Paramount to Report Earnings After Sale Speculation

Paramount Global, facing increased risk of a possible credit downgrade and persistent chatter about being sold, will provide a financial update to Wall Street on Wednesday after the bell.

Like its competitors, the media conglomerate is struggling to scale and make its streaming business profitable as it looks to offset a declining linear television business. But its financial picture has become more strained after being placed on a negative credit watch by the ratings agency S&P Global last week.

Analysts surveyed by Zacks Investment Research expect Paramount to report a fourth-quarter 2023 earnings loss of five cents per share on revenue of $7.78 billion.

As of Tuesday’s close, Paramount had a market capitalization of $7.7 billion and debt of around $15 billion. Its stock price has fallen 47% in the past year, 23% in the last six months and about 21% year to date.

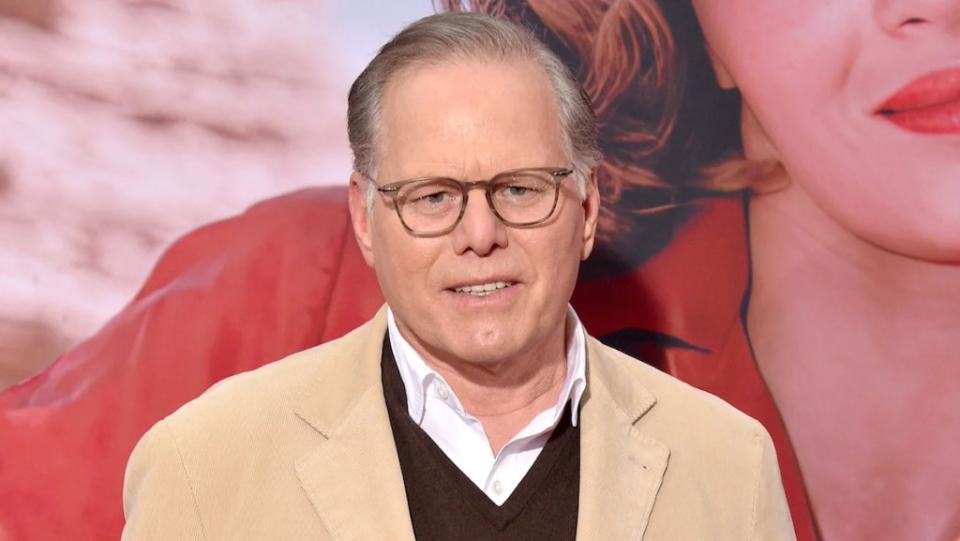

When Paramount Global CEO Bob Bakish talks to Wall Street, he’s going to have to “basically chew gum and juggle at the same time,” Moody’s Investor Service senior vice president Neil Begley told TheWrap.

Bakish will need to show signs that Paramount’s subscriptions and revenues are continuing to grow, while also demonstrating that EBITDA and free cash flow are improving and that the company is reducing its debt from the six times leverage level at mid-year 2023, Begley said. He added that Paramount needs to lay out what other alternatives it has to “rapidly improve its margins,” such as potential asset sales.

Paramount could field questions on a number topics during its earnings call with analysts, including interest from potential buyers, its debt reduction efforts, its dwindling linear business, its timeline for streaming profitability and its ability to generate cash flow outside of the impacts from the Hollywood strikes.

The company, which has a total of 63.4 million subscribers in its direct-to-consumer division, anticipates full year losses for the segment to be lower than 2022, with the fourth quarter of 2023 similar to the year-ago period. But a timeline for breakeven currently remains unclear.

“Paramount’s lower streaming losses are a testament to its strong execution, lending credence to a positive outlook for 2024, but prospects may dim beyond that,” Bloomberg Intelligence analyst Geetha Ranganathan said in a recent note to clients. “Cost cuts and price increases suggest a substantial improvement in the profit trajectory, with total adjusted EBITDA projected to rise 17%. That won’t be enough, as a lack of scale and heavy linear-TV exposure weigh on the future outlook.”

Ranganathan expects 2023 streaming losses to hit $1.7 billion, down slightly from $1.8 billion in 2022, and to ease to around $1 billion in 2024.

Negative Credit Watch

S&P ratings director Jawad Hussain said in a statement that Paramount’s cash flow metrics are weaker than its similarly rated peers due to “its smaller scale, less business diversification, and slower DTC [direct to consumer] ramp up,” resulting in negative free operating cash flow in 2022 and the firm’s expectation of “minimal” free operating cash flow in 2023.

He noted that S&P could lower the company’s current BBB- rating if Paramount’s adjusted leverage remains above 3.5 times or if free operating cash flow/debt remains below 10%. The firm currently anticipates that Paramount’s free operating cash flow and debt will improve about 5% in 2024, and 7% to 8% in 2025, remaining below the 10% threshold it set for the rating.

Hussain said S&P will make a determination in the next several weeks, incorporating the upcoming earnings results into its analysis.

Paramount, which reported $377 million in free cash flow during the third quarter, said it expects strong free cash flow during the fourth quarter, citing the strike’s impact on the production of content. It added it would sustain programming changes made in response to the strike, resulting in lower steady-state production spend and improved cash flow in 2023 and 2024, which will also benefit its debt level.

Sale Speculation

While Paramount has signaled that it could consider a sale, it remains unclear that there’s a buyer interested in the whole company or that a deal could even be done in the current regulatory and macroeconomic environment.

To set itself up for a possible sale, Paramount has filed a change-of-control and severance protection plan for executives, also known as a golden parachute. Experts have previously told TheWrap that they see Paramount ultimately being sold off in pieces.

On Tuesday, CNBC reported that Warner Bros. Discovery was halting talks about a potential merger with Paramount after Bakish and WBD CEO David Zaslav met in December.

The decision comes after WBD shares tanked 13% on Friday after the company posted a wider-than-expected quarterly earnings-per-share loss of 11 cents and a 6.6% decrease in quarterly revenue to $10.28 billion. The company declined to provide detailed financial guidance for 2024 while acknowledging struggles in its linear networks and studios businesses.

“We do have the optionality of looking at other assets. But it’s going to be a very high bar for us,” Zaslav told analysts when asked about M&A. “We like our hand where it is and we like the particular strategy right now of building Max and really deploying all of our great creative assets.”

Morningstar analyst Matthew Dolgin told TheWrap that the halt in talks is “not overly surprising” given the companies’ respective financial positions.

“The pairing of the two companies could make sense, but the distraction, financial details, and prolonged process to try to get it through may be more than the companies can withstand or focus on right now,” Dolgin said.

Other potential buyers include Skydance Media, which has reportedly made a preliminary offer to acquire controlling shareholder National Amusements to take control of Paramount and is doing due diligence on a potential transaction; and Allen Media Group founder Byron Allen, who has placed a $30 billion bid, including the assumption of debt, to buy Paramount for $28.58 per voting share and $21.53 per non-voting share.

Neither party appears interested in keeping the company’s whole portfolio, which includes Paramount Pictures, streaming platform Paramount+, CBS and linear networks including Comedy Central and Nickelodeon. Wall Street is also skeptical of Allen’s ability to put together financing.

Despite the chatter, LightShed Partners analyst Rich Greenfield wrote in a blog post that he remains skeptical about a potential deal actually happening “until there is greater clarity around [Paramount’s] renewals with major distributors” such as Charter Communications and Dish.

He previously called on Paramount to scale back its investment in Paramount+ and has since cited the “risk to distribution renewals” as the reason why.

“Unfortunately, Paramount has not listened to us and they are now heading for a very difficult 2024,” he added.

Bakish has pushed back against the sale speculation, emphasizing that the company is focused on creating shareholder value. In a memo in January, he said Paramount would drive earnings growth in 2024 by cutting back on content production, leveraging content licensing and laying off employees.

“We’re a storied public company in a closely followed industry,” the CEO said.“But I have always believed the best thing we can do is concentrate on what we can control — execution. Leaning into what’s working, while continually adjusting to current realities.”

The post Paramount to Report Earnings After Sale Speculation appeared first on TheWrap.