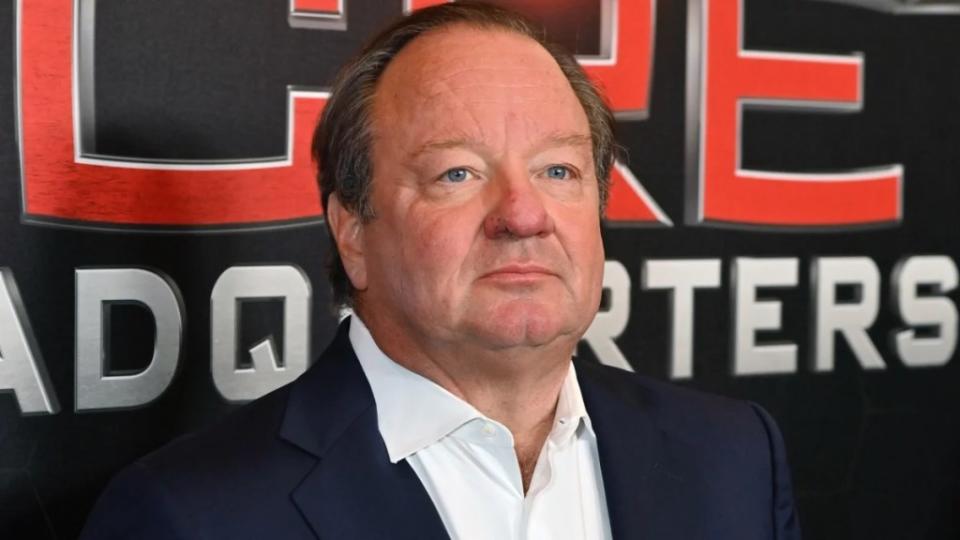

Paramount CEO Bob Bakish Steps Down

Paramount Global CEO Bob Bakish has officially stepped down from his role atop the company, the entertainment giant announced Monday. He will remain with the company as a senior advisor through Oct. 31 to help ensure a seamless transition of his duties.

Following Bakish’s departure from his role as CEO and from the board of directors, three senior executives will take leadership over Paramount Global moving forward: George Cheeks, CBS CEO and president; Chris McCarthy, Showtime/MTV Entertainment Studios and Paramount Media Networks CEO and president; and Brian Robbins, Paramount Pictures and Nickelodeon CEO and president.

“Paramount Global includes exceptional assets and we believe strongly in the future value creation potential of the company,” Paramount non-executive chair and controlling shareholder Shari Redstone said in a statement. “I have tremendous confidence in George, Chris and Brian. They have both the ability to develop and execute on a new strategic plan and to work together as true partners. I am extremely excited for what their combined leadership means for Paramount Global and for the opportunities that lie ahead.”

With the three execs operating as the newly formed Office of the CEO, Cheeks, McCarthy and Robbins are set to work closely with CFO Naveen Chopra and the board of directors to develop a comprehensive plan that would focus on leveraging Paramount’s popular content, strengthening its balance sheet and continuing to optimize the company’s streaming strategy.

“We’d like to thank Shari and the board for putting their trust in us. This new structure will allow us to continue leveraging the power of the entire company. Ours is a partnership built on respect, camaraderie and, most importantly, a shared love of Paramount Global, its employees and our world-class content,” the trio said in a memo to staff on Monday. “We also want to thank Bob for his leadership, many contributions and his support of our brands and businesses. We wish him well and much success in the days ahead.”

Bakish’s departure comes after the media conglomerate’s board met over the weekend to discuss the matter. Two insiders with knowledge of the discussions previously told TheWrap that the board was upset with the executive over his decision not to divest assets such as Showtime and BET Group and for not going far enough to cut costs.

Bakish joined Paramount Global predecessor Viacom in 1997, where he held a series of senior corporate, sales and development positions. In 2000, Viacom merged with CBS, but the two companies would later split in 2006. In 2016, he was named CEO of Viacom and three years later, Viacom and CBS would merge again to form ViacomCBS, which would later be renamed Paramount Global.

The decision coincided with Paramount’s release of its first-quarter earnings results for 2024 and comes amid merger talks between Paramount and David Ellison’s Skydance Media, with other suitors waiting in the wings. An individual familiar with negotiations previously told TheWrap that it is unlikely that a deal would be reached before the exclusivity window expires on May 3. It is unclear if that window will be extended.

“Today’s strong Q1 earnings [are] a direct reflection of your incredible hard work, and we ask that you continue to stay focused as we move into this next chapter. We know this has been a challenging time, and the days ahead may be equally challenging as we adapt and collaborate in new ways together. The work we will need to do together is important and will set us up best for long term success,” their memo continued. “Please know we will move forward with purpose, focus and passion on behalf of all our important stakeholders – all of you, our teams, our shareholders, creative partners, advertisers and distribution partners.”

The Office of the CEO said it would be in touch with more updates in the coming days, including information for an employee town hall.

Skydance, which is valued at over $4 billion, has been a coproducer with Paramount on projects such as “Top Gun: Maverick” and the “Mission: Impossible” franchise.

The two-step merger deal would see Ellison and Skydance acquire controlling shareholder Redstone’s majority stake through National Amusements, which owns 77.3% of Paramount Global’s Class A (voting) common stock and 5.2% of its Class B common stock. The two studios would then be merged together to create a combined company valued at around $5 billion.

The deal for Paramount must be approved by the board’s independent special committee. Earlier this month, Paramount revealed four board members would step down from their roles at the company’s annual meeting — including three who were on the special committee.

Multiple shareholders have expressed opposition to the Skydance deal, including Matrix Asset Advisors, Ariel Investments, Aspen Sky Trust and Blackwood Capital Management. They have called on the company to pursue competitive bidding negotiations, arguing that the Skydance deal prioritizes Redstone’s interests at the expense of the rest of Paramount’s shareholders and would be “detrimental” to the company’s market value.

Ariel’s founder and chairman John Rogers Jr. and GAMCO Investors Inc. chairman/CEO Mario Gabelli have both previously warned that they could pursue litigation if the Skydance deal or any other bid does not appropriately benefit their clients. Ariel owned a 1.8% stake as of December, while Gabelli owns 5 million shares of Paramount’s voting stock.

To assuage investors’ concerns, Skydance has submitted a revised offer that would include a cash infusion of $3 billion as well as a premium sweetener for a percentage of non-voting Class B shares. Redstone, who is already set to get a premium for her shares, could take less cash and keep more equity in Paramount under one scenario being discussed. She and National Amusements also agreed to give non-voting, minority shareholders say in the approval of any transaction.

In addition to Skydance, Apollo Global Management made a $26 billion bid for Paramount, which was reportedly rebuffed due to concerns around the financing of its bid. The private equity firm has since entered talks with Sony about potentially making a new joint bid, though no offer has formally been made.

In a memo to staff in January, Bakish said Paramount would prioritize driving earnings growth in 2024 and laid out a three-pronged strategy to drive revenue while managing costs. Efforts the company has taken thus far include producing fewer local originals, leveraging content licensing, consolidating some of its operations and laying off 800 employees.

During its fourth-quarter earnings call, Bakish said that the company’s direct-to-consumer division is on track to reach streaming profitability domestically in 2025. At the time, Paramount narrowed its streaming losses to $490 million and reported 67.5 million DTC subscribers. When asked about mergers and acquisitions during the call, Bakish said that he would not comment on speculation but emphasized that Paramount is “always looking for ways to create shareholder value.”

The post Paramount CEO Bob Bakish Steps Down appeared first on TheWrap.