The real reason millennials can't afford to buy a home

Your daily coffee break may be the reason you can’t afford to buy a home.

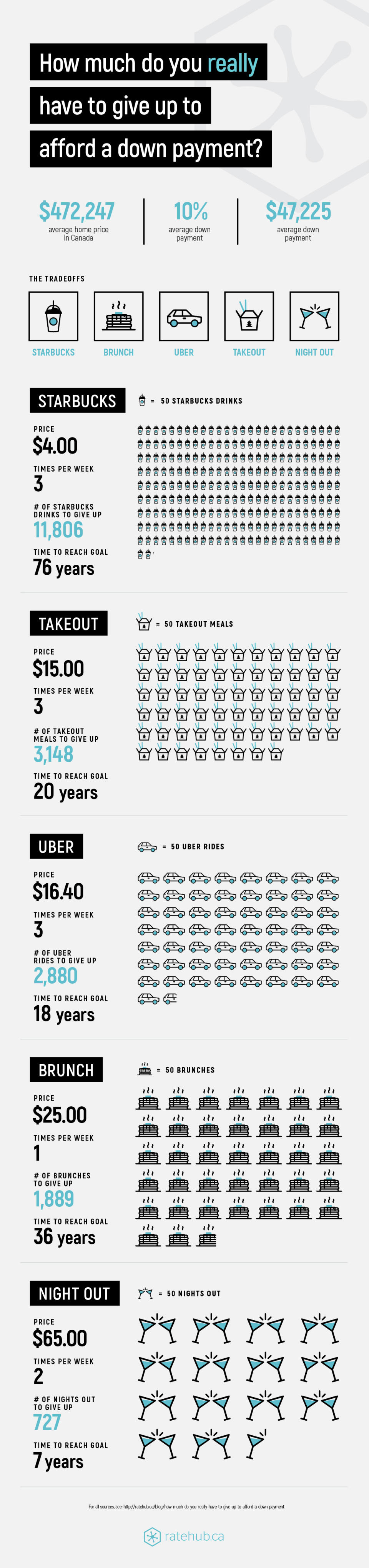

According to mortgage rate comparison site Ratehub, millennials overwhelmingly embrace comfort and convenience over financial prudence. With the average price of a home in Canada at $472,247 in August with an average 10 per cent down payment of $47,225, Generation Y will have to give up a significant number of creature comforts to meet any home-owning aspirations. A combination of these small but significant steps could bring you much closer.

Stop speaking Starbucks

Yes, it’s so funny when they misspell your name on the cup and such a time-saver when you order ahead on the mobile app. But if you spend an average of $4 on some kind of lactose-free no-whip half-caff concoction three times a week, that’s 11,806 drinks you’ll have to do without if you want to buy a property. Drink whatever’s free in your office and you’ll have enough for your downpayment in just 76 years.

Buy groceries and a cookbook

Too tired to cook? This may change your mind: If you get a $15 takeout meal only three times a week, you’ll have to give up 3,148 meals (cooking at home for 20 years) to reach your down payment goal. That shrimp pad thai isn’t so tasty now, is it?

Take the subway or walk — or stay home

All those late-night Uber requests add up. If you take a $16.40 ride just three times at week, you’ll need to give up 2,880 of those by taking public transit for 18 years to reach your goal.

It’s not just avocado toast

Millennials love brunch. Their wallets, not so much. If you head out for brunch every Sunday and spend $25, you’ll have to forego 1,889 brunches for a down payment. That means eating brunch at home for 36 years.

Party’s over

Heading out for some drinks on a Friday or Saturday night out is great, but is anyone really aware of how much it adds up to? Ratehub estimates that on an average night you’ll spend at least $65 on drinks, cover charge, cab, and food. That means staying in for 727 nights to reach the down-payment goal. If you’re going out twice a week, it means you’ll have to stay home every weekend — both nights — for seven years.

The main takeaways from the Ratehub.ca study are 1) stop blaming avocado toast, and 2) scaling back even slightly on these non-essential spends can bolster any savings account — because a down payment is only a fraction of the complete cost of home ownership.

Download the Yahoo Finance app, available for Apple and Android.

Yahoo Finance

Yahoo Finance