Pay by the gallon or the mile? As more EVs hit NC roads, officials study funding options

As drivers waited in the long vehicle line for the free ferry between Hatteras and Ocracoke islands, several gathered together and muttered about the price of gasoline.

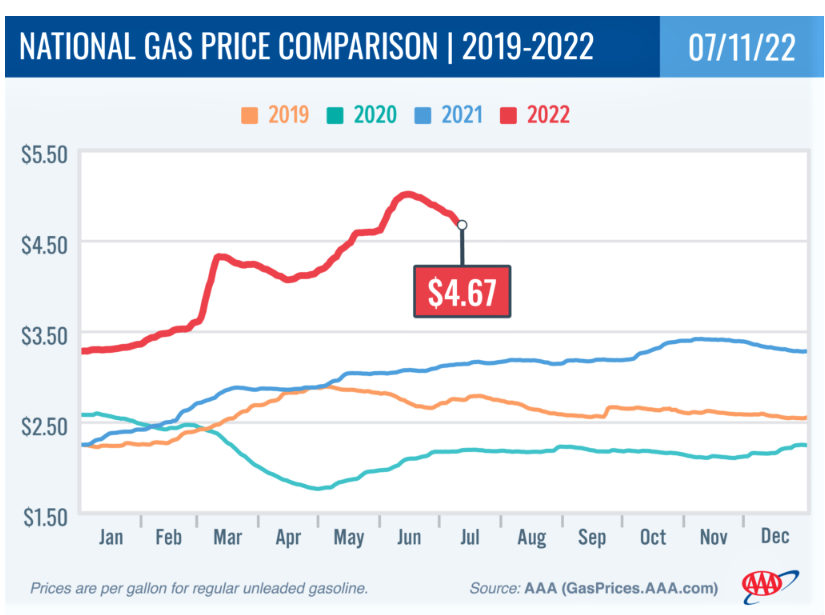

Although having fallen back a bit in recent weeks, the price was still pushing $4.50 a gallon at many of the stations that dot the Outer Banks. As a vacation hot spot and a place that's notoriously hard to get to for both visitors and suppliers, seeing higher prices than those found on the North Carolina mainland isn't a surprise.

But Bobby Johnson, wrapping up his week-long holiday at one of Cape Hatteras National Seashore's campgrounds, wasn't complaining.

NC's dirty secret: Vehicles account for more greenhouse gas emissions than power plants

"I don't really pay much attention to gas prices anymore," said the Piedmont resident as he leaned against his Tesla electric vehicle under the blazing mid-July sun. "It's not a concern of mine these days."

For state officials, though, that's a problem. Not the price of gas, per se, but that the tax revenue from selling gas isn't going as far as it used to in North Carolina because more people — like Johnson — are either driving electric vehicles that don't use gas or getting behind the wheel of newer vehicles that get a whole lot more miles to the gallon that older gas guzzlers. According to the U.S. Department of Transportation, the average fuel economy of the U.S. 2021 vehicle fleet was 36 miles per gallon (mpg), with new standards increasing that 33 percent by 2026. It was 24 mpg in 2000.

While that's great for the environment and the battle against climate change, since greenhouse gas emissions from vehicle tailpipes are now the state's top pollution source, it isn't such a rosy picture for the bottom line of the N.C. Department of Transportation (DOT).

The state gas tax of 38.5 cents per gallon generates nearly $1.8 billion a year for the DOT and is the department's largest revenue generator. The federal gas tax of 18.5 cents, along with a slightly higher tax on diesel, is the primary source of the more than $1 billion a year in federal funding North Carolina receives from the federal government.

But the gas tax hasn't kept up with inflation or rising costs at the pump, and politicians are loathe to raise taxes in general and gas taxes in particular since gas prices are so visible and the tax impacts almost everyone on a daily basis. Congress, for example, hasn't raised the federal gas tax since 1993, and the nonprofit Tax Foundation states that in real terms the tax has lost half of its value since then because it isn't indexed for inflation.

The decline in gas tax revenue comes even as more vehicles crowd North Carolina's roads and highways as the Tar Heel State continues to be one of the fastest-growing states in the country. Urban sprawl is also fueling the need to keep adding to and improving the state's road network, and North Carolina's airports, ports, ferries, and transit systems also rely on the DOT for some or all of their funding. Costs in general, from acquiring land to hiring labor to secure materials, also are on an upward trajectory.

More news: These 4 Brunswick County towns are among the fastest growing in North Carolina

That increasing need for transportation funding coupled with a gas tax that isn't keeping up with costs, however, hasn't stopped politicians from a number of states — including North Carolina — and even President Joe Biden from proposing "gas tax holidays" or driver refunds this summer as prices at the pump topped $6 a gallon in some places.

New revenue stream

While those gas tax suspensions would only be short-term fixes for consumers, and more funding headaches for transportation agencies, North Carolina officials are looking at long-term funding alternatives to help the DOT as fossil fuel-powered cars become increasingly outdated as the electric vehicle revolution gathers momentum.

Legislators took an important step in that direction this month when tweaks to the 2022-23 state budget included plans to redirect 2% of the state sales tax revenue to the DOT. That amount would increase to 4% in 2023-24, and 6% in subsequent years.

The move comes after several studies last decade, including one by N.C. Chamber, found that numerous states use sales tax revenue to boost their transportation funding.

NC Go, a coalition of groups that supports increased transportation spending and infrastructure, also endorsed the move.

"This is the time for creative solutions," the group stated in a release. "N.C.'s Motor Fuels Tax will not be a sustainable source of revenue in the future, with more hybrid and electric vehicles on our roads — and with the vehicle, fuel-efficiency increasing overall. Inflation is driving up the costs for asphalt, diesel fuel, concrete, steel, and labor — and is busting transportation project budgets. And, after years of storms ravaging our transportation network, projects must be designed and built to be resilient against damage, a requirement that is further driving up costs by 10-50%."

But while gas tax revenue is declining, it isn't likely to fall off a cliff — at least in the short term. Zero-emission vehicles still account for fewer than 50,000 of the nearly 8.7 million vehicles on North Carolina's roads, although Gov. Roy Cooper in January announced plans to boost that number to at least 1.25 million by 2030.

That could buy state officials time to look at more far-reaching funding options.

'Antiquated' funding system

The move to transfer sales tax revenue from the state's general fund to the DOT generally drew bipartisan support in Raleigh, since it didn't include a new tax or fee and could be done while North Carolina is enjoying a substantial budget surplus.

But state officials are also exploring a much more revolutionary concept: Instead of paying by the gallon to support North Carolina's transportation infrastructure, what if drivers paid by the mile?

North Carolina is one of a number of states that are studying the concept and is participating in a pilot program to engage interested drivers so they can see what they'd pay under a proposed mileage-based user fee approach.

For supporters of a pay-as-you-go system, it's seen as a great equalizer, making sure everyone pays the same amount for using the roads no matter how their vehicle is powered. It also reflects the future of driving, which increasingly include non-gas-powered and even autonomous vehicles. North Carolina owners of electric vehicles currently pay an annual fee of $140 to compensate for not paying state gas taxes.

"Technology is changing so much in our field, but the gas tax is an antiquated, 100-year-old way we're using to fund our transportation system," said Patricia Hendren, executive director of the Eastern Transportation Coalition, which is heading the pilot program.

But getting politicians and, more importantly, drivers on board for such a massive change isn't going to be easy.

POWER OUTAGE: How to keep the lights on in the future: Duke, environmentalists jostle over future grid

Hendren said most drivers think the nation's transportation system, albeit with some warts and potholes here and there, functions well — even if they're unsure exactly how it's funded or what their personal contribution to maintaining it is or how it's generated.

"We take it for granted, and that means most of us don't realize the current funding model is unsustainable," she said.

An earlier study and pilot program by the coalition looking at how a mileage-based pay system would work in North Carolina found rural drivers could save up to $17 a year, partly because urban drivers would shoulder more of the funding load because cities are where more electric and fuel-efficient vehicles are found.

Hendren said robust personal security protections, including offering drivers a non-GPS way to record their mileage, also helped reduce participants' concerns over privacy from 52% before the program started to just 7% after the pilot wrapped up.

"It's not the NCDOT in your car," she stressed.

But with 50 states that often don't see eye to eye and are jealous of protecting their legal turf along with a trucking industry — already one of the highway system's biggest users and payers — that's wary of even more federal or state bureaucratic red tape being placed on them, Hendren knows change likely won't be easy or quick.

But she said the concept that you should pay less if you use something less is one that resonates with a lot of people.

"Let's see if we can set up our transportation funding mechanism to mirror that," Hendren said.

Want to participate in the mileage-based user fee pilot program or just learn more about it? Visit https://tetcoalitionmbuf.org/landing-page-nc

Reporter Gareth McGrath can be reached at GMcGrath@Gannett.com or @GarethMcGrathSN on Twitter. This story was produced with financial support from 1Earth Fund and the Prentice Foundation. The USA TODAY Network maintains full editorial control of the work.

This article originally appeared on Wilmington StarNews: NC explores new road funding sources as gas tax revenue dries up