What Paramount+’s Recent Content Cuts Mean for Subscribers | Chart

Following the lead of Max, Disney+ and Hulu, Paramount+ has announced it would cut a raft of shows and movies. Perhaps the most surprising of these was “Grease: Rise of the Pink Ladies,” which just had its finale on June 1. Within weeks of the season’s end, Paramount announced that the show was not only canceled but would be removed from Paramount+ entirely.

The musical comedy, a prequel to the original “Grease” movie, premiered on April 6 and struggled to take off until its final weeks when it reached its highest levels of demand, according to Parrot Analytics‘ data, which takes into account consumer research, streaming, downloads and social media, among other engagement. It peaked at 20 times the average series demand the day after its finale. Unfortunately for fans of the show, it won’t get a longer runway to make further inroads with audiences.

Also Read:

Lionsgate’s ‘John Wick’ Tops the Most In-Demand Movies of 2023 So Far | Charts

Another surprise among the list of shows being cut was “Star Trek: Prodigy.” Paramount+ has built a reputation as the home for all things “Star Trek” and, given the many other “Star Trek” series that remain on the service and form an important pillar of what it has to offer subscribers, it’s hard to imagine that there is a more logical home for this show. The last time we measured the relative contribution of “Star Trek” to its online home, the franchise accounted for nearly a third of demand for all Paramount+ originals.

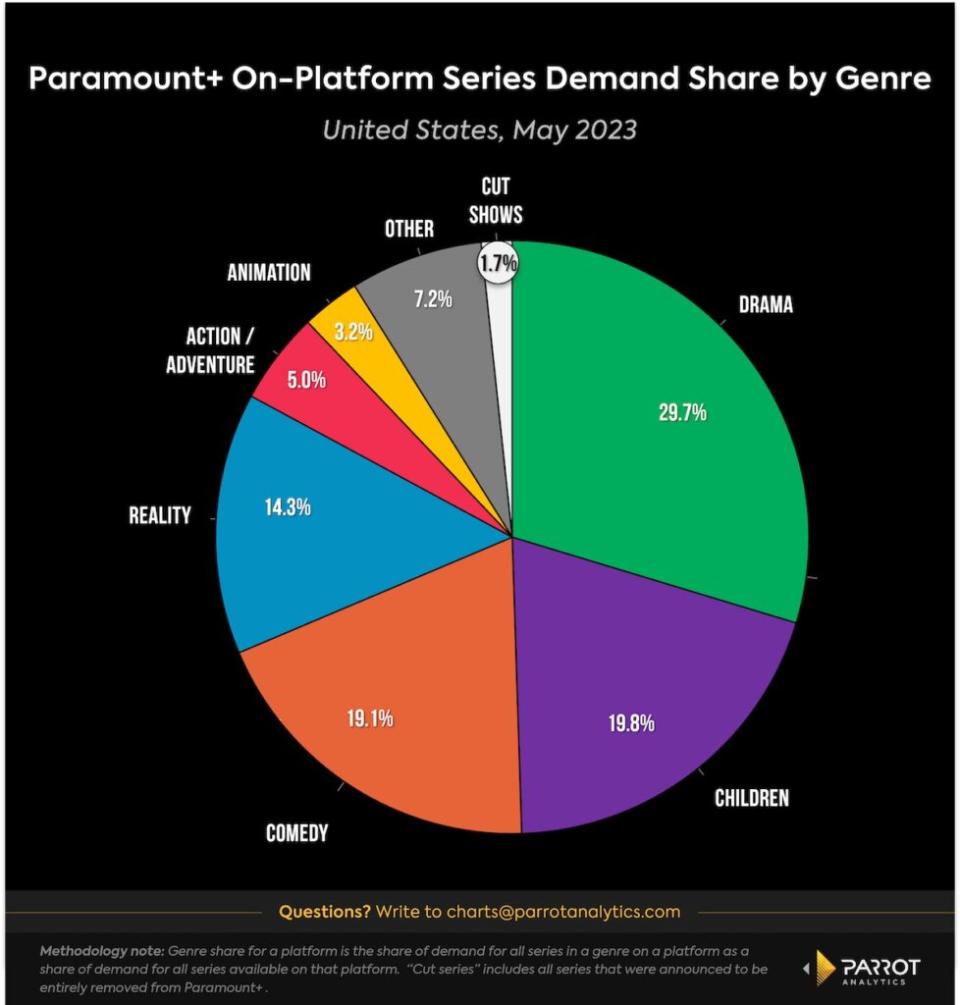

We measured the impact of these cuts to the demand for content on Paramount+. The removal of “Grease: Rise of the Pink Ladies,” “Star Trek: Prodigy” and other shows amounts to cutting 1.7% of the total demand for all shows on Paramount+ as of May. This is not a huge dent to the catalog but to put it in perspective, collectively these shows attracted more demand than “RuPaul’s Drag Race,” the second most in-demand show on Paramount+ in May.

As a point of comparison, when we measured the impact of Max’s first round of cuts last year they amounted to 2.1% of the total demand for shows on that service (about the scale of removing “Game of Thrones” from Max). When Disney+ announced cuts to its lineup recently, the more than 30 titles removed made up 1.9% of demand for all shows and movies on the service. This means that the recent cuts to Paramount+ are slightly less drastic than those made by other streamers.

What is behind the cuts being made by streaming services? Hollywood’s renewed focus on profit margins is driving belt-tightening moves. Paramount as well as other companies that have made cuts may be able to claim a tax write-off. Since streamers still have to pay licensing fees to keep content available, removing shows can help cut back on costs. Finally, there is financial potential in licensing these shows to another service, as Warner Bros. Discovery did with “Westworld” and “The Nevers” after removing them from Max.

While recent cost-saving moves like this rarely seem consumer-friendly, it provides an opportunity for streamers to make sure they are laser-focused on either serving their existing audience or attracting new users. In many cases, the shows being taken off a service might be a better fit for another streaming home. There is certainly no shortage of services that would be happy to pick up new content, whether that is a FAST service (free ad-supported streaming TV) looking to monetize content in a different way or another SVOD (subscription video on demand) altogether, as we saw when Warner Bros. Discovery licensed some HBO shows to Netflix.

Christofer Hamilton is a senior insights analyst at Parrot Analytics, a WrapPRO partner. For more from Parrot Analytics, visit the Data and Analysis Hub.

Also Read:

20 HBO and Max Shows That Warner Bros. Discovery Should License to Netflix | Chart