Paramount CFO: Streaming Content Spending Could Come in Below $6B Target In 2024

- Oops!Something went wrong.Please try again later.

Paramount Global CFO Naveen Chopra signaled during an investor conference on Feb. 28 that the entertainment giant could spend less on streaming content in 2024 than previously forecast due to the integration of Paramount+ and Showtime. He also touted the opportunity to “reinvigorate the Showtime content slate” and the Paramount studio’s “killer movie slate” this year.

Speaking at the Deutsche Bank Media, Internet and Telecom Conference in Palm Beach, Fla. in a session that was webcast, he was asked about the studio lineup for the current year. “It’s a killer slate,” he said, adding that it looked even better than the one that delivered a strong 2022, led by Top Gun: Maverick. The slate includes new Mission: Impossible, Transformers, Teenage Mutant Ninja Turtles and Paw Patrol movies, as well as Dungeons & Dragons: Honor Among Thieves.

More from The Hollywood Reporter

'South Park' Licensing Deal Sparks Lawsuit From Warner Bros. Discovery Against Paramount Global

Paramount Earnings: Why Cash, Not Just Content, Is King for Wall Street

The Paramount CFO also touted early success in streaming. “We have added more subscribers on an absolute basis than any other major streaming service,” he said about the first two years of Paramount+, touting its “very powerful consumer value proposition that is content-driven.”

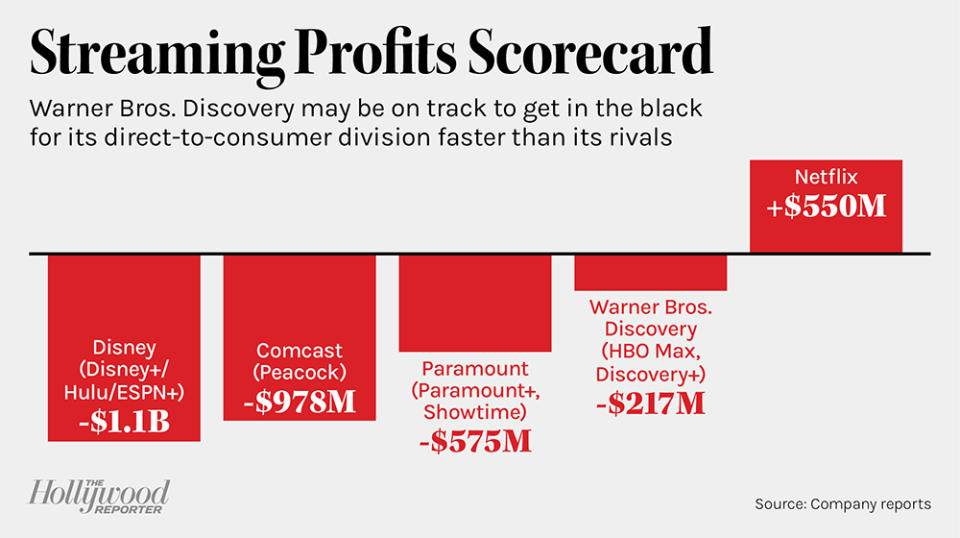

Management’s is now focused on “starting to deliver on the path to profitability of streaming,” he emphasized, reiterating that 2023 will be the peak year in streaming investment. The expense side includes such opportunities as integrating Paramount+ and Showtime and marketing spending, he said.

Asked why Paramount was ahead of the curve in monetizing content across platforms, including via licensing to third parties, and whether that would change now that others have followed that approach, Chopra signaled management would continue it. “We didn’t have the luxury of unlimited financial resources” to build a streaming service, he also explained. “Many folks have now woken up” with streaming profits having come into focus across the sector and Wall Street, the CFO added.

Chopra also cited other examples of different strategies in streaming that Paramount has stuck to, including not feeling it needs to have fully owned streamers in international markets, instead partnering with Comcast’s Sky on SkyShowtime in parts of Europe, for example. After all, rolling out one’s own streamer worldwide is “a very expensive proposition,” Chopra explained.

On Jan. 30, Paramount became the latest Hollywood conglomerate to revamp its streaming setup and strategy, unveiling a sweeping combination of the Paramount+ streaming service and Showtime. The move will bring changes to programming — originals like Kidding, Super Pumped and American Rust, among others, were removed from the Showtime platform — along with additional layoffs.

Executives later unveiled that the monthly subscription price for the rebranded streaming service Paramount+ with Showtime would rise in the third quarter and that company would take an impairment charge of $1.3 billion-$1.5 billion in the first quarter. The cost of the advertising-free premium streaming plan will rise from $9.99 per month for Paramount+ to $11.99 for Paramount+ with Showtime, while the essential plan with advertising will see a price hike from $4.99 a month to $5.99.

Asked about the Paramount+ and Showtime integration in the U.S., Chopra noted that this approach showed consumer and financial success in international markets. He also said that it will also allow the company to “reinvigorate the Showtime content slate, I mean it is a phenomenal studio.” For example, he touted “what we will be able to do with franchises like Dexter, Billions, Yellowjackets,” without sharing more details, “and then thinking about how we take some of the historical Showtime audiences and create new franchises for them I think is going to be really exciting.”

Both revenue upside from higher subscription fees and “significant” cost savings in the likes of content and marketing will help with the push to streaming profitability, Chopra added. “You need less content to program one streaming service” and less marketing spending, with a focus on more franchises, which “are more efficient,” also saving money.

Speaking of saving money, Chopra was asked about Paramount’s previous guidance for streaming 2024 streaming revenue of $9 billion and $6 billion in content spending. He said that the revenue side has been affected by advertising challenges, but Paramount+ has been ahead of targets, both in terms of subscriber and average revenue per user growth. He didn’t detail what all those trends could mean financially. “On the cost side of the equation, the integration of Paramount+ and Showtime does mean that I think we will spend less than we previously anticipated in [direct to consumer] content expenses,” Chopra said. “We haven’t issued any new guidance or updated” it.

The CFO was also asked about streaming price increases. Paramount+ has an “incredible value proposition” within the streaming space, he argued, adding the Showtime content and optimizing the overall content offering will further enhance that. “The risk in pricing is less about turnover,” he concluded. To continue getting more users in, the firm will look at various strategies, including annual price offers.

At the same Deutsche Bank event last year, Chopra had rejected the notion that the entertainment conglomerate doesn’t have enough hits and content firepower to succeed in the streaming space, saying: “There are a lot of companies out there [that] would love to have our portfolio of content and, importantly, well-known IP.”

Paramount recently reported that it ended 2022 with more than 77 million streaming subscribers worldwide, up from 67 million as of the end of September, as Paramount+ posted a record quarterly user gain to hit nearly 56 million customers, driven by such popular content as blockbuster movie Top Gun: Maverick. However, higher streaming investments were a drag on the entertainment company’s bottom line, and TV unit advertising sales dropped.