Nothing about the FAANG stock rally is normal

This post first appeared on The Irrelevant Investor.

Netflix, Facebook and Amazon are each up 60% in the first 11 months of the year. Apple, is up 50%. Google, the laggard, is up just 34%. These five stocks have added over $900 billion in market capitalization in the first eleven months of the year.

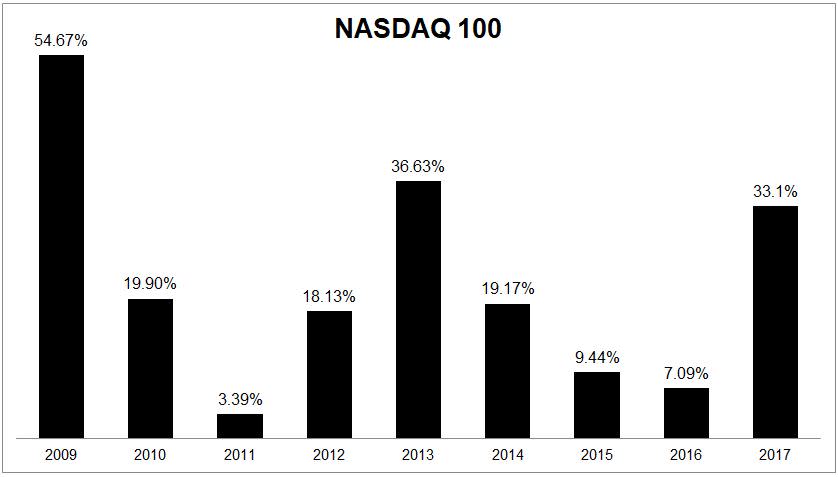

The tech-heavy index, which these companies represent one third of, is up 33% year-to-date, and is on pace to close higher for the ninth year in a row. With double digit returns in six out of those nine years, the NASDAQ 100 has grown 21.5% a year for over this period, turning $1,000 into over half a bitcoin.

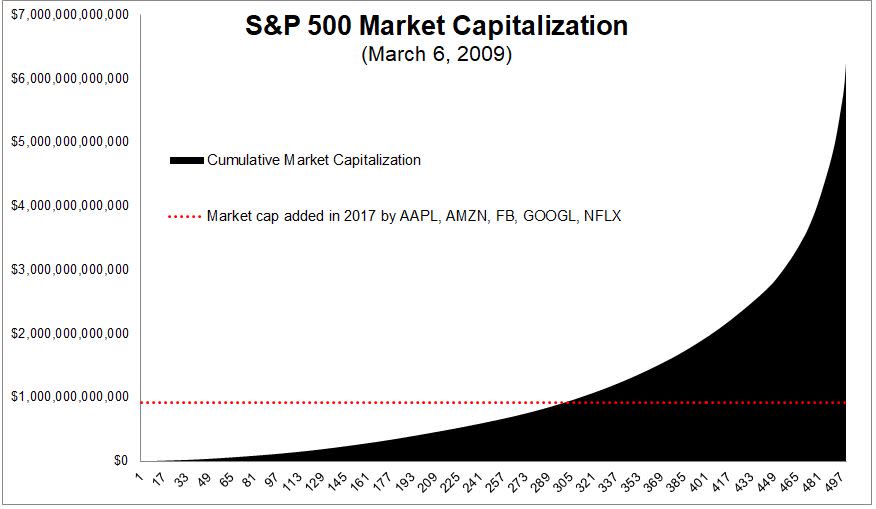

This sort of run would have been completely unthinkable coming out of the GFC. At the bottom in 2009, none of these FAANG stocks were in the top ten in market cap for the S&P 500, Netflix wasn’t in the index, and Facebook was private. This is a totally ridiculous comparison, but it’s my blog and I’ll do what I want: The 201-500 biggest stocks in the S&P 500 at the time had a market cap equal to what these five companies added in the first 11 months of this year.

The chart below shows that the total market cap of the S&P 500 in March 2009 was $6 trillion, and the cumulative market cap for the 300 smallest companies in the S&P 500 were less than what five companies added in eleven months this year.

People talk a lot about how to survive a bear market, but surviving a meltup can present similar psychological challenges. This doesn’t have to end tomorrow, but it can’t continue like this forever. Enjoy it while it lasts because nothing about this is normal.