How we predicted Express's big earnings beat

Andy Swan is co-founder of LikeFolio, a company that provides social-media data to investors.

A little over a month ago we asked the question, “Is Express ready for a turnaround?”

On Wednesday, the company (EXPR) announced better than expected sales and earnings numbers, with its e-commerce division posting a very significant 28% increase in e-commerce sales. At the opening bell on Thursday, the stock was trading roughly 20% higher than it was on Tuesday as Wall Street rallied around this refreshing news from the retail sector.

This turnaround was unexpected by most on Wall Street, as several sources had predicted poor numbers for Express. In fact, as recently as June 1, the retailer’s shares sank on a disappointing first-quarter report. Since that report, industry insiders have been warning investors of slowing customer traffic and predictions of mall closures. Express stock had declined more than 50% during the past 12 months and was down over 40% for the year to date period. Not good.

Given all this negativity, how did we know that things were actually looking up at Express?

Our company, LikeFolio, uses Twitter (TWTR) data to discover insights into consumer behaviors. For Express, all of those insights lined up into a really great comeback story!

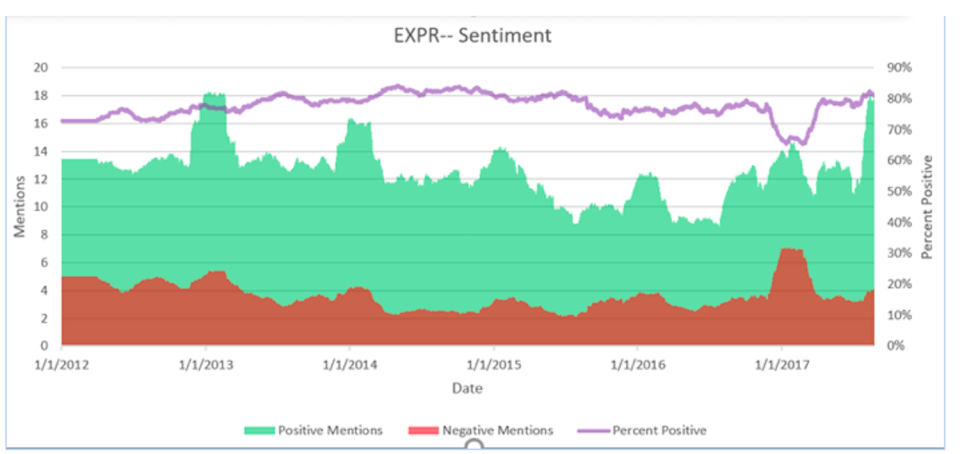

Consumer happiness has been improving significantly over the past month or two. This is a very powerful predictor of spending behavior, especially in retail fashion, where being on-trend is the name of the game.

As you can see from the chart above, Express is now back to levels of consumer happiness not seen since almost a full year ago. But that’s not all of the story..

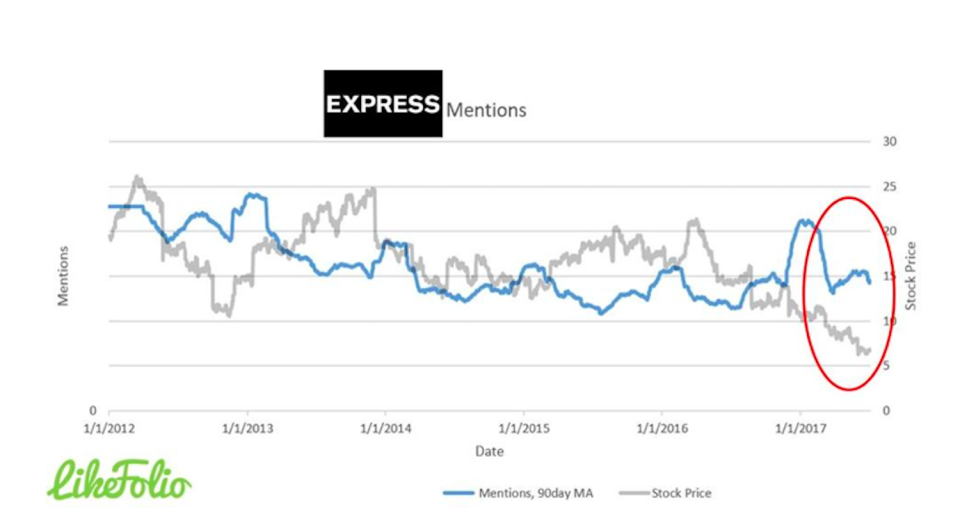

2. Mentions of Express stores and product lines have been surging lately, creating a significant divergence opportunity with the stock, which was trading at multi-year lows…

Consumer mentions of Express brands were popping higher as the stock fell, as you can see highlighted with the red circle. On Wednesday, the earnings report from Express confirmed that consumers were indeed doing more shopping at Express, and were happier while doing it.

That’s how turnaround stories begin.

Following social data for clues in consumer-trends allows investors in companies like Express to understand the overall satisfaction and enthusiasm of consumers on Main Street, before those trends start making headlines on Wall Street.

We’ll keep watching the social data on Express to see if this is simply a momentary bounce for the retailer, or if this turnaround story has staying power.

More from Andy Swan:

These 2 companies could be bucking the devastating retail trend

How we predicted Chipotle’s warning to investors — and what’s coming next

Here’s evidence the Weight Watchers comeback is truly under way