In Their Own Words: Disney, FX, NBCU, Warner TV Execs Redefine Success in ‘Peaked TV’ Era

- Oops!Something went wrong.Please try again later.

As Hollywood entertainment companies wage war in the streaming era, the benchmarks for success are tougher to define.

At the 2024 Television Critics Association winter press tour which wrapped up last week, TV’s top executives told TheWrap that they were prioritizing profitability, cultural impact and high quality — instead of relying on traditional ratings.

“When it used to be linear television only, it would be very easy to look at your Nielsen overnight ratings among certain demographics,” National Geographic President Courteney Monroe told TheWrap. “Now you can look at hours streamed, episode continuation and travel ability, and all of those things are meaningful. It’s much more nuanced and complex.”

Lisa Katz, president of scripted content for NBCUniversal Entertainment, said: “To me, success is creating compelling and impactful shows that resonate with audiences across our platforms.”

TheWrap asked a half-dozen executives running television production and distribution how they measure success in this precarious time for the industry — as networks and platforms face consolidation, certain death or the privilege of being Netflix’s No. 2.

The answers — from leaders at Disney and its linear brands (including FX, ABC News and NatGeo), NBCU, Warner Bros, PBS, Paramount Global, Fox, Hallmark and more — varied. Some spoke of making themselves indispensable to their media conglomerate bosses; others talked about simply making their own rules.

“The reason that there’s not one metric right now is that the definition of success, depending on which company you’re dealing with, is a little bit different,” Hub Entertainment Research founder Jon Giegengack said during the TCA event. “As we see the huge number of streaming platforms now start to coalesce… that’s when we’ll start to see more commonality of metrics across them.”

Profitability is certainly a tangible measure of success, but most of the major streamers are unlikely to achieve that until the end of 2024 or sometime in 2025. Scale and engagement are also huge factors in a landscape marked by an overwhelming number of players.

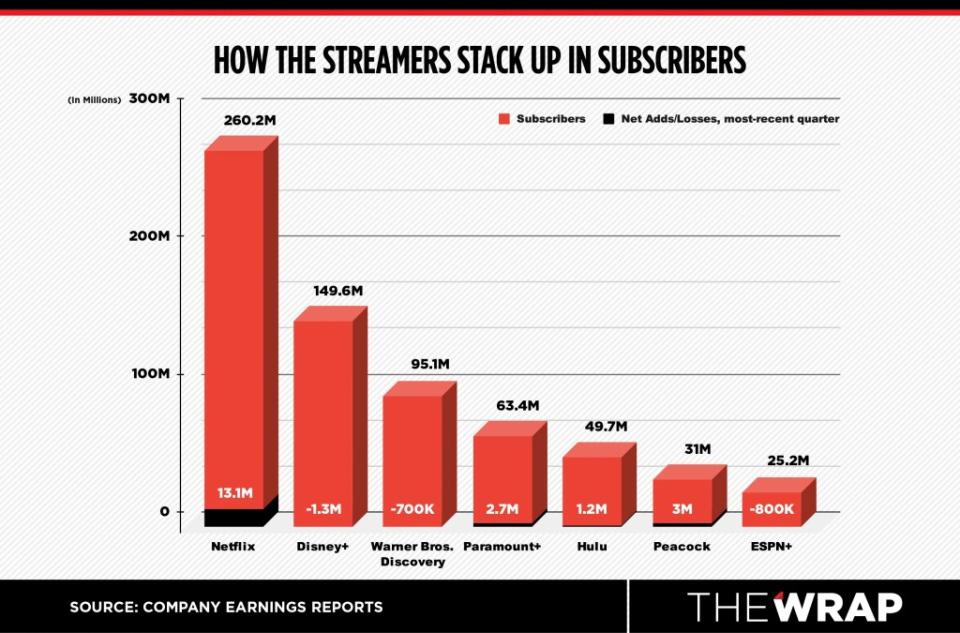

In terms of profitability, scale and engagement, Netflix is the reigning champion, boasting 260 million paid global subscribers who watch billions of minutes of content from the platform annually. The streamer recently released a comprehensive look at its viewership data for the first six months of 2023, a bold move that told competitors Netflix didn’t need to be so secretive anymore because it’s already so far ahead.

No other company is likely to want to replicate a viewership data dump “because it’ll show how much bigger Netflix’s scale is,” Giegengack said.

Representatives from Netflix, Amazon, Apple TV+ and Max declined to comment for this story. Representatives from Warner Bros. Discovery and AMC Networks did not respond to TheWrap’s request.

Below is a look at the common threads between them, and why others remain tight-lipped.

Viewership and engagement

According to Nielsen’s The Gauge, in January broadcast programming made up 24% of total TV viewership (with 28% of broadcasting’s share consisting of sports), while cable viewership accounted for 27.5% of the total.

Streaming still dominated with 36% of total TV viewership and one side effect of that dominance is that overnight Nielsen ratings are a less important piece of the puzzle. Broadcast and cable networks’ ratings reports now include multi-platform viewing as part of the total.

Streamers have become a potential lifeline for the brands behind the networks. “Disney+ is our contingency plan,” Monroe said. (Disney owns NatGeo.)

Even without ties to major streamers, linear networks like the CW, PBS and ABC News have implemented a multiplatform approach to “meet people where they want to be,” said PBS CEO Paula Kerger. While the CW’s broadcast network reaches 120 million households, per network entertainment president Brad Schwartz, it has garnered 100 million downloads for its streaming app.

Disney, NBCUniversal and Paramount Global have seen a viewership boost from their streaming arms, but they have struggled to come close to matching Netflix. Disney generated nearly 54 billion hours of TV viewing in 2023 across its U.S. linear networks and streaming platforms, Disney Television Group president Craig Erwich said. Netflix’s semi-annual data dump revealed the streamer tallied nearly 100 billion hours viewed worldwide from January to June.

Netflix measures its success through streaming viewership, as seen through its first data share in December and weekly top 10 audience reports. Its counterparts, by contrast, frequently shy away from sharing viewing metrics publicly. While no streamer has achieved the same level of data transparency, Max, Disney+, Paramount+, Peacock and Hulu release streaming figures surrounding major releases, especially multiplatform launches across linear and streaming.

Likewise, standalone streamers Prime Video and Apple TV+ have shifted their strategy on sharing viewing figures as they hone their audience. Prime Video inked a three-year deal with Nielsen in 2022 allowing the measurement company to report viewership for Thursday Night Football. And despite not releasing figures for hits like “Reacher” themselves, Nielsen’s weekly roundup of the top 10 streaming programs revealed the show hit 1.2 billion minutes during the week of Jan. 15.

Apple TV+ has avoided disclosing viewing figures, while still propping up recent releases like “Masters of the Air” for scoring the streamer’s biggest opening weekend ever — without providing any specific metrics.

Quality and impact

Television executives continue to promote quality as a key measure of success.

“Quality, not quantity is our strategy and we really measure ourselves by how well creatively realized our shows are,” Craig Erwich, president of Disney Television Group told TheWrap. That means engaging audiences across multiple generations, “from preschool to adulthood,” Ayo Davis, president of Disney Branded Television, told TheWrap at TCA.

Davis emphasized the importance of being able to connect with the consumer in whatever way they prefer, whether through Disney’s linear channels, which include Disney Junior and Disney Channel, its streaming vertical Disney+ or even through YouTube.

As we see the huge number of streaming platforms now start to coalesce… that’s when we’ll start to see more commonality of metrics across them.

Hub Entertainment Research founder Jon Giegengack

Mike Kelley, head of ABC News Studios, pointed to the content hub’s upcoming docuseries “Brats” as an example of the quality level the studio is chasing. “We’re trying to create conversations in the zeitgeist,” Kelley said.

During his executive session at TCA, FX chairman John Landgraf — who has overseen shows such as “Atlanta,” “Fargo” and “The Bear” — noted that in this competitive television landscape “we owe audiences a system that demands excellence and the best shows.”

Since Disney acquired FX Networks in 2019, it has become a “vitally important part of Hulu and a vitally important part of The Walt Disney Company’s streaming ambitions and their ecosystem,” Landgraf said, likening the network’s impact to that of Disney Animation, Disney Branded Television, ABC, Marvel, “Star Wars” and Hulu originals. “It’s a huge relief because we were a basic cable channel seven years ago and staring off the edge of a really steep downward cliff.”

FX-produced shows that air exclusively on Hulu include the Emmy-winning “The Bear” and critical darling “Reservation Dogs.” The streamer also benefits from airing FX original series after airing on linear, like Ryan Murphy’s “Feud” anthology and the upcoming historical epic “Shogun.”

Dedication to creative success also extends to the studio side. “It means continuing to work with the best creatives to develop the best shows, and then finding the right homes to give our shows the greatest chance for success,” Channing Dungey, Warner Bros. Television Group chairman and CEO, told TheWrap.

At the CW, which aspires to become a “Big Five” of broadcast, the focus is on creating a home for “must-have television.” The network is reaching into living rooms through its investments in live sports, and by building content to create “franchise nights.”

“It doesn’t happen overnight across the board, but you need to start establishing some bulwarks in this fragmented universe out here,” Dennis Miller, president of the CW, told TheWrap. “We have our own internal metrics about how shows perform, both sports and non-sports.”

Netflix and Apple have emphasized how much they value quality. During a TCA panel for the Apple TV+ original “Loot,” showrunner Matt Hubbard noted that he judged success “creatively” when asked how he qualified the term.

“We don’t know exactly what the ratings are, but Apple has been such an incredible partner with us and always has been enthusiastic,” Hubbard told journalists.

Netflix chief content officer Bela Bajaria echoed that sentiment during a recent slate presentation. “No entertainment company has tried to program with this ambition — for this many tastes, cultures and languages. Ever,” Bajaria said.

Profitability and scale

Despite many on Wall Street deeming Netflix the winner of the streaming wars, FX’s Landgraf declared that they are “far from over.” The network’s parent company, Disney, is ready to put up a fight as the industry enters the precarious “peaked TV era,” he said.

Disney currently sits in the No. 2 spot with a total of 149.6 million Disney+ subscribers, 49.7 million Hulu subscribers and 25.2 million ESPN+ subscribers — still about 35 million short of Netflix. During its first quarter earnings for 2024, the company’s direct-to-consumer division reported an operating loss of $216 million and revenues of $6.08 billion across the three platforms.

Disney says its streaming business will be profitable by the end of 2024, accomplishing in five years what took Netflix over a decade.

NBCUniversal parent Comcast said that Peacock ended 2023 with 31 million paid subscribers, while Warner Bros. Discovery and Paramount Global reported 95.1 million and 64 million total subscribers for Max and Paramount+, respectively, as of the end of their third quarters of 2023. Warner will report its next quarterly earnings on Friday, while Paramount is set to deliver its results next week.

As for profitability, Peacock reported a full-year loss of $2.7 billion for 2023, while its revenue grew 57% year over year to $1 billion. Comcast reiterated that it would experience peak annual losses for the platform in 2023, with meaningful improvement expected in 2024.

In the third quarter, Warner reported a direct-to-consumer operating profit of $111 million, a $745 million year-over-year improvement and its second profitable quarter in a row, and the company said it is on track to at least break even across its DTC segment.

Paramount, which narrowed its streaming loss by 31% year over year to $238 million in the third quarter, expects full-year DTC losses in 2023 to be lower than in 2022, with the fourth quarter of 2023 similar to the year-ago period.

In 2021, Amazon reported more than 200 million Prime members worldwide and said over 175 million of them had streamed its film and television content in the past year. The company has not offered any concrete update on Prime Video’s subscriber base since then. During the company’s fourth quarter earnings call, Amazon CEO Andy Jassy said he had “increasing conviction” that Prime Video would be a “large and profitable business on its own.”

Likewise, Apple surpassed 1 billion paid subscriptions in August, though it does not break out how many of those are attributable to Apple TV+ or offer any guidance on the streaming platform’s profitability.

To make progress towards profitability, many of the major streamers have launched ad tiers, cut back on content spend and even removed some titles from their platforms. Netflix has also been rolling out a password-sharing crackdown over the last several months, with Disney to follow suit in 2024. Several major streamers, such as Warner Bros. Discovery, have also ramped up the licensing of their content.

The years ahead may also see live sports — a linchpin of the cable bundle — continue to embrace a streaming future while industry consolidation increases. With that, the streaming playing field will level off, setting the stage for industry-wide metrics for success.

“I, for one, welcome the advent of a sustainable scripted TV business built primarily on streaming, with a tough but fair set of metrics for creative and commercial success,” Landgraf said.

The post In Their Own Words: Disney, FX, NBCU, Warner TV Execs Redefine Success in ‘Peaked TV’ Era appeared first on TheWrap.