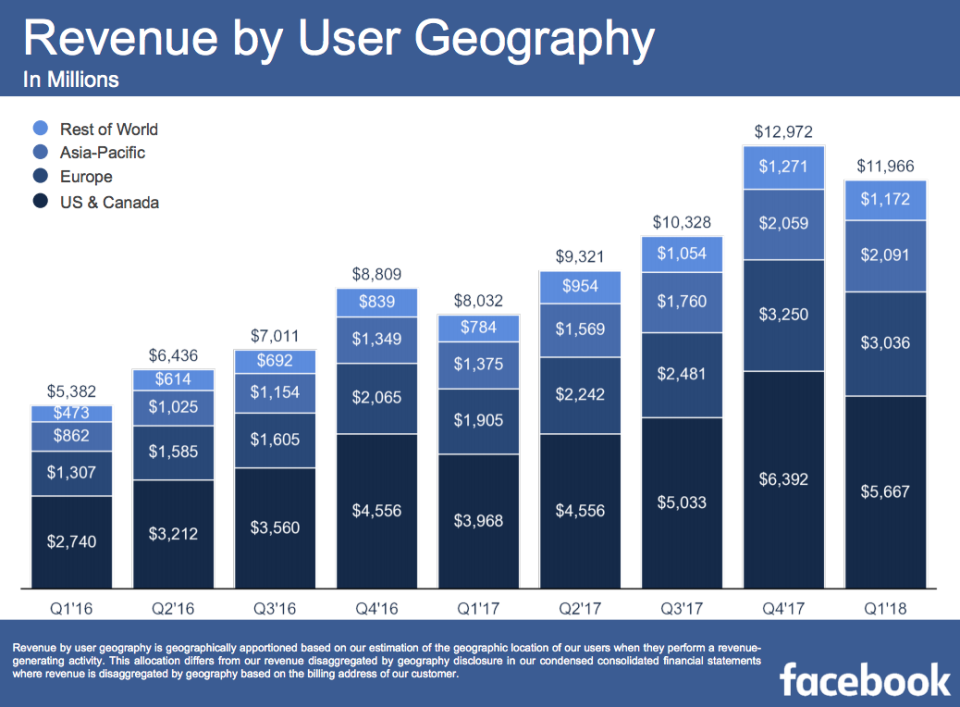

The fine totals about 7 minutes worth of the Facebook’s revenue.

The fine was so small because the company violated a 1998 data protection law that capped penalties at 500,000 pounds. Under the newly-passed General Data Protection Regulation (GDPR) regulations that took effect in Europe in May, however, the company’s maximum penalty would’ve been up to 4% of annual global revenue, or around 1.4 billion pounds. Not nothing, but still not the kind of financial penalty that would cause much more than a quarter of analysts “looking through” a one-time charge that impacts GAAP profitability.

And, as regulators increasingly look to take on big tech companies like Facebook and Google, more regulation will entrench these companies’ dominant positions in the online advertising industry. Which means that rules aimed at reining in tech giants will merely ensure their dominance in markets lawmakers already think the companies have too much control over.

“As history has shown, we believe that regulation will embolden the incumbents and increase their market share at the expense of smaller tech firms,” said Mark Kelley, an analyst at Nomura Instinet in a note to clients on Tuesday.

“We draw comparisons to the financial services sector post Dodd-Frank, where there has been a clear decline in new banks formed as regulation created higher barriers to entry, likely the result of the outsized impact of compliance costs on smaller banks versus that of larger institutions.”

Kelley cites data from the Minneapolis Fed that shows reported compliance costs at banks with less than $100 million in assets pose a burden that is four times that faced by banks with between $1 and $10 billion in assets.

“This disparity in the financial burden of compliance would likely be replicated in the tech sector, punishing smaller firms and reducing competition to the benefit of the incumbents,” Kelley writes.

“With this as a backdrop, we believe the big players such as Facebook and Google are best positioned to handle the heightened operating costs from regulation and will also benefit from increased barriers to entry.”

The fine levied against Facebook this week — which could be potentially fatal to a tech startup that runs afoul of regulations — illustrates the extent to which tech’s biggest players can swat away regulatory action.

Kelley and his team also think that worries over GDPR regulations neutering the ability for websites to track users’ activity online are overblown.

“Anyone on the internet can go to an EU website to see what the new cookie disclaimers and privacy policy notices look like now that GDPR is in effect,” Kelley said.

“In our opinion, to an unsuspecting consumer (which is likely the majority of consumers), clicking ‘okay’ to the new cookie use policy — which grants the site permission to collect data to be used for tracking purposes — doesn’t look much different than what it looked like in a pre-GDPR environment, if at all.”

Kelley’s note marked the firm’s initiation of coverage on the U.S. internet sector, with the firm putting Buy ratings on shares of both Facebook and Google’s parent company Alphabet (GOOGL).

“Overall, we think there is still some room for growth in digital advertising for the foreseeable future — led primarily by digital video and social (and TV budgets making the transition to digital), and primarily on mobile devices,” Kelley writes.

“As a result of slowing user growth and already high internet penetration, the growth will likely be led by pricing, rather than volume, and the consistent shift away from offline to online media.”

And to the benefit of Facebook and Google.

—

Myles Udland is a writer at Yahoo Finance. Follow him on Twitter @MylesUdland