Nielsen Sold for $16 Billion – But It Was Worth Double That 6 Years Ago | Analysis

The recent sale of embattled measurement giant Nielsen for $16 billion seems like a big number even by Hollywood standards, yet analysts told TheWrap that the figure is only half of what Nielsen might have been worth to an investor only six years ago. And the company’s new owners have a long journey to making their money back.

Kern Schireson, chairman and CEO of Known marketing company, called Nielsen’s rating systems “antiquated” compared to digital advances in the audience data gathering space being used by mega-streamers and other content providers in both the ad-supported and premium content business.

Since the 1950s when television sets became more common in households, Nielsen Audience Research has provided the reliable go-to measurement for how many eyeballs were tuning in. While the company finally stopped using paper TV diaries to collect data in 2018, as of 2021-22, Nielsen says it still relies on data from about 40,000 TV households out of 121 million U.S. TV households.

Schireson contrasts that with newer technology used by streamers that can instantly tap an audience pool of tens of millions — and can offer “accurate, second-by-second behavioral measure on tens of millions of television screens, not to mention all the digital screens that are around them.” He added, “We have to expect continued erosion and potentially pretty drastic erosion of this measurement business, given everything that’s evolving around it.”

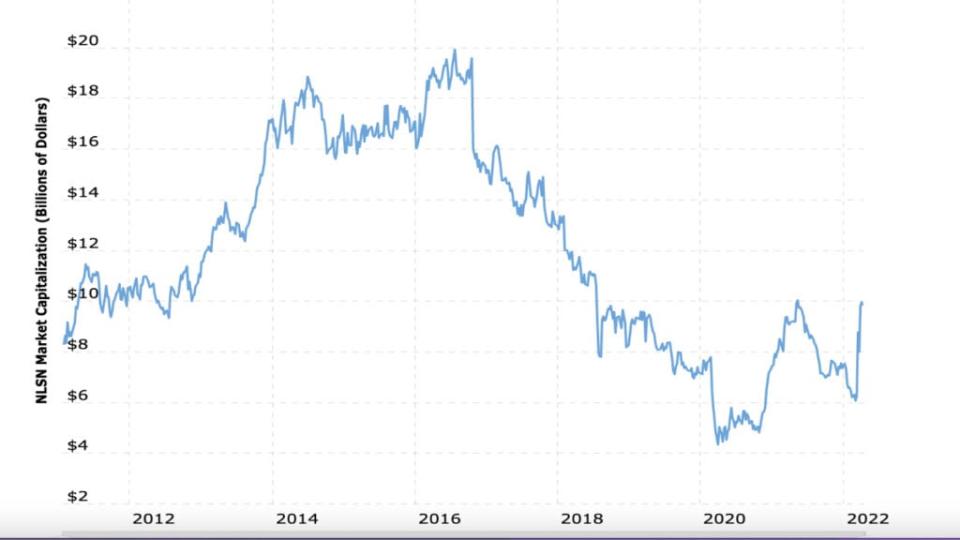

Multiple analysts point to the emergence of more sophisticated technologies as one of many reasons Nielsen has slipped in value since 2016.

On March 29, Nielsen Holdings Group — founded in 1923 as privately-held A.C. Nielsen Co. — was acquired by a private equity consortium led by Evergreen Coast Capital Corp. and Brookfield Business Partners LP. Just two weeks before, Nielsen had rejected a private equity consortium’s $15 billion offer.

However, Nielsen’s share price was double that of its current value six years ago, reaching an all-time high of $56 per share in February 2016, as compared to $27.40 per share at market close on Thursday. And according to data from Macrotrends, Nielsen’s market cap in 2016 reached almost $20 billion, compared with $10 billion in April 2022.

Of course, market cap is different from “valuation,” a more vague term that usually comes from a publicly announced sale price — but there’s no valuation figure readily available for Nielsen in 2016 since nobody made a public bid to acquire it that year. However, one expert who asked not to be named said it wouldn’t have been out of line to value Nielsen at $40 billion to $50 billion in the mid-2010s, right up there with the WarnerMedia-Discovery deal in stature and clout if it had sold at that time.

As Nielsen’s stock market standing declined, the company also saw an erosion of its reputation as the most reliable ratings standard for the entertainment industry. In January, the company was accused of undercounting the out-of-home viewing audience for 16 months, an error that would end up costing $700 million worth of ad time that networks were unable to sell to marketers.

Nielsen has also struggled for years with criticism that its household sample doesn’t include enough members of minority groups and young people who are important to advertisers. The out-of-home viewing gaffe exacerbated that perception since the large number of minority group members consuming content away from home also weren’t counted.

Although Nielsen doesn’t publicize its fees, one industry executive who asked not to be named said newer technology is also cheaper, estimating that a large individual company who opts for Nielsen is most likely paying “tens of millions of dollars” for the company’s data.

Given its recent history, many analysts see a $16 billion investment in Nielsen as a big risk for a tech dinosaur that’s also perceived as politically incorrect. Can Nielsen change fast enough to compete with increasingly sophisticated audience measurement technology and give its buyers a return on their investment?

Not surprisingly, Nielsen’s new investors believe so. “We are firmly convinced that Nielsen will continue to be the gold standard for audience measurement as it executes on the Nielsen ONE [cross-platform measurement] roadmap,” Managing Partner Jesse Cohn and Senior Portfolio Manager Marc Steinberg said on behalf of Evergreen and Elliott in a statement when the acquisition was announced. “Today’s outcome represents a significant win for Nielsen’s shareholders and for the business itself, as our multibillion-dollar investment will help Nielsen reinforce its transformation at this critical inflection point.”

Nielsen didn’t immediately respond TheWrap’s request for comment on the specifics or timeline for the “transformation.”

Others watching Nielsen are also optimistic, but more cautiously so. Ashwin Navin, CEO and co-founder of Samba TV, told TheWrap that he sees greater opportunity for Nielsen to evolve as a private company.

“The Nielsen acquisition is evidence of the demand that we and others are seeing from the capital markets to fund the next generation of measurement,” Navin said. “The ad industry is moving to a multi-currency future, where omni-channel measurement systems built on first-party data need to capture everything that viewers see on a global scale. Nielsen’s legacy in measurement is quite strong, and going private should give the company the time and resources needed to retool and develop future-proof solutions that play in this multi-currency world.”

Even Schireson isn’t totally negative about Nielsen’s prospects. He noted that investors have also acquired another arm of the company, Nielsen Buyer Insights, which provides retail marketers with shopper data. Schireson described the Buyer Insights arm as “pretty healthy,” but added, “If a big piece of the value is pegged to the television measurement side or the viewer measurement side, I think they’re in for a very rough ride.”

An industry analyst who asked not to be named said that Nielsen has a chance to survive if it can transition to more sophisticated measurement systems. However, the cost of transformation will most likely exceed what investors paid for the company. “It will take a substantial amount of capital to transform its legacy infrastructure and to acquire additional companies that can be attached to Nielsen to make it a growth company,” this analyst said. “And that will happen in the U.S., and it will happen in their international business where there’s probably a more substantial growth opportunity for them.”

Although competitors may continue to spring up, including Comscore and VideoAmp, the analyst said the ad-supported TV and streaming business will always need independent audience assessment to run successful content platforms. So if Nielsen can get its tech together, there will always be a market for its services.

“You need someone who doesn’t own the inventory, who’s not grading their own homework,” he said. “And that needs to be based on first-party data.”