Stock market multiples tell you almost nothing about the next year's returns

The price-to-earnings (P/E) ratio is the most basic and most popular measure of value in the stock market. And unfortunately, it is a disaster when it comes to signaling what the stock market will do in the near term.

For the S&P 500 (^GSPC), you calculate the P/E by taking the price of the index and then dividing it by earnings. If the P/E is above the long-run average, then you could argue that the market is expensive. If it’s below, then you could argue the market is cheap. Importantly, prices don’t necessarily have to fall for the P/E to fall — they just have to rise at a slower pace than earnings.

Currently, the S&P 500 is trading at a forward P/E of around 17.7. According to Factset, this is significantly higher than the 5-year average of 15.3 and the 10-year average of 14.0. In other words, the market looks expensive.

Does this mean the stock market is doomed to tumble in the next year? No.

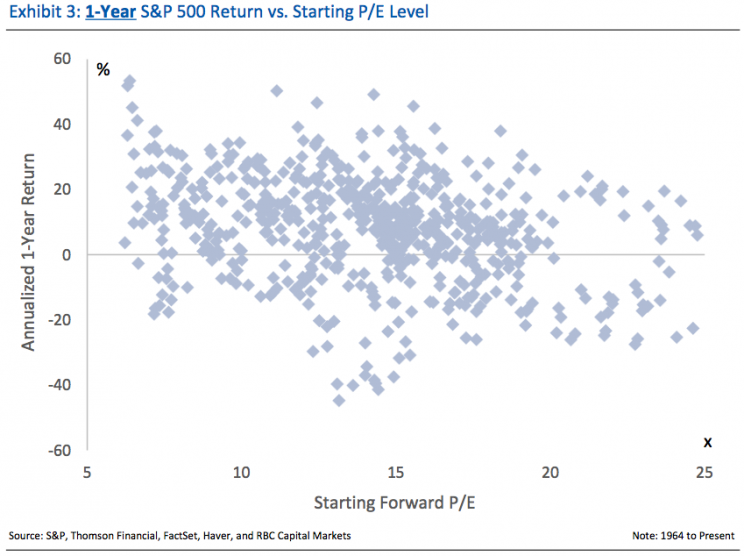

In a new research note to clients, RBC’s Jonathan Golub demonstrates to clients that P/E levels are terrible at predicting the next year’s worth of returns. This is illustrated by the chaotic dot-plot below, which shows that high valuations can be followed by both significant gains or losses in the next year.

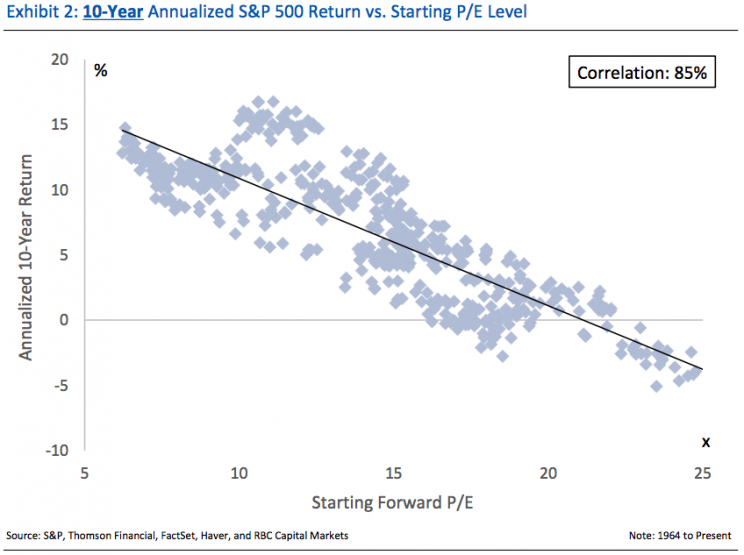

However, P/E ratios aren’t totally useless. This same dot plot takes on a different shape when you extend the time horizon.

“There is a very strong relationship between the level of P/Es and returns of the subsequent 10 years,” Golub wrote. “This relationship carries an 85% correlation.”

As you can see in the chart below, a low P/E (left) is typically followed by higher longer-term returns. On the other hand, a high P/E (right) is typically followed by low returns or losses over a long-term period.

A chorus of experts ranging from billionaire Warren Buffett to Nobel prize winner Robert Shiller have been warning against making short-term investment decisions based on the P/E multiples alone.

“[M]any investors are ringing alarm bells that valuations are problematically stretched, highlighting the risks of a pullback,” Golub said, noting that they are also pointing to a turn in economic data.

To those investors, Golub offers two responses: 1) valuations are not good at predicting the short-term direction of the market, and 2) valuations are being driven by earnings growth, not economic growth.

And earnings growth has been robust.

–

Sam Ro is managing editor at Yahoo Finance.

Read more: